Independent financial consultant. Financial Consultant. What services does an independent financial advisor provide?

A financial consultant or personal financial advisor is a management specialist personal finance who knows how to save and increase money.

The role of a financial advisor is very similar to that of a family doctor or psychologist; his main task is to analyze your situation, develop a strategy to improve it and implement it with you.

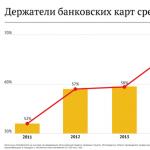

In the markets of Europe and the USA, financial consultants have existed for many years, so their services are used by a large part of the population of Western countries, while in Russia this profession began to emerge only in the 90s.

The responsibilities of a financial advisor include:

Making a plan to achieve financial goals, for example, buying an apartment, going on vacation, starting your own business

- Development of individual investment strategy to achieve goals

- Selection of the most profitable and current offers financial companies

- Legal support when using financial services, protection of your rights in case of unfair treatment of financial companies

- Constant support at all stages until all goals are achieved

A financial advisor can work either independently or on the staff of a representative company financial market. The obvious advantage of an independent financial advisor is his independence, which guarantees work exclusively in the interests of his client and a choice based on an analysis of the instruments of not one company, but many.

Reasons to become an independent financial advisor now:

1. Constant development

Each situation is individual, it is impossible to develop a single algorithm that can satisfy the needs of everyone, therefore, when working with each new client, the consultant needs to come up with a new strategy and study a variety of opportunities in the financial market.

2. Operating mode

An independent financial advisor has a flexible schedule and coordinates his own time with each client. This profession gives you freedom to choose your time for work and rest.

3. Status

A successful financial advisor is respected not only in professional society, but also among his clients, for whom he becomes practically a member of the family, since the most intimate details of the financial situation are discussed with him.

4. Prospects in Russia

Today the need Russian citizens There is a growing number of financial advisors, but due to the relatively recent nature of the profession, the market is still largely empty.

5. Mission

The main advantage of working as a financial consultant is its mission - improving the well-being of the citizens of our huge country and creating an economically strong society.

Indeed, the typical client of a financial advisor is a wealthy person. A Sravni.ru survey among consultants paints such a portrait. Age over 35, has a higher education - technical or humanitarian, top manager or businessman, family, with children. Financial goals - formation passive income, care about pensions, improvement living conditions, teaching children. The minimum income level is from 150 thousand rubles per month.

But this portrait is like the average temperature in a hospital. In reality, anyone can use the services of advisors. It’s just that the help for them will be different. For example, independent financial advisor Saida Suleymanova says that for her target audience are people with above-average income, so that you can substantively discuss financial goals with them, because they have some savings for their implementation. However, this does not exclude working with people of lower income. For these clients, the main goal will be to understand how they can increase their income.

So, according to the executive director of the consulting group, “ Personal capital» Irina Gulevskaya, for those who still have modest income, the consultant will recommend how to manage them, how to save reserve fund and so on. For those who have already accumulated capital, the consultant will offer the most profitable way investment and will amount investment portfolio.

“You can go to a financial advisor with any amount that you allocate to investments,” says financial advisor and asset manager Andrey Chernykh. According to him, the problem of investment is a psychological problem.

“If you, like most Russians, first spend everything, then, of course, you won’t have any left to invest. Therefore, first of all, you need to invest a certain percentage of your income, and then spend the rest. This is how people become millionaires,” says Chernykh.

When do you need a financial advisor?

Saida Suleymanova highlights several of the most relevant financial issues, with which the client can and should contact the adviser. There are ten “ifs” in this list:

- by the end of the month you have no money left;

- free funds lie and do not generate income;

- you are saving for large purchase, but you constantly put it off;

- you are thinking about your future pension;

- you want to save for your children’s education;

- you want to reduce your debt load;

- you want to create your own investment portfolio;

- you are unhappy with how much your investments are earning;

- you don't know how to achieve your financial goal;

- You are the only source of income in the family, but your life is not insured.

There are also unusual cases. “Personal Capital” increasingly receives orders for organizing investments that do not contradict the principles of Islam. Saida Suleymanova is sometimes asked about how to force her ex-husband to pay more alimony. One client of Natalya Smirnova asked to draw up a schedule for his portfolio for 2017, indicating purchase prices for each day, and another wanted to increase his portfolio from 5 million rubles to 100 million in three years.

What can consultants do?

To summarize, personal advisors offer:

- one-time consultations, including on personal budget management;

- drawing up a personal financial plan;

- investment advice based on your goals;

- managing your capital.

Consultants, of course, do not make their people millionaires; in fact, clients do it themselves - they accumulate capital, choose a conservative or aggressive investment strategy.

“All clients have different risk appetite and time reserve: someone can start with $900 thousand, have 10 years, then he needs a return below 2%, he can stupidly invest in bonds of issuers A with maturity in 10 years and don't think about anything. And someone starts with 250 thousand and has 5 years, then the option is a very aggressive strategy with an expected return of over 30% per annum. Both can become millionaires, but the risks and General terms they have different ones,” explains Natalya Smirnova.

The same thing happens with future ruble millionaires. Here you also need to take into account that not all clients come to advisors with exactly these expectations - some have lower cost goals. And the consultants themselves deny such ambitions. “I don’t have a goal to turn clients into millionaires, I see my goal differently - to teach how to manage their finances so that they can provide themselves with a qualitatively different standard of living,” admits Saida Suleymanova.

How much does financial advice cost?

The average cost of a one-time consultation ranges from 3 to 5 thousand rubles per hour. “The rest of the services are tied to the cost of an hour of a consultant’s work, depending on the complexity of the client’s task,” says Irina Gulevskaya.

The most expensive thing is to draw up a personal financial plan; here prices start from 10-30 thousand rubles and can reach up to 100 thousand, depending on the complexity and number of goals. You can create an individual investment portfolio or, in other words, your own investment strategy for a fee of 10-15 thousand.

If the capital is large, then it may make sense to put it under management. Natalya Smirnova charges 0.5-1% of the portfolio for this. “We don’t take a percentage of the profit, since this is not a completely fair option: if the portfolio grew by 20% in a year, and then fell by 20%, then it turns out that they will charge you a percentage of that 20% for the first year, which may may never be achieved again. Therefore, we take a percentage of the capital under management: we are interested in its growth, but 0.5-1% of the capital does not eat up a significant part of the growth, like, for example, 20-30% of the profit,” the expert notes.

But this is not the case for everyone. For example, Andrei Chernykh takes a percentage of the profit for some of his services, while the first consultation is usually free. “Next, we determine how I can be useful and what products or programs I can recommend. This can also be free of charge,” he clarifies.

How to choose a financial advisor?

The choice of a financial advisor should be approached as responsibly as the choice of a bank or insurance company. “First of all, you need to familiarize yourself with the list of services, the price list and the profile of the financial advisor himself,” says Saida Suleymanova.

Must have significant independent investment experience. “Because if the consultant himself does not invest in various securities, he does not know all the subtleties and will not always be able to correctly assess the risks,” explains Irina Gulevskaya.

You definitely need to pay attention to the availability of specialized education. “And not for consultant courses in 1-2 weeks with a basic higher education as a baker or philologist, but rather a higher education as a financier, plus 5 years of experience in finance and also specialized education as a financial consultant,” advises Natalya Smirnova.

Next, according to her, you need to watch the consultant’s videos, articles: does he speak clearly to you, will you work well together, are you comfortable with him, at first glance, ask for an example of work (impersonal), perhaps client reviews.

How to recognize a charlatan?

“To identify a “naduvalov”, you need to ask the consultant to voice the expected profitability and risk (and provide historical values for these instruments), describe where the selected instrument invests, plus describe the current situation on the market, provide analogues of the same type of instruments for comparison average yield for such instruments. And also give an example of profitability and risk for the most conservative option of this type of instrument. For example, for bonds, compare them with government bonds for up to a year,” recommends Smirnova.

If an advisor tells you a guaranteed return of 50% or 70%, it is almost always a scam. Professional consultants promise clients a return of no higher than 5-8% per annum in foreign currency, says Irina Gulevskaya from Personal Capital.

How can you save money on the services of a financial advisor?

You can save only at the initial stage, for example, by choosing a remote consultation via Skype or consultation with assistants rather than with the main consultant. “Or you can try to do everything yourself, without the help of a consultant, based on the free materials of this consultant. If the consultant participates in financial literacy events, attend them (they are usually free) and ask a few questions in person. But we must remember that free is, as a rule, limited in time and, as a result, lower in quality than a full-fledged personal consultation,” says Natalya Smirnova.

Nothing, the consultant simply loses his client. “There will be no compensation for losses, except in cases fraudulent activities. But if this is not fraud, but simply a consequence of choosing unprofitable instruments, then this is a market risk. In our country, brokers and management companies do not compensate clients for losses in the markets for unprofitable recommendations, so the same logic applies to consultants,” explains Natalya Smirnova.

For the consultant’s recommendations to have an effect, efforts are also necessary on the client’s part, in particular financial discipline, reminds Saida Suleymanova: “The biggest disappointment for clients comes when the consultant shows that achieving the plan will require time, the desire to act, and control over their actions in terms of financial management."

Today the time is coming when people realize that every job must be done by a professional. The habit of doing everything on your own is gradually becoming a thing of the past. Many people understand that by solving any issues on their own, they may not achieve the desired efficiency, or simply spend an inadmissible amount of time.

Moreover, before my eyes - Western countries, where the service sector has long been developed, and people sensibly assess their capabilities, understanding that to thoroughly understand a new field for themselves, and even more so to become a specialist in it, is a labor-intensive and often unnecessary task. Last years Russians are increasingly willing to entrust their problems to specialists in various fields. This is understandable - a person who performs similar tasks day after day has definitely become proficient in solving them. Among these narrow specialists are financial consultants.

An independent financial advisor is a fairly young profession in our country. Essentially, this is a person who can tell you how to manage your personal finances, increase your capital or organize your own pension accumulation, choose protective insurance solutions, invest capital to generate income, talk about specific investment instruments. In short, it will teach you how to make your money work for you, your children receive a decent education, your family’s health is protected, and you don’t need anything after retirement.

As a result of working with a financial consultant, clients receive contracts and agreements concluded directly with leading suppliers financial services, which will be selected based on the challenges and opportunities personal budget. The advisor also benefits from the opportunity to earn money not only from consulting and drawing up investment plans, but also to receive a commission from those companies whose services clients use.

Worried that inflation could threaten your savings?

Do you want to be confident in your future?

Are you shuddering at the thought of your impending retirement?

Do you want to protect your family from possible financial risks?

And just want to put your family budget in order?How do I know if I need a financial consultant to plan my home budget now?

So, in order to understand whether you need cooperation with a financial advisor now, I suggest you honestly answer the questions below:

- Have you already made unsuccessful attempts to form capital?

- After listening to someone's advice, you chose the wrong one financial instrument for investment?

- Do you want, despite any circumstances, to fulfill all the financial promises made to your family?

- Wondering how to provide for yourself in retirement?

- Do you want your financial security to remain the same after you retire?

- Have you saved up some money and want to be sure that it will not be affected by inflation?

- Worried about the future well-being of your family?

- Do you want to have passive income?

- Do you have a burning question for your financial advisor?

If you answered yes to at least one of these questions, then you certainly have something to discuss with a financial advisor. In this case, it makes sense to hold at least an introductory meeting with the adviser, based on the results of which you will be able to assess the need for further cooperation.

What does each of us want? To have the opportunity to live with dignity under any external circumstances.

You can, of course, follow your own personal thorny path, gaining bumps and gaining invaluable experience.

But you can do it much simpler - seek help and advice from a specialist in your field.

You don't do your own haircut, do you?

So why not rely on professionals in all walks of life?

Entrust the planning of your financial well-being to a person who

whose calling is to help you realize your most daring ideas regarding capital,

– independent financial advisor.An independent financial advisor at your service,

Dmitry Sobolev.

Economics does not stand still, and so does terminology. More recently, the concept of “financial advisor” did not exist at all, but over time we are beginning to hear it more and more often. What is his job? And what is the difference between a financial advisor and its independent counterpart?

What is an independent financial advisor?

The profession is a completely new branch, and a very vague one. A financial advisor can be an employee of a bank or insurance company. Their initial task is to sell a certain product to their client. They do not waste time investigating the problems of their customers or their financial capabilities.

There are several differences between a regular advisor and an independent financial advisor (IFA). The second has no attachment to any specific enterprise, be it a bank or. He is fully aware of the products of various enterprises and offers his client the most profitable one. Financial capabilities, goals, etc. are taken into account.

This profession takes its roots from the West, namely the United States of America. It is fully licensed, which has many advantages. IndependentFinancialAdvisor is what independent financial advisors are called in the USA. If you are eager to try yourself in this profession and live in Russia, you need to undergo training from existing advisers. There is an alternative option - to enroll in and study in a special program.

What services does an independent financial advisor provide?

A financial consultant has a whole list of services offered:

- He advises clients regarding their financial situation;

- Develops custom financial plan;

- Helps set financial goals;

- Selects the most profitable investments for client;

- Can open an investment program;

- Accompanying clients' investments;

- Selects and opens insurance programs;

If an independent financial advisor is educated and knowledgeable, he or she will be able to help with any financial decision. He will give practical advice and tell you how to manage your finances.

How does the consultation take place?

On your first visit, the NFS will identify your financial goal, discuss plans for the future, identify your financial condition. Then you will receive full list recommendations that he will make individually for your situation.

On your first visit, the NFS will identify your financial goal, discuss plans for the future, identify your financial condition. Then you will receive full list recommendations that he will make individually for your situation.

If the discussion is successful and there is a desire to cooperate in the future, he visits the consultant again. At the second meeting, you will discuss your personal financial plan with which you can achieve your goal.

The work of an independent financial advisor is very similar to the profession of a doctor. In other words it can be called - financial doctor. He asks many questions by which he understands your situation and makes a “diagnosis”. In the next step, the advisor prepares a personalized plan, that is, a “cure” that will help your financial well-being. The last point can be considered your general health, which is at risk or is not showing any positive signs. The main goal of an independent financial advisor is to identify the source of the disease, diagnose and cure your problems.

Stay up to date with all the important events of United Traders - subscribe to our