Tax on winnings in the state lottery. What is the tax on lottery winnings? What amounts of profit from participation in lotteries are not taxed

All income of a Russian is taxed, this rule also applies to winnings of money and material objects.

When it comes to a small prize, there is no need to pay tax, but for expensive winnings you need to give a percentage to the state in the form of personal income tax.

What is the tax on lottery winnings

In accordance with the two hundred and twenty-eighth article of the tax code of the Russian Federation, there are several options for interest rates for winning the lottery, for example, in the "Russian Lotto":

In accordance with the two hundred and twenty-eighth article of the tax code of the Russian Federation, there are several options for interest rates for winning the lottery, for example, in the "Russian Lotto":

- for a cash payment - thirteen percent;

- for a prize in the form of a material object - thirty-five percent of the market value of the object;

- for any form from a foreigner - thirty percent.

The lottery procedure is under the control of the authorities, therefore, each winner is obliged to contribute a part of the amount received to the federal budget.

In general, all types of lottery tickets can be divided into drawing tickets, where the results are not known, and non-drawing tickets, where winning tickets are already issued with the victories included in them. As a rule, the latter look in the form of cards, on which the protective layer must be erased.

Car winnings tax

Carrying out promotions where one of the prizes is a vehicle is a common topic.

Carrying out promotions where one of the prizes is a vehicle is a common topic.

As a rule, the prize is a representative class car, but there are options for more budget cars.

If a person is lucky enough to become the recipient of a car, then, in addition to joy, he will be obliged to pay tax. The tax will be calculated based on the market value of the car, which is presented by the dealers. The interest rate is thirty-five percent.

Let's look at an example. Citizen K in June 2018 won a car worth one million rubles at Stoloto. He will have to submit a declaration by June 2019 and pay three hundred and fifty thousand rubles.

Prize tax

A tax of 35 percent is paid not only for a car, but also for any material item that has been won and has a value of more than four thousand rubles.

A tax of 35 percent is paid not only for a car, but also for any material item that has been won and has a value of more than four thousand rubles.

As a rule, these include: real estate, household appliances, electronics and more. The cost of the item is determined by the organizers of the lottery.

If the winner has doubts about the veracity of the price, then he has the right to turn to an independent examination, within the framework of which the final cost of the object is specified.

Its useful to note: the tax is paid at the place of registration of the person who won. Since the filing of a tax return is made at the place of registration of a citizen.

What amount of winnings is tax-free

According to regulatory enactments, if the winning amount is less than four thousand rubles, then there is no need to pay tax on the prize. This applies not only to money forms, but also to things.

According to regulatory enactments, if the winning amount is less than four thousand rubles, then there is no need to pay tax on the prize. This applies not only to money forms, but also to things.

When determining whether you need to pay personal income tax or not, it is important to calculate the market value of the property.

Great difficulties arise when the amount of the win is large, and is presented not in the form of cash, but in the form of a certain object, for example, a car, an apartment.

For such items, you need to give a lot of money, often people have to either refuse the prize, or quickly sell the received item in order to pay money to the state.

How to pay tax on lottery winnings

![]() If the winnings are presented in cash, then the organizers will issue financial resources after deducting tax.

If the winnings are presented in cash, then the organizers will issue financial resources after deducting tax.

That is, the winner receives money and does not owe the state anything else, since the tax is withheld by the creators of the competition.

If the prize is in material form, then the person receives it, and then, after assessing the market value, he is obliged to pay an income tax of thirty-five percent.

In order to deposit money on your own, it is required, first of all, to fill out a tax return in the form of personal income tax-3, which fixes the value of the prize, the interest rate and the amount of tax payable.

You can submit a declaration during a personal visit to the tax service, as well as through an online application through the FTS website. As for the timing, the finances must go to the tax account before the fifteenth of July of the year following the period for receiving the prize.

For example, if a person received a car as a gift in March 2018, then payment for this gift should arrive by mid-summer 2019.

Is it possible not to pay

The legislative level does not provide for situations in which a person is exempted from paying tax on winnings, even in the "Field of Miracles".

The legislative level does not provide for situations in which a person is exempted from paying tax on winnings, even in the "Field of Miracles".

Moreover, interest is charged for non-payment or delay.

Good to know: if the amount of debt is large, then the person may be threatened with the accrual of large interest, as well as criminal liability. The amount of the fine cannot exceed thirty percent of the debt, but this is significant, especially when it comes to large payments.

In the event that the winner in the sweepstakes realizes that he cannot afford to pay personal income tax, then he is recommended to contact the organizers of the lottery with a request to find a compromise. In some cases, they offer a certificate for an amount equal to the value of the prize. With a cash payment, it is easier to transfer personal income tax in favor of the state.

Winnings tax is a certain amount of money given to the state. The amount of funds is determined by the rate, which is set depending on the form of the prize and its market value. Both parameters are determined by the competent authorities.

If we are talking about a cash payment, then the payment of tax is borne by the organizers of the lottery, and if it is a material item, the winner pays personal income tax himself.

If someone thinks that, having hit the jackpot in the lottery, he can safely keep the entire amount for himself, then he is deeply mistaken. In Russia, this number will not work, because, according to our legislation, any winnings, be it "Sportloto" or poker, are taxed. And it's not that small. Our article is devoted to the question: "What is the tax on lottery winnings in Russia?" Let's consider it in detail.

The legislative framework

It is not difficult to find out what percentage of the tax on winnings is charged to the lucky person. This can be done by looking at the tax code of the Russian Federation. Article 228 (clause 1, sub clause 5) states that any resident of Russia who is lucky in sweepstakes, lottery (public and private) or other risk-based gambling is obliged to give the state 13% of the amount received ... If he won a valuable prize, then he is also taxed - 13% of its market value. Any winnings are considered the income of an individual, and the tax on it in our country is just 13 percent.

It should be recalled that persons who stay in the country for 183 days or more for 12 consecutive months are considered residents of Russia.

Cash lotteries

Another very important nuance - the tax on lottery winnings is calculated at 13% only when it comes to cash prizes! The specificity of such lotteries is that they are based on risk. That is, buying a ticket or performing another action within the framework of the game, its participant receives nothing but a chance to win. Another type of lottery, which will be discussed below, is taxed at a much higher rate. Some are not taxed at all.

Incentive lotteries

A classic of the stimulating lottery genre is the ubiquitous drawing of prizes in supermarkets among check holders. The condition for participation here, as a rule, is made for a certain amount of purchases. As a result of the lottery, the luckiest buyer can receive some product or money as a prize.

So, the tax on prizes and winnings that do not exceed the amount of 4 thousand rubles is zero, that is, it is not charged at all. If we are talking about an amount over four thousand, then its happy owner must give the state as much as 35%. True, not from the entire gain, but from the difference between the tax-free maximum and the actual size of the jackpot.

Tax payment methods

There are several ways to pay tax on winnings. In incentive lotteries, the prize is usually a product. If it costs more than 4 thousand rubles, then the recipient must independently pay the state a percentage of the difference. If the organizers offer money as a prize, then they deduct 35 percent immediately and pay the tax themselves.

The situation is approximately the same in the field of cash lotteries. You can put the tax on the shoulders of the organizers. Then the winnings will be credited to the recipient's account without 13 percent. Alternatively, you can pay the tax office yourself by filling out the appropriate tax return and submitting it no later than April 30 of the year following the year in which the prize was received. Payment must be made before July 15th. In the event that a resident of Russia violates the established deadlines, he is assigned a fine (starting from 100 rubles).

The prize in cash lotteries is not only money, but also apartments, cars, land plots, etc. In such situations, the procedure becomes much more complicated. After all, not every winner has 13% in cash of the cost of, say, an apartment.

Therefore, in order to pay the tax, he must first sell the won property, which is not always possible to do quickly. And the tax office does not like to wait and sets clear terms.

Private lotteries

On July 1, 2014, some amendments to the lottery law entered into force. Now all non-state types of them are prohibited. The essence of the amendments is that all sweepstakes existing in the country should be carried out on a competitive basis, with the participation of the Ministry of Sports and the Ministry of Finance.

The new rules allow only adults to participate in the draws. For violations, such as running a lottery without permission, late transfer of funds or refusal to pay winnings, the organizers of the draws will be subject to penalties. In addition, all lottery organizers are required to provide statements of their income.

Also, these amendments indicate that All-Russian lotteries can be held on the territory of our country, but with the participation of the above ministries. All adult residents of the country can take part in such raffles. Also in Russia it is allowed to hold International lotteries (as a rule, foreign ones), which are organized on the territory of several states at once. The Russian Federation is one of the countries where such draws are allowed, in contrast to the United States.

Most Frequently Asked Questions

Tax rules for lottery draws are quite simple and transparent. But in life there are different cases and circumstances, so people often have questions.

So, for example, many people ask whether the percentage of tax on winnings depends on who is the owner of the prize - a retired person or an able-bodied resident. Answer: it doesn't. The tax is the same for everyone - the legislation does not provide for benefits and discounts for certain categories of people.

The question of the right to dispose of the property won is still relevant. For example, is it possible to donate an apartment or a car received as a prize? Answer: you can. But only after tax has been paid. Moreover, for residents of Russia who won the state lottery, it is 13%, but if a non-resident won, then 30% of the value of the property will have to be given.

From time to time, Russians are faced with situations where the value of a won piece of land is deliberately overstated by the organizers of the lottery. And what tax on the winnings will have to be paid depends on this. People are also interested in whether it is possible to prove that the real cost of the site is lower? The answer is this: you can contact the antimonopoly committee. There is no other way to solve the problem. And organizers do often inflate the value of objects in order to force the recipient to refuse their prizes.

Participation in foreign lotteries

Another side of the gaming industry is foreign lotteries. There are many Russians among Russians who are inclined to seek their happiness abroad. How much is the tax on winnings in this case?

It should be noted that with foreign lotteries, not everything is so simple and clear. And in muddy water, as you know, fish is easy to catch. Therefore, there are so many people who want to hit the jackpot outside their homeland. After all, someone else's tax office is unlikely to get the offender, and his own, dear, will not find out about the win. And, thus, it turns out to "ride a hare".

If everything is done according to the law, then before joining the game, you should find out if Russia has an agreement with the country where the lottery is held. This refers to an agreement according to which the Russian recipient of the prize will not be obliged to pay tax on lottery winnings to both countries - his own and someone else's. The absence of such a document will significantly "curtail the happiness" of the winner. The only exceptions are cases when in the state conducting the drawing, there is no tax on the prize in the lottery at all.

List of countries where there is no tax on winnings

Among the states that do not claim part of the winnings are:

- Australia.

- United Kingdom.

- Latvia.

- Canada.

- Finland.

- Belarus.

But residents, for example, the USA, Israel, France, Italy, etc., like the Russians, are obliged to share with the tax authorities. Moreover, in some countries the percentage of deductions is even higher than ours.

About the amount of taxes abroad

The most greedy state in this regard is the United States of America. How much money tax will take away from a lucky lottery winner in this country? It depends on the amount won and the specific state. The minimum bet is 25% and is charged if the prize is equivalent to $ 600 or more. Plus, many states are throwing their interest rates to the national minimum. And the appetites are different everywhere. States like California, Texas, and Nevada charge nothing. Michigan is capped at 4.35% regional tax, and New Jersey will ask for an extra 10.8%.

The Swiss are also not happy with the claims of their tax officials. They take 35% of all "honestly earned" from the lottery player. Residents of the Czech Republic are forced to pay tax on lottery winnings in the amount of 20%. And in Bulgaria it is 10%. Italy has a relatively low tax on winnings. It is expressed as only six percent of the total.

As for the settlement system with the tax inspectorate, in most states everything is entrusted to the organizers of lotteries. Tax on prizes and winnings is automatically deducted and credited where applicable. And the lucky gambler gets his money already clean. This is done both for the convenience of citizens and in order to avoid possible cases of tax evasion.

According to the law, upon receipt of a valuable prize or upon winning the lottery, the winner must pay tax. The amount of tax and the procedure for paying it depends on many factors, including the type of lottery, the value of the prize, etc. In the article we will talk about what winnings are taxed, how to pay the tax to the budget, and also, using examples, consider the calculation of tax in various situations.

Lottery winnings

Surely everyone has purchased a lottery ticket at least once in his life, hoping for an easy win. But few people know that having received the coveted jackpot, part of the amount will have to be paid to the budget. Below we describe the calculation and terms of payment of tax for the so-called risky lotteries, in order to participate in which you must pay a certain fee (for example, buy a lottery ticket).

Tax rate

What is the tax on lottery winnings? The rate is 13% from the total gain. The winner can pay off his obligations to the budget in one of the ways - to file a declaration and pay tax in the general manner, or to receive income from the lottery service after deducting the fee.

Some lotteries, when organizing draws, provide for the terms of payment of the winnings to the winner minus the budget payment. In this case, the lottery service assumes all responsibility for paying off tax liabilities. and the winner has no choice but to receive the amount due and spend it at his own discretion. If the service transfers funds to the budget on its own, then this information must be indicated in the conditions of the lottery (as a rule, it is posted on the official website of the organization).

It should be noted that at the moment most lottery services pay the winner in full. This means that the person who won the lottery is responsible for paying the tax on the income received.

Declaration of winnings and payment of tax

If you have received a cash prize, then you must first of all declare it. It is necessary to submit a declaration in accordance with the 3-NDFL form in the general order - by April 30 of the current year for the past year. That is, if you hit the jackpot in 2016, then by April 30, 2017 you need to submit a declaration to the Federal Tax Service at the place of residence, in which you indicate:

- your personal data (name, TIN, registration address, etc.);

- the amount of the received prize;

- calculation and amount of personal income tax, which is payable to the budget (13% of the winnings).

The declaration can be submitted in any way convenient for you:

- go to the fiscal service body in person, receive a document form and fill it out on the spot according to a sample;

- download the form on the Internet (on the FTS website), print it and fill it out at home, and then send it by mail with a list of attachments and delivery notification;

- register on the official website of the Federal Tax Service, then fill out the form and send it electronically using the "Personal Account" service.

The first method of providing a document is undoubtedly the most reliable. In addition, if the form contains errors or inaccuracies in filling out, the service employee will point out them, after which you can correct or supplement the information on the spot. If you do not have the opportunity to personally visit the tax office, then use the postal services: fill out the sending of the document by letter with a notification, enclose the inventory in the envelope. Having received the envelope, the employee of the fiscal service will check the availability of documents with the inventory and sign for receipt. The confirmation of the fact of filing the declaration for you will be the spine of the notification, which you will receive by mail.

To optimize the workflow and simplify the procedure for filing a declaration for payers of the Federal Tax Service, an electronic resource was created, thanks to which you can fill out and send a declaration without leaving your home. To do this, you need to go to the FTS website and register, after which you have the opportunity to use the "Personal Account" service. Filling in the declaration is carried out using visual cues, and sending - via e-mail. You will also receive information about the acceptance of the FTS document by e-mail.

Having sent the declaration on time, take care of the timely transfer of funds to the budget. Having received income in the current year, the fee must be transferred by July 15 (for 2016 - by July 15, 2017). When paying by cash or credit card, we advise you to keep supporting documents (receipt, payment order, bank statement). If any disputable situations arise with the fiscal service, they will serve as confirmation of the fact that tax obligations have been fulfilled.

Example # 1: 05/23/2016 Matveev L.D. bought a ticket "Russian Lotto" and won 348.600 rubles. Let's calculate how much tax Matveev must pay? Since this is a risk-based lottery, and participation in it requires financial investments in the form of buying a ticket, Matveyev is obliged to transfer 13% to the state:

348.600 * 13% = 45.318 rubles.

The conditions of the "Russian Lotto" stipulate that the fee is paid by the winner, therefore, until 04/30/2017 Matveev must declare income, and by 07/15/2017 - pay the fee.

Prizes in promotions

Quite often, large shopping centers and hypermarkets give away valuable prizes and gifts to customers. These events are called incentive lotteries, their goal is to increase the loyalty of existing customers and attract new customers.

Are winnings in these promotions taxed? Yes, having received a monetary reward or a product, you, as the winner of the drawing, are obliged to transfer a part of its value to the budget. The tax rate in this case is 35%... Moreover, if the winnings are less than 4.000 rubles. then it is taxed at a rate of 0%, that is, nothing needs to be transferred to the budget. The same amount (4,000) is deducted from the base when taxing other prizes (see example below).

If you have won a cash prize, then you do not need to declare income, because according to the law, all obligations to pay the fee are assumed by the organizers of the actions. "On hand" you receive a "gift" in the form of 65% of the total amount.

A different situation develops when a material object acts as a prize in a promotion - household appliances, real estate, a car. Since you do not receive any funds "on hand", you will have to declare income and pay the fee yourself. The basis for taxation is the value of the winnings, which is documented by the organizer of the action.

If you think that the hypermarket has overestimated the cost of the TV set you won (washing machine, car, etc.), then you have the right to turn to the services of an appraiser. Specialists of an independent company will assess the prize for a separate fee, and draw up a corresponding act indicating the objective market value of the prize. From this indicator, you will need to calculate the tax for subsequent payment. The appraisal act itself will serve as a confirmation of the price of the goods in case of any questions from the Federal Tax Service. Note that it is advisable to contact the appraiser in case of receiving a large prize (apartment, car, etc.), since in this case you incur additional costs for the company's services. The submission of the declaration and payment of funds to the budget is carried out in the general manner and according to the terms described above.

Example # 2: In March 2016, Stepanov V.L. bought a mobile phone in the Techno Rai store. In April 2016, Techno Rai held a TV drawing among its customers, the winner of which was Stepanov. The cost of the TV is 21.300 rubles. Let's calculate how much of a win Stepanov should pay a fee to the budget?

As you know, the amount of winnings up to 4,000 per year is not taxed. Therefore, Stepanov will pay the fee from the amount minus 4.000: 21.300 - 4.000 = 17.300.

The fee is paid at a rate of 35%, Stepanov will pay to the budget: 17.300 * 35% = 6.055

Bookmaker offices

One of the organizers of gambling are bookmakers, whose visitors can bet on the result of certain sports. Due to the fact that this segment is quite large, in 2014 bookmakers were classified as tax agents. This means that having won on sports bets, you do not have to burden yourself with filling out a declaration and transferring the fee. The bookmaker takes on the responsibility of withholding and transferring funds to the budget, but you get a "net" income minus all the necessary deductions. Since sports betting is a risk game, winnings at the bookmaker's office are subject to a 13% tax.

A feature of the taxation of such income is that the tax base is reduced by the size of the rate made. That is, 13% of the fee is calculated not on the total winnings, but on the difference between the bookmaker's winnings and the previously made bet.

Example # 3: Vorobiev F.D. is a client of the Sports Game bookmaker. In June 2016 Vorobyov made a bet on the result of the football match Russia - Wales in the amount of 324 rubles. The result of the match was predicted by Vorobyov correctly, so he won 32.400 rubles.

Let's find out from what amount of winnings the tax will be calculated and how much Vorobyov will receive as income. Since the fee is not levied on the entire amount of money won, but after deducting the bet, then 13% must be calculated from 32.076 (32.400 - 324). The Sport Game office will pay the tax in the amount of 4.169 (32.076 * 13%). Vorobyov will receive 28.231 (32.400 - 4.169).

Casino gambling

The lucky ones who managed to hit the jackpot in the casino are obliged to pay the fee according to the general procedure - the tax percentage of the winnings is 13% .

An anonymous survey conducted among legal representatives of this type of gambling business showed that institutions do not want to take responsibility for repaying their obligations to the budget. This means that by winning in casinos located in strictly designated territorial zones, you will receive the entire amount in full. Next, you need to declare income and transfer the budget payment.

A rather controversial situation is developing with the income received from playing in online casinos. On the one hand, this type of gambling does not belong to the territorial zones provided for by law, and therefore should be prohibited. But there is no administrative or criminal liability for playing in an online casino, and the income received must be declared in a general manner with the subsequent payment of 13% tax. In this case, the fact of receipt of income is not the date of the prize itself, but the day when the funds were received on the electronic wallet (bank card) of the winner.

It is noteworthy that, unlike betting organizations, income earned in casinos is fully taxed. That is, the amount of your bets does not affect the calculation of the tax.

Example # 4: December 21, 2014 Kondratyev S.T. won in the online casino "Split" the amount of 74.613 rubles. The money was credited to Kondratyev's account on January 13, 2015. How is this winnings taxed?

Since Kondratyev received the money on 01/13/2015, he is obliged to submit a declaration for 2015. Kondatiev must complete and submit the document to the Federal Tax Service Inspectorate by 30.04.2016. Kondratyev is obliged to transfer the fee by 15.07.2016 in the amount of 9.699 rubles. (74.613 * 13%).

Example # 5: Visitor to the casino "Oracle" Khomyakov D.L. made a bet of 1.840 rubles. and won 1.420.600 rub. Since the size of the rate made does not affect the tax base, Khomyakov must pay the tax in the full amount of 184.687 (1.420.600 * 13%).

Foreign lotteries

Quite often, citizens of the Russian Federation purchase tickets for foreign lotteries, hoping for a large currency win. It is important for foreign lottery players to know that the winner will need to pay tax at the rate adopted in the host country. That is, if you play the lottery in Spain, then you are obliged to give 20% of the income received to the budget of Spain. However, the amount up to 2,500 euros is not subject to tax.

An analysis of the conditions for lottery participants in different countries shows that the tax rate of winnings differs significantly from the Russian Federation, both upward and downward. Playing in Italy, you will have to pay 6%, in the Czech Republic - 20%, in Bulgaria - 5%. American lotteries are taxed at the highest 25%. This fee is federal and may increase depending on the state in which the ticket was purchased. In addition to 25%, you will have to pay in Michigan (4.35%), Illinois (3%), New Jersey (10.8%).

In some countries, there is no tax on lottery winnings. These countries include Australia, Germany, Great Britain, Finland.

It is worth noting that the winner of the overseas lottery pays the tax of the host country only if an agreement on the absence of double taxation has been concluded with this country. If there is no such agreement, then you will have to pay the fee twice - at the domestic (13%) and foreign rates. True, such cases are quite rare - the corresponding agreements have been concluded with the majority of developed countries.

Responsibility for non-payment of tax

Let's separately talk about what threatens the offender who has not declared income in the prescribed manner and does not pay tax on time:

- The main responsibility for tax evasion is a fine of 20% of the tax amount. If the court proves that you knew about the need to pay and did not fulfill your tax obligations on purpose, then you will have to pay a fine of 40%.

- For each overdue day of payment of the fee, a penalty is charged. It is defined like this... П = 10.5% (refinancing rate) / 300. Penalty is calculated from the day following the date of payment (in the general order - from July 16), and until the moment when you repaid the debt.

- If you have not declared income, a fine is also provided for this. It is 5% for each month of delay and is calculated similarly to the penalty - from the month following when you had to submit the document to the Federal Tax Service (from May of the year following the reporting year - in the general procedure), until the actual submission of the paper to the fiscal service ... You should know that the fine cannot be more than 30% of the tax and less than 100 rubles.

The collection of the main debt, as well as the fines and penalties that have arisen, can be enforced by the FTS on the basis of a court decision. One of the ways of recovery is withholding the debt from the offender's salary; the corresponding writ of execution is previously transferred to the employer's accounting department.

And of course, you shouldn't forget about criminal liability. If you owe the budget more than 300,000 (this is possible if you win large sums), then the court may apply a measure in the form of arrest for up to a year (or a fine of 100,000 - 300,000).

Example # 6: In 2016 Soldatov N.G. won the lottery in Russia 84.610 rubles. Soldatov received all the money "in his hands". Soldatov has delayed the fact of declaring income (until 04/30/2017) and payment of the fee (until 07/15/2017). On October 31, 2017, Soldatov filed a declaration and on the same day paid a fee of 10.941 (84.160 * 13%). In addition to the debt, Soldatov paid:

- Penalty for violation of tax obligations 2.188 (10.941 * 20%).

- Penalty for late payment of 3.83 (10.941 * 10.5% / 300), in just 108 days (from 16.07.2017 to 31.10.2017) - 414 (108 * 3.83).

- The penalty for late declaration is 547 for each month (10.941 * 5%), for 6 months in total 3.282 (231 * 6 months).

In total, Soldatov will pay 14.637 (10.941 + 414 + 3.282) to the budget.

Question answer

Question :

Do non-residents pay tax? Or does the duty lie only with the citizens of the Russian Federation?

Answer... Yes, non-residents are also required to pay the fee. For persons staying on the territory of the Russian Federation for a period of less than 183 days, the tax on winnings in Russia is calculated at the rate of 30%.

Question :

Does the tax rate depend on whether the draw is a state or non-state lottery?

Answer... No, the status of the organizer does not matter in this case. The rate changes only depending on the type of the drawing - a risky lottery in which a player invests (buys a ticket, places a bet) is taxed 13%, prizes in promotions - 35%.

Answer... Yes, if the organizer of the action is an individual, and the gift is real estate, transport, land, shares. The fee is paid at a rate of 35%. There is no need to transfer money to the budget only when the gift is received from close relatives (spouse, parents, brothers / sisters, grandparents).

If you have any questions about the topic of the article, please do not hesitate to ask them in the comments. We will definitely answer all your questions within a few days. However, carefully read all the questions and answers to the article, if there is a detailed answer to such a question, then your question will not be published.

Hello Samvel.

If the winnings were monetary, then the organizer of the lottery (competition, etc.) acts as a tax agent and independently calculates the tax on your winnings and pays to the state, and gives you the amount in your hands, after tax deduction.

For individuals who received income, upon receipt of which tax was not withheld by tax agents, the provisions of Art. Art. 228 and 229 of the Tax Code of the Russian Federation are obliged to independently calculate and pay tax to the budget, as well as submit a declaration of the 3-NDFL form no later than April 30 of the year following the expired tax period.

In cases where it is impossible to withhold tax, when the prize is "clothing", the organizer is obliged to notify the Federal Tax Service of the income you received and the impossibility of withholding tax. After that, the entire obligation to pay tax falls entirely on you. When receiving the prize, do not forget to ask the organizer of the action for the Certificate of Acceptance and Transfer of the certificate, where its cost will be indicated. To fill in the Declaration (3-NDFL), you will need a 2-NDFL certificate, which must be issued by the organizer of the action. From this certificate you can find out all the details of the organizer required to fill out the declaration, the personal income tax rate (13 or 35%).

By accepting this prize / gift, you automatically have the obligation to close the income and pay tax. The tax office is not interested in where you get funds, how and with what you will pay. You can sell an apartment (a car, etc.), you can take out a loan, borrow from friends, you can even refuse a gift and not pay tax.

Nobody relieves you of the obligation, moreover, if you do not submit a declaration, fines arise, do not pay on time - every day there is a calculation of the late payment penalty.

I won the stoloto lottery. The total amount of the prize was 1,500 rubles. Should I pay tax?

Hello Olga!

For this lottery, the amount of tax on winnings is 13% of the amount won. To avoid double taxation, you need to know whether you received the full amount of your winnings or not.

If the announced amount of the prize is RUB 1,500. and you got this amount in your hands, then no one, as a tax agent, paid tax for you, and if you position yourself as a conscientious taxpayer, you must declare income and pay 195 rubles from the winnings. That is, when filing a personal income tax return for 2016 (if you have an obligation on other grounds), indicate, including this income, or if there are no other grounds for paying personal income tax, submit a declaration solely for the reason of declaring income from winnings.

If you receive in your hands the amount of 1305 rubles. (which is unlikely, since the organizers of the lottery do not have complete data on the winners of the lottery), then your income has already been declared and the tax has been paid. And this frees you from the obligation to pay tax.

Hello. If I have lived outside the territory of the Russian Federation for more than 183 days and won a foreign lottery, do I have to pay tax in the Russian Federation, of which I am a citizen?

Hello Anton!

No, you are not required to pay tax to the RF budget.

This is simply because you acquired the status of a non-resident of the Russian Federation, having lived permanently abroad for more than 183 days during the next 12 months in a row, and the income was received from sources outside the Russian Federation (a foreign lottery played outside the Russian Federation). Accordingly, such income is not subject to personal income tax in accordance with the rules and requirements of the tax code of the Russian Federation.

If you won in a foreign lottery, get an incognito prize, do not report it in Russia and live peacefully with this money abroad. Or put them on your card of a foreign bank and easily withdraw them in Russia. And do not try to report this card to the Russian authorized bodies, and Russia will manage without them 13%.

If you won and are not a tax resident in the Russian Federation, then you have nothing to hide, there is simply no point in hiding and listening to advisers about a foreign bank, since being not a tax resident, we remain a currency resident, i.e. you must transfer all the winnings to the Russian Bank, and then only wherever you want. Penalty 75-100% of the hidden.

I won 128 rubles in the Russian lotto. Do I need to pay tax on them?

They are obligated, but since the lottery organizer has no information about you, you understand that no one else will know about this.

Hello Victoria!

Yes, this is taxable income.

In practice, due to the insignificance of the tax amount (17 rubles in your case), taxpayers do not pay, since the tax inspectorate will not carry out inspections on the indicated source of income (it is difficult to track the source of income, there is no interest in checking, etc.).

At the same time, penalties for not submitting a declaration (if this fact comes up) will significantly exceed the amount of the winnings.

In a word, this question remains on the conscience of the recipient of the prize and his citizenship towards the laws.

Hello. Can you please tell me if I won in stoloto several times for 20 rubles and once for 160 rubles, but did not receive the winnings, but simply returned them back to my wallet, do I have to pay tax?

Hello, Alexander!

Receiving income is not about getting the amount due, but having a real opportunity to dispose of the money. Leaving money in your wallet, you made your choice, that is, you disposed of the fate of the winnings at your own discretion.

You are legally considered to have earned taxable income.

Hello, the tax on winnings is clear But what about the money spent on tickets? From can you make a tax deduction ?!

Good afternoon. I participated in a promotion for sellers from one brand, where it was necessary to register codes from packages, dialed the maximum number of codes and won a phone, estimated by the organizer at 55tr. In this case, you have to pay tax (as I understand it is about 17tr.)? Let me remind you that the promotion was aimed at sellers, and the prize in the promotion is more like a rebate.

Hello Ivan!

Yes, you are right the tax will be 17,850 rubles. (55,000 rubles "-" 4000 rubles (deduction) "X" 35%).

This is practically a standard situation. This promotion is stimulating and aimed at promoting the product. Therefore, a 35% rate is applied to the stated winnings. You must calculate the tax yourself, as well as submit a declaration and pay the tax yourself (without a tax agent).

The declaration must be submitted by April 30, 2017, and the tax must be paid by July 15, 2017.

good afternoon! bought a Russian loto ticket at a kiosk, it turned out to be a winning one (500,000) this was confirmed by the organizers (we called them) how much tax will we have to pay?

Hello Denis!

RUB 500,000 is the total winnings that were not subject to tax processing, that is, tax was not withheld from this amount.

In this regard, it is from 500,000 rubles that tax must be paid at the rate of 13. The tax amount will be 65,000 rubles. You need to pay tax after the actual receipt of funds. The declaration is submitted the next year after the receipt of the winnings by April 30th. Payment until July 15 of the year in which the declaration was submitted to the Federal Tax Service Inspectorate.

Won a little over 500 rubles in the Russian lotto. Received on an electronic wallet in December of this year. I understand that I have to pay about 70 rubles. ndfl. Question - when drawing up a declaration, how to confirm the source of income? For example, I confirm the salary received during the year with a certificate of income for 2-ndfl. I hand over the declaration in connection with the receipt of the property tax deduction.

Hello Nikolay!

The source of income is simply indicated in the declaration (name of the lottery organizer, his TIN, KPP and OKTMO). This limits the taxpayer's obligations to confirm the source and amounts of income. It is not necessary to provide any documents for the IFTS.

Upon receipt of a property deduction, the declaration is accompanied by documents confirming transactions and financial calculations for which deduction operations are carried out (for example, the purchase and sale of an apartment and documents for its acquisition).

2-NDFL is submitted to the declaration due to the fact that the tax amount has already been paid by the tax agent in the form of advance payments (so as not to pay the specified amount twice).

However, the tax code does not prohibit the submission of documentation for the declaration, which substantiates the corresponding amounts. In this regard, to confirm income, it is enough to attach a copy of the lottery ticket, visual information from the media (newspaper) or from the site of the lottery organizer, as well as a printout of the transaction (upon receipt of the prize) from the electronic wallet.

Tell me, is the winnings in the casino certified by some document?

Let's say I won an amount that is not in the cash register now, they will give me some piece of paper and what kind of document will it be?

Hello Mark!

Such cases are not specifically regulated by law.

Usually, money is exchanged for chips of the corresponding denomination.

If during the exchange there is a lack of funds, then an act should be requested from the administration, which will indicate the surrender of chips by the visitor, but without payment (partial payment) of money. A kind of reconciliation act with the obligation to pay off the debt or any other official debt document.

Good day! I play online poker in my spare time. And although, unfortunately, I have not yet been lucky to hit the jackpot, but still sometimes huge prizes are spinning there. And I am always worried about the question if I can win a large amount. How can you pay tax anonymously in order to avoid coverage in the local media, and the dissemination of information by the human factor, that is, through the tax workers themselves, who are also people, is it possible to pay a large sum anonymously so that only the tax authorities know about it? Thanks.

Hello Alexey!

The tax is an individual monetary obligation of a citizen to the state. Personal income tax is paid on the basis of a declaration, which is a statement of a specific person about the intention to pay tax due to the occurrence of certain financial and economic events in the life of the taxpayer. Depersonalized funds are not accepted by the tax authority, and anonymous payments cannot be equated with the proper fulfillment of a tax obligation. That is, there is a single rule for submitting a report on the source of income, the amount of tax and the payment of the tax itself. This is the presentation of a 3-NDFL declaration and the transfer of tax in a registered payment document (payment from a specific person).

At the same time, the tax code provides for the institution of so-called tax secrets. Information about income and its sources, as well as about the taxpayer, can be transferred in exceptional cases by the competent authority at their request, for example, to law enforcement agencies. In this regard, information about a large tax, its payer cannot be leaked to the media, since this would be a violation of the law and measures of influence may be applied to the tax inspectorate. The information used by the employees of the Federal Tax Service belongs to the category of DSP (for official use), so the tax employee will also not disseminate information known by the nature of the service, under the threat of dismissal and filing a civil suit.

Well, these are general rules, there are exceptions due to the variety and unpredictability of the bends of life's routes, which cannot be predicted.

Hello, I bought a Russian lotto ticket for 100 rubles, and won 121, i.e. income of only 21 rubles. is it really necessary to pay from this?

Winning implies income. The legislator does not provide for ranking or the principle according to which tax is exempt due to low income. Therefore, it is supposed to pay tax on small amounts.

Some taxpayers do not pay tax on small amounts due to the fact that it is more expensive to draw up a declaration and submit it to the Federal Tax Service Inspectorate than the prize itself. Failure to submit a declaration is done in the expectation that the tax authorities will not be interested in such small amounts and no one will notice a tax violation.

Some people fulfill their tax obligations honestly.

Each taxpayer decides for himself how to be in relation to the law.

Our compatriot from the Voronezh region won 1.5 million rubles in the program "What? Where? When?" What amount of taxes should he pay: 13% personal income tax or 35%?

Hello Anatoly!

Income received as a result of winning a quiz show according to the general rules of the game (non-bonus, out-of-game gifts and themed prizes from an advertising sponsor) is subject to a 13% tax rate.

That is, the tax amount will be 195,000 rubles.

Hello Dasha!

If an international agreement on taxation is concluded between the country where the winnings were received and the tax on the winnings was paid and the Russian Federation, then there is no need to pay the Russian 13% personal income tax. If there is no such agreement (in modern life this is a rare phenomenon), then you will have to pay both foreign and Russian taxes.

There are no legal ways to avoid such an obligation (that is, if there is no international treaty).

Ordinartsev Roman, why are you fooling people? I often take part in various state lotteries. I haven't won large sums yet, but within 1000 rubles. won several times. And I have never been given a winnings minus 13% tax. If a prize of 900 rubles was announced in the drawing, then I received these 900 rubles. People ask you questions to find out from what amount of winnings the lottery organizers themselves deduct 13% of the tax and give the winner 87%. And you got it: "By law it is necessary, by law it is necessary ...". Is there a level from which the winner gets his winnings after deducting taxes?

Starting from what amount of winnings, the organizer of the state lottery deducts the due tax and gives out to the winner the amount without tax, i.e. 87% of your winnings?

Hello, Alexander!

Gambling lotteries (of a gambling type, that is, not of an advertising nature) do not imply a tax deduction (13%) by a tax agent (lottery organizer). Drawing up reports (declarations) and paying tax is the responsibility of the winner of such a lottery.

Therefore, the taxpayer, regardless of the amount won, receives the full amount and deals with the taxation issue himself.

Hello. we won a guaranteed prize of 50,000 rubles from the store. How much will the tax be?

Hello Oleg!

Apparently, we are talking about an advertising-stimulating lottery (competition). Prizes received from such events are subject to 35% NFDL.

The calculation is made according to the formula: ("winning amount" - 4000 rubles) X35%. In this regard, the tax will amount to 16,100 rubles.

Since the prize will be paid in money (or the monetary equivalent amount is known exactly), the organizer of the event, as a tax agent, must withhold the amount of tax from you, report to the tax office for you and pay tax to the budget.

Ask your question

Instructions

After you took part in the game or lottery and became the owner of the prize, you will receive a document from the event organizer that will confirm the value of the prize. In addition, it must contain information about the name of the organization that held the event and its TIN. It is best if this document is a certificate drawn up in accordance with the 2-NDFL form.

Get an individual income tax form from your local tax office. Calculate the amount of tax on your winnings yourself, based on the conditions under which it was received. Then carefully fill in all the required fields of the 3-NDFL form. Attach to the declaration a copy of the document confirming the value of the prize. Take the documents to the local tax office in person. Or you can send the declaration in a valuable letter with a mandatory list of attachments. As soon as the declaration is verified, you will be sent a payment order for tax payment. Pay for it at the nearest Sberbank no later than three months from the date of receipt.

Are you the proud owner of a lottery or casino win? Congratulations, but don't forget that you must pay 35% tax. In order that the joy of winning is not overshadowed by the accrued fines for failure to provide information to the tax authority, submit information about the win to the territorial department of the Federal Tax Service Inspectorate in time.

You will need

- - certificate on the 2NDFL form,

- - tax declaration,

- - details for the payment of tax.

Instructions

Ask the employer for the amount of your income in the form of a 2-NDFL certificate for the period in which the winnings were received.

Contact the tax authority at your place of residence, fill out the personal income tax return by April 30 of the year following the reporting tax period. The declaration can be filled in independently, following the samples posted on the website of the Federal Tax Service Inspectorate of the Russian Federation. In order to avoid mistakes for filling out the declaration, it is advisable to contact a specialized organization that provides accounting and consulting services.

You can submit a completed declaration, copies of documents (2-NDFL certificates) to the tax authority in person or send them by mail. When sending by mail, be sure to make an inventory of the attachment in order to avoid misunderstandings.

Pay tax on the winnings specified by you in the personal income tax return. You can check the details on the website of the Federal Tax Service Inspectorate or in the territorial tax authority.

Keep the declaration, copies of documents and the back of the payment order for the payment of tax on winnings for 3 years.

Related Videos

note

If participation in the games is not systematic, the declaration is submitted to the tax authority within 5 days after winning. The obligation to submit information about income and tax payment lies entirely with the taxpayer. You should not wait for a notification from the tax authority, because if the tax is not paid on time, penalties in the form of interest will be charged.

Helpful advice

By July 15, you must be sent a notice of the payment of tax on the winnings, if the application has not been received, this does not exempt you from paying tax on the winnings. Winnings above RUB 4,000 are taxed at a rate of 35%. The winning amount is calculated for the entire reporting period (calendar year).

Related materials:

Tax law equates winnings to income. And this is the basis for payment - personal income tax. However, lottery and lottery are different, and not every prize has to be taxed.

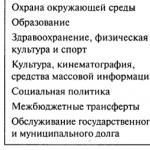

In accordance with the Law "On Lotteries", drawings are divided into two types (this division depends on the method of forming the prize fund):

- Risk-based drawing, the right to participate in which is associated with the preliminary payment of a fee (in other words, a bet made or the purchase of a lottery ticket), due to which the lottery prize pool is formed.

In May 2012, a bill was introduced to the State Duma aimed at abolition of all non-state lotteries. The bill is pending.

In accordance with Article 228 of the Tax Code of the Russian Federation, if an individual receives a prize paid by the organizers of lotteries, sweepstakes and other risk-based games, then the lucky ones who have won the prize themselves calculate and pay personal income tax at a rate of 13%, based on from the winnings.

The amount of tax payable is calculated as follows: the amount of the winnings in rubles must be multiplied by 0.13 to get the amount of tax that must be paid. If you won 500,000 rubles, the calculation formula looks like this: 500,000x0.13 = 65,000

In this case, the lottery organizers are not obliged to report the winnings to the tax office. All responsibility for paying the tax rests with the lucky taxpayer.

- A drawing, the right to participate, in which is not associated with the payment of a fee, the prize fund of which is formed at the expense of the organizer of the lottery (this is the so-called incentive or advertising lottery).

The value of any winnings received in contests and other events held for the purpose of advertising goods, works or services is taxed. If the value of the prize exceeds 4,000 rubles (Article 217 of the Tax Code of the Russian Federation), the prize is taxed at a rate of 35%. Prizes worth less than 4,000 are tax deductible.

That is, if you won a car worth 500,000 rubles, you will have to pay with 35% of its value minus the non-taxable 4,000 rubles. The calculation of the tax is as follows: (500,000-4,000) х0.35 = 173,600 rubles.

The tax return is filed on April 30 of the year following the expired tax period, i.e. the calendar year in which the income was received. Personal income tax must be paid no later than July 15 of the year following the expired tax period.

When holding incentive lotteries, the organization conducting the drawing is obliged to calculate, withhold from the taxpayer and pay the amount of personal income tax in the event of the issuance of cash prizes, if the prize was in-kind (car, travel voucher) - notify in writing of the receipt of the prize by the taxpayer to the tax office within one months (Article 226 of the Tax Code of the Russian Federation). In the latter case, the calculation and payment of the tax shall be the responsibility of the taxpayer who received the prize. He is obliged to submit to the tax authority at the place of his registration a tax return indicating the amount of the winnings no later than April 30, and pay the accrued tax no later than July 15.

If you become a prize winner of the incentive lottery, the organizer will ask you for documents: copies of internal (pages 3 and 5), pension certificate or.

Failure by the taxpayer to submit the declaration to the tax authority within the prescribed period entails liability under Art. 119 of the Tax Code of the Russian Federation.