How much does the insurance premium increase? Factors influencing the cost of comprehensive insurance. Additional function "multidrive"

The insured amount is one of the most important terms of the CASCO contract, because it significantly affects the price of insurance and the size of the potential payment. In most cases, car owners do not pay enough attention to the amount of the insured amount, which leads to negative consequences when paying.

We are talking about determining the amount of payment upon the occurrence of insurance event. How exactly will a change in the sum insured affect the amount of compensation? In search of an answer, one cannot help but recall another key aspect of a voluntary auto insurance contract - insurance cost cars.

Insurance value

The insured amount depends on the market value of the car. The latter is a constant value only when it comes to a new car, because in this case its price is determined on the basis of a sales contract.

When insuring a used car, insurance company managers typically use one or more of the following sources of information.

- Car sales sites.

- Own directories of the insurance company.

- Specialized reference publications.

Most often, insurance department specialists use the first option. At the same time, there is a significant variation in prices for a specific car model of a certain year of manufacture. This gives the policyholder the opportunity to independently determine the final insured value, and therefore the insured amount.

If the latter is within the limits of the minimum and maximum market price, the car owner will not face catastrophic consequences when settling the loss. However, he will still experience the effect of the change in the sum insured under the following circumstances.

- Complete loss of the car.

- Theft or theft.

In both cases, the amount of compensation will change greatly due to the enormous magnitude of the damage. Theft of a car or its total destruction entails the maximum possible payment, and we are talking exclusively about monetary compensation.

The lower sum insured, the less they will pay the owner of the car.

Moreover, in case of damage to the car (without complete loss), the insurance company will settle the loss within the amount of actual damage. That is, it will either pay for the repair in full or transfer to the car owner an amount sufficient to restore the car.

Trespassing

If the insured amount exceeds the limits real value car, the car owner will face very serious consequences. And not only after theft or total damage, but also in case of minor damage to the car. Here it is necessary to divide the topic under consideration into two categories. So, the sum insured can be:

- Overpriced.

- Greatly underestimated.

This division is simply necessary, because in each case the car owner faces different consequences. In some situations, changing the sum insured may be beneficial for the client, but only if he acts consciously.

Overestimation of the sum insured

The size of the payment depends on the value of this parameter: the higher the sum insured, the more the insurance company will pay in case of theft or “total”. At the same time, the price of the policy will also increase, but some car owners are ready for such an overpayment in order to increase the payment.

However, in practice there will be no benefit from the extra costs. By law, the insured amount cannot be more than the actual price of the insured car. Otherwise, some citizens could engage in deliberate damage to the insurance object.

Underwriters of insurance companies strictly monitor compliance with this legislative norm. However, there is always the possibility of managerial oversight. What happens if the contract specifies an insured amount that exceeds the market value of the car? There are only two options for the development of events:

- Insurance Company will go to court to declare the contract invalid.

- The car owner will be paid compensation based on the maximum market value of the car on the day the insurance was taken out.

There is no point in inflating the insurance amount if it exceeds the actual price of the property.

In the best case, the amount of compensation will be determined based on the market value of the car. At the same time, insurance companies often strive to use the first option, that is, they simply return the money paid for insurance to the policyholder. If the court supports the insurance company’s arguments and invalidates the contract, the car owner will have to repair the car at his own expense.

Understating the sum insured

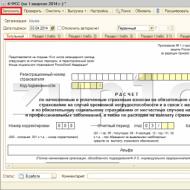

If the maximum limit financial responsibility insurance company under the contract turns out to be lower than the insurance value, managers will definitely apply the insurance proportionality coefficient. For example, if the insured amount is half a million rubles and the real value of the car is one million rubles, a coefficient of 0.5 will be applied.

Simply put, after an insured event, the company will pay only fifty percent of the actual damage. Moreover, we are talking about all incidents without exception, including theft and constructive death cars.

Understating the insured amount beyond the market price of the car entails extremely Negative consequences upon the occurrence of an insured event.

However, in rare cases, this insurance option is very useful. Often, owners of secured cars owe the bank ten to twenty percent of the total loan amount. In such a situation, some credit institutions allow borrowers to insure vehicles for the amount of the outstanding loan balance.

It turns out that the borrower will purchase a CASCO policy for only ten to twenty percent of its real cost. This option is needed solely to fulfill the bank's requirement for car insurance. There is no need to talk about real insurance protection, when the car owner will have to pay more than eighty percent of the cost of repairs on his own.

It is possible that you have been choosing a CASCO car insurance policy for a very long time in search of best price Having monitored dozens of insurance companies, choose the one whose policy will cost the least.

Perhaps you really have chosen the best CASCO policy in terms of the ratio of low price and maximum insurance coverage. But it is also likely that you have been insuring yourself under CASCO insurance for the third or fifth year, but the pricing has changed greatly from year to year, and you are simply accustomed to the annual increase in the cost of such insurance, without wasting time monitoring prices in other companies. In any case, look at these most significant factors that influence the final cost of a CASCO policy - perhaps you can change some of them. We have given 10 factors in determining the cost of the policy, and for each factor we calculated how much you can approximately save by idealizing this factor in the direction of reducing the price.

1. Insurance risks - up to 70% of the price

So, we know that cars are insured under CASCO, but from what exactly? There are three common auto insurance risks on the market:

- damage insurance;

- theft insurance;

- insurance against total loss of the car.

Each of these risks can most often be insured separately. Typically, insurance only, for example, against theft can reduce the cost of a CASCO policy by as much as 70%. For example, a calculator RESO Guarantee when calculating the cost of a policy for a 2016 Toyota Corolla car in an online calculator, it showed the cost insurance policy with all the risks of almost 80 thousand rubles. At the same time, if you reduce the risks only to the point of theft, then the cost drops to 18 thousand.

At the same time, it should be borne in mind that if you have a credit car, the bank will most likely impose a condition on insuring the car against all risks.

2. Franchise - up to 60% of the price

A deductible is a clever trick from an insurance company that allows the company not to pay for insurance damage if the amount of such damage exceeds a certain figure. Due to this, the final cost of the policy is reduced, and significantly.

At the same time, the franchise can be conditional or unconditional. In one case, with a deductible of, for example, 20 thousand rubles and damage of 50 thousand rubles, the insurance company pays the full amount, and if the damage is less than 20 thousand, it pays nothing. In the second case, the insurance company also does not pay anything if the damage is 20 thousand, and if the amount of damage is 50 thousand, it pays only 30 thousand rubles (50 thousand minus the cost of the franchise of 20 thousand rubles).

That is, when a small amount damage You undertake to repair the car at your own expense, and in this case you only insure the car against significant damage.

With most insurance companies, you can choose which type of deductible is right for you, as well as the deductible amount within the limits set by the company. It should also be taken into account that in the case of credit cars, banks rarely provide the opportunity to insure with a deductible.

3. Type of car - up to 45% of the price

What you drive affects your insurance premium (the premium is the cost of the insurance policy). And the point here is not only and not so much in the parameters of the car - yes, the more powerful the car, the older and larger it is, the greater the risk of getting into an accident, but insurers analyze all requests to insurance companies and have a single database of car models that most often get into in an accident.

If your car is popular with young people, you can probably pay a higher price. For example, the highest CASCO prices are for a number of Mazda, Honda, Kia, and Hyundai models.

4. The circle of persons admitted to management - up to 40% of the price

Everything is simple here - if one driver is included in the policy, who is 45 years old, of which he has been driving for 25 years, then the cost of the policy for him will be minimal, depending on his experience. If the policy is without restrictions, and any drivers can drive the car, then such insurance will cost more.

5. Age - up to 30% of the price

Your age is the main driver-specific factor that determines the price. Teens and older adults face especially high insurance costs because they are the most likely to be involved in a driving accident. The Insurance Institute for Highway Safety (IIHS) has determined that teenagers are 3 times more likely to be involved in fatal crashes than drivers over the age of 21. And these risks justify more expensive CASCO insurance.

6. Driving experience - up to 25% of the price

It is logical that not only age, but also experience significantly affects the risk of getting into an accident. Insurers carefully evaluate the experience of drivers who will be included in the insurance policy.

7. Purposes of using the car - up to 25% of the price

How and for what purposes you use your car affects the price of the CASCO policy. If you drive for commercial purposes, for example, work in a taxi, you need to disclose this information when applying for CASCO. If you do not do this, your request may be denied insurance compensation if you have an accident while working.

8. History of insurance claims - up to 15% of the price

The insurance claims you make to the insurance company will also affect the cost of your comprehensive insurance. And we’re not just talking about those claims in which you were at fault for the accident. Even no-fault claims can increase costs. Therefore, you should think about it when you decide where to contact: the insurance company at fault for compulsory motor liability insurance or your own CASCO insurance that if you choose the latter option, you may lose benefits from re-insurance - perhaps even more to lose than compensation for minor damage.

You should also keep in mind that if you simply change the insurance company, then nothing will be known about the previous claims of the new insurance company.

9. Marital status - up to 9% of the price

Drivers who are married are less likely to be involved in driving accidents than single drivers. Most insurers will reduce rates for drivers under 25 years of age if they are married.

10. Region of residence - up to 7% of the price

Insurers have a lot of data on insurance claims in the region where you live and travel. Things like population density, the degree of motorization and crime in your area are factors that they take into account when calculating the final price of a CASCO policy.

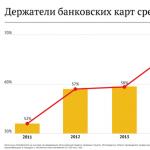

It is interesting both for owners of new cars and for owners of used vehicles. According to statistics, in Russia every year more than half of the cars purchased already have mileage.

Therefore, the question of which year of manufacture of a car you can purchase a CASCO policy becomes very relevant. In our article we will look at all the restrictions and nuances of obtaining voluntary car insurance.

Insurance under the CASCO program is not regulated at the state level.

Expert opinion

Natalya Alekseevna

Each insurance company develops its own rules for voluntary motor insurance, including, among other things, a limit on the age of the vehicle that is insured.

Therefore, before insuring an old car, you will have to inquire about the insurance rules of different insurers.

If we talk about the current trend, most insurance companies set the maximum age limit at the following level:

- not older than 7 years for domestically produced cars;

Having a car of this age, the car owner can count on any programs comprehensive insurance CASCO. Moreover, with the inclusion of an option that allows you to receive payments without taking into account wear and tear. And for transport as it ages, this is very important.

Types of car insurance.

If the age of the car exceeds the limit established by the company, then a contract may be concluded with the car owner individual contract insurance that has higher rates or special conditions.

Most often, insurers put forward the following conditions:

- Mandatory presence of a deductible - the amount that the insurer will not pay to compensate for damage. The owner of the car covers repairs for this amount with personal funds.

- Parts may change to non-original parts. In other words, from another manufacturer, and not the official manufacturer for a specific model and brand of car.

- It is allowed to repair parts instead of replacing them.

To profitably obtain CASCO insurance, the owner of an old car needs to spend more time than the owner of a new car. You will have to visit the offices of many insurers to compare their offers. As a rule, large insurance companies have more favorable insurance rules and a larger range of insurance programs.

Good luck on the roads!

When purchasing a comprehensive insurance policy, the price of the car is one of the main criteria for determining maximum payout upon arrival insured event. For a high payment price, you will have to pay the price of a comprehensive insurance policy - it increases in proportion to the cost of the car (with the exception of expensive cars, for which special programs insurance).

How to determine the value of a car?

A comprehensive insurance policy can be sold to a car owner who has a domestic car up to 5 years old and a foreign car up to 7 years old. As a rule, cars that are more than 7 years old are not insured under standard programs. But in some cases, exceptions are possible: some insurance companies may meet halfway - for this you will have to pay with an increased policy price.

Insurance companies have a complete list of car modifications that indicate market price vehicle for each of recent years. These data may change over time, either up or down.

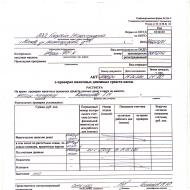

The cost of a new car is determined according to the act of sale of the vehicle (the price you paid upon purchase). In the first year of use, the car loses 18% of its market value, in the second - 15%, in the third and subsequent years another 10%. If the service life is “uneven”, then the cost is calculated proportionally.

For example, the initial price of a car is 500 thousand rubles, its age is 3 years. The calculation is:

Cost of the car after the first year of operation: 500 thousand rubles. - 18% (90 thousand rubles) = 410 thousand rubles.

Cost of the car after the second year of operation: 410 thousand rubles. - 15% (61.5 thousand rubles) = 348.5 thousand rubles.

Cost of the car after the third year of operation: 348.5 thousand rubles. - 10% (34.850 thousand rubles) = 313.65 thousand rubles.

Cost of the car after 3.5 years of operation: 313.65 thousand rubles. - 5% (half of 10% (RUB 15,682)) = RUB 297,968

Do not forget that the price received may vary depending on the actual value of the car on the market.

Is it possible to underestimate or overestimate?

In order not to make calculations, it automatically substitutes the cost of the car, which corresponds to the assessment of insurance companies. You can change this value yourself. The insurance company will refuse to sell a comprehensive insurance policy if stated cost your car will be higher market indicator. According to the law, such a transaction will be considered void.

On the other hand, if you want, then the cost of the car can be reduced by any amount - this is permitted (except in cases with credit cars). As a result, you will receive compensation for damages that is less than necessary. Thus, you will be forced to compensate part of the damage at the expense of own funds. The optimal condition for choosing the price of a car is its market value, which is calculated by a representative of the insurance company.

Sravni.ru advice: Do not overestimate or underestimate the cost of your car when calculating your comprehensive insurance policy.