Home credit installment card how to use, tariffs and grace period. What is the catch of the Home Credit Bank installment card: conditions, service What can be paid with a home credit installment card

A bicycle, a fur coat, a car and even a turbo mop in installments - this is how a new card from Home Credit Bank was announced. If you already have a Home Credit installment card, we will tell you how to use it and the grace period below. Indeed, with the funds in her account, you can buy a lot: from a bicycle to a smartphone or furniture. Much depends on the size of the provided limit on the account. But in order not to pay interest on the amount taken, you need to repay the debt correctly and on time. To do this, we will tell you in detail about the terms, tariffs and the interest-free period.

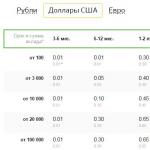

We study tariffs and interest rates

- Grace period of installments - 3 months for all types of purchases. If you place orders in Home Credit Bank partner stores, then this period increases to 4-12 months. The list of partners is very extensive, it is on the bank's website in the document "Installment program of HCF Bank LLC". Purchases at these points are also called "Special Offers".

- Interest rate during the installment period (preferential) - 0%.

- The interest rate after the expiration of the installment grace period is 29.9%.

- SMS-informing service - free of charge.

It follows from this that during the installment period, no interest is charged for the use of money. You can make purchases, transfer funds, recharge your mobile phone and make other payments without transferring interest for using a loan. That is, within 3-12 months (grace period) the interest rate is not charged.

But it is important to return all the money back to the card account before the end of the installment period. Even if this happens on his last day, the repayment of the debt will be counted. If the repayment of the loan does not occur, then interest will begin to accrue on the total amount withdrawn - 29.9%.

An example of using installments, making payments

Not all types of purchases offer a 12-month installment plan. The grace period leaves 3 months for all types of orders made on the Internet. If you shop in partner stores, then the installment period increases: from 4 to 12 months.

An example of how to use the Home Credit installment card:

The holder of the Home Credit installment card was credited with the following limit of funds to the account: 100,000 rubles. During the grace period, he made purchases in the amount of 60,000 rubles. These were orders that do not belong to the "Special Offers" category. For this reason, the grace period is 3 months. How much should the holder be paid if he does not repay the debt on time or does it before the end of the installment period?

If the owner of the Home Credit installment card has deposited funds back to the account before the expiration of 3 months, then no interest rate is charged. He does not need to pay interest on the funds taken from the account.

If the holder has not transferred the money before the expiration of 3 months, then he is charged:

- Interest rate on the amount of debt in the amount of 29.9% per annum.

- Mandatory minimum payment: 7% of the debt each subsequent month.

If the minimum payment is not made, then the bank has the right to charge fines, penalties, etc. Since 60,000 rubles were withdrawn, the mandatory minimum payment in the first month after the expiration of the grace period is 7% of this amount (4,200 rubles). And now the funds used are called not an installment plan, but a loan, therefore, 29.9% per annum is also charged on the total debt.

Other rates:

- Issuing a card after its expiration date is free of charge.

- Reissue (at the request of the client) - 200 rubles.

If you pay off your debt on time, you don't have to pay anything. If you do not repay the loan before the expiration of the grace period, then you should make both interest at the annual rate and the minimum payment.

Grace period and distribution of payments

Any installment card is a convenient financial instrument. No need to take loans and pay interest on them. You can temporarily use the amount on the card and then return it back again before the expiration of 3-12 months. For some, this is a great opportunity not to borrow money “before payday”, for large and small purchases, etc.

For those who already have a home loan installment card, how to use it can be seen clearly on the bank's website. For example, it is proposed to add several examples (products for different amounts) and see how much you need to pay for them monthly:

The picture shows that the system itself evenly distributed the amounts that need to be returned during the installment period for purchased goods. Everywhere, the percentage and fee for using the loan is 0. If you move goods by month, then the use of installments will always be free.

But this is available only during the installment period, which is also called preferential. And it is quite large - 3 months for absolutely any purchase. It can be orders of any goods, services: from air tickets to furniture, sneakers, etc. An important condition is that all calculations should be made only online.

The installment period reaches 4-12 months, that is, even during the year free use of funds on the Home Credit card is available. It is activated for purchases on special offers, that is, those made in partner stores of the bank. There are a lot of them, so at these points online you can pay for almost all types of goods and services.

As for payments during the installment period, the money can be returned back in equal parts, and in one amount, or in some other way. The main condition is to do it on time, until the grace period has ended. Of course, even if the holder did not have time to do this, he still has a way out. It is important for him to make at least the minimum payment to the account and start paying off his debt.

Advantages of the Home Credit card and its differences from others

If we summarize all the advantages of the Home Credit installment card, then they come down to the following list:

- Convenient use: online payments for purchases, Internet banking, mobile application.

- A large list of bank partners with installments from 4 to 12 months.

- 3 months installment plan for all types of purchases.

- Free use of funds on the card during the grace period.

- Online issuance of a card directly on the Home Credit Bank website.

- Free SMS alert service.

Holders are not allowed to withdraw funds from ATMs or cash desks, but many do not need this. Now most purchases and payments are made via the Internet, so for many this restriction is even an advantage.

How exactly does this product differ from a dozen other installment cards? The differences are:

- Large grace period. It reaches a whole year, which not all banks can offer. For all types of purchases, this period is 3 months, which is also a lot.

- Extensive list of partners. If you make purchases online from them, then a grace period of 4-132 months is provided.

The credit limit is set on an individual basis. The official website does not indicate its exact size and boundaries, but many sources have information about 10-300 thousand rubles. The size of the amount on the card depends on many things. But the level of income of the client, his solvency, credit history is of the greatest importance. An application for a Home Loan installment card is submitted online. In the application, you must specify data on income and not only. Based on this, the limit on the card is determined.

When you already have a Home Credit installment card on hand, you can find out how to use it in Internet banking or a mobile application. All these services are available for free and online. There is also a personal account of the holder, the history of operations, and other important sections. Even the amount of payments, debt and the remaining amount can be found there.

As for payments for purchases with an installment card from Home Credit, they are available only on the Internet. When placing orders for goods and services online, you just need to enter your card details and confirm the transactions. Usually it is necessary to indicate the code sent to the phone in a message from the bank.

Recently, not just credit cards, but installment payment cards have begun to gain more and more popularity. And this is no accident. Such cards have a number of advantages. Not so long ago, the Home Credit Bank also issued its installment card.

Installment card

The Home Credit Bank installment credit card was issued in August 2017. And immediately competed with such cards as "Conscience" and "Halva". This card, unlike others, has a wider affiliate program, as well as a long installment period. This makes it more attractive in the financial services market.

With the Home Credit installment card, you can pay for goods and services not only in stores, but also on the Internet. In this case, the payment period can be from three months to one year.

The credit limit on the card is set by the bank after consideration of the submitted application. For each client it is individual. The credit limit varies from 10 thousand to 300 thousand rubles.

However, please note that cash cannot be withdrawn from the card. It is intended only for payment of purchases by bank transfer.

Advantages of the card

Reviews of the Home Credit Bank installment card are mostly positive. And all thanks to its many advantages:

- Firstly, the card is issued by the bank absolutely free of charge. In addition, the client receives free SMS notifications about transactions made with the card.

- Secondly, this is an interest-free installment period in absolutely any store. And in those outlets that are partners of the bank, when paying with this card, it reaches twelve months.

- You can pay with the card in any store around the world, since the card is supported by the Visa international payment system.

- The card has a renewable limit. If you make a loan payment on the card, then these funds can again be spent on new purchases.

- You can pay off the debt on the card in full, at any time and without fines and hidden fees.

Reviews about the Home Credit installment card are also good because only one passport is enough for its registration, which means that you do not need to collect a special package of documents and certificates. In addition, the card has a flexible debt repayment system. You can make both equal monthly payments and pay the minimum amount. It is only seven percent of the total debt.

Card Disadvantages

Despite numerous positive reviews, the Home Credit installment card has its drawbacks. One of them is the inability to withdraw cash. It can only pay for goods and services. In addition, the bank does not issue cards to holders of credit cards of its own bank. This is due to the fact that the client in this case has too high a financial burden.

The disadvantages include the fact that there is little information about the card on the official website of the bank. And yes, it is very superficial. Therefore, it will not be easy for a person who is not strong in credit topics to immediately understand the intricacies of installment plans.

Who and how can get

Credit card "Installment" from "Home Credit" received different reviews. This is due to the fact that not everyone can easily get a card. Under the terms of the bank, the card is issued to clients who have reached the age of majority, but in fact it is problematic to obtain it at that age. Agree, at the age of eighteen, few people have a permanent source of income. Yes, and lovers of getting a lot of credit cards, most likely, will be refused by the bank. This is due to the fact that any credit card increases the financial burden of the borrower, even if it is idle. Therefore, before getting a lot of credit cards, it is worth considering.

In general, any solvent citizen of the Russian Federation from 21 to 65 years old who has a positive rating in this bank can get a card. For clients who first contact the bank, the age range is from 23 to 64 years.

Of the documents, it will be enough to provide a passport, and for non-working pensioners, a pension certificate.

An application for a card can be issued both at the bank branch itself and on its official website. As a rule, the review takes no more than three days.

But it is worth considering that this card is not delivered to your home. Therefore, it will be necessary to visit the bank with a positive decision.

Installment card "Home Credit" - customer reviews

This card is a novelty of the credit market. For this reason, reviews about it may be different. However, banks often listen to the opinion of customers and try to eliminate shortcomings and improve positive indicators as soon as possible. Unfortunately, the Home Credit installment credit card, according to customer reviews, has its own "cons". For example, customers complain that they were denied a card, and there were difficulties in understanding the terms of concessional lending. Complaints were also received about too long registration. But, apparently, all these claims do not apply to the action of the card itself and cannot fully characterize it.

Negative reviews about the Home Credit installment card are also expressed by those customers who were denied receipt of it due to the high debt load. So, in one of the reviews there was a complaint and an indication that the borrower had been a client of the bank for several years. At the same time, he regularly pays on an existing credit card. But it was precisely the presence of a bank card that could serve as a refusal. The presence of several credit cards in one bank is almost impossible, since this affects the solvency of the borrower.

Those customers who understand well the conditions provided by the installment card and skillfully use them, remain satisfied and leave only positive feedback about it.

Before you draw a conclusion after reading the negative reviews, you should consider that most of them are written on emotions. Therefore, it would be nice to learn about the card from bank employees.

It is also necessary to take into account the fact that so far there have been no complaints about fraudulent transactions by the bank.

Reviews of bank employees

Reviews about the Home Credit installment card come not only from those who use it, and those who were denied issuance, but also from the bank employees themselves.

In their opinion, the "Installment" card has a number of advantages over the cards of competitor banks ("Conscience", "Halva"), since its grace period is three months when purchased in any of the stores. And in partner stores, it reaches twelve months. Another positive quality of the card is that the annual maintenance of the card is free. And this makes it more profitable compared to the new products from Alfa-Bank (card "100 days without interest") and "Post Bank" ("Element 120").

But it is worth considering that this card does not have any cashbacks or other bonus programs.

Terms and rates

The terms of the Home Credit Bank installment card are quite simple. As has been repeatedly said, it is intended only for purchases. Therefore, one of the conditions is the inability to withdraw cash.

The card does not have a cashback and it is impossible to connect the "Benefit" bonus program to it. For this, the bank issues separate cards.

You can pay the debt on the card in equivalent payments. They depend on the credit limit and the funds spent on the card and are calculated at the bank. In this case, there will be no overpayment for purchases at all. If the client decided to repay the debt with minimum payments (seven percent of the funds spent, but at least 1,000 rubles), then it turns out that he took a loan from the bank at 29.9 percent per annum.

In this case, it turns out that the client pays a penalty and thereby does not spoil his credit history. And the conditions of the bank will not be violated. Only the conditions for granting installments are violated.

Principle of operation

For those who have already repeatedly dealt with credit cards that have a grace period, it will be easy to figure it out. Well, those who first issued such a credit card will also be able to quickly understand the whole essence of the installment plan and its grace period.

The "Installment" card has a calculation period, its beginning can be the fifth, fifteenth or twenty-fifth day of each month. The billing period lasts one month, during which the bank records all transactions made on the card.

The installment period begins when you make your first purchase with a card. It will last three months, and if the purchase was made from one of the bank's 40,000 partners, then a whole year.

The first card payment must be made in the amount that is necessary for payment by installments. Other payments can be made with the same amount or minimum payments.

The Home Credit Bank installment card received many negative reviews precisely because of a misunderstanding of the difference between the minimum payment and the installment payment.

How to top up the card

The mechanism for replenishing the card is quite simple. There are many standard ways to deposit funds. First of all, these are bank cash desks. It can also be done in any terminal.

You can also replenish the card through your personal Internet banking account by transferring funds from any other bank card. The main thing is not to postpone the payment until the very last moment, because it happens that funds are received on the card late.

Early repayment

You can make early repayment on the card at any time. There are no penalties for early repayment. As soon as the borrower deposits the entire amount spent on purchases on the card, the debt will be repaid automatically.

Do not forget that when depositing only a part of the amount, it will be necessary to continue to make minimum payments. The most optimal way to make early repayment will be during the payment period.

But an incomplete or not made payment on time will automatically terminate the installment plan. It will be possible to resume it only after paying the full amount of the credit card debt.

What are the benefits of the card

Many people wonder what is the benefit of partner stores? After all, it is much more profitable to sell goods on credit than in installments.

Everyone has their own benefit. Bank customers can purchase goods, while paying for it in equal installments, without interest. Partner stores, participating in the bank's program, increase the number of their customers, and consequently, the number of sales.

What is the benefit of the bank?

The bank attracts new customers, who may be interested in other products of the bank in the future. Also, the bank receives cash interest for late payment or when the client makes only the minimum payments.

Should I open the card?

As already mentioned, reviews of the Home Credit installment card are different. This makes many think whether it is worth issuing this card.

There are pros and cons. For example, given that the grace period on the card is three months, not only with bank partners, but also when making a purchase absolutely anywhere, of course, it’s worth it.

Against the fact that any delay in payment will add almost thirty percent to the amount of the remaining debt.

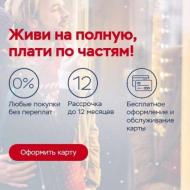

The new installment card from Home Credit is a successful rethinking of credit cards from QIWI and Sovcombank. At least that's how it's presented. How is everything really, why is “Installment” so convenient and what conditions can you count on? Let's take a look at the novelty on the shelves.

Home Credit Bank has created its own "Installment" card, designed for purchases in stores. This is a Visa Classic based card with a credit limit that provides an interest free period on any purchase.

At the same time, the institution hung on it a lot of additional services and bonuses. In general, it turned out to be a credit card that is convenient for almost everyone, and at the same time inexpensive to maintain.

A bank card can be equipped with PayWave technology (payment by touch without entering a PIN code). Initially, the card is made without a name. But you can order personalized plastic for free, if you clarify this point at the bank office upon receipt of a non-personalized card.

Terms and tariffs of credit card installment "Home Credit"

The card is issued for 5 years immediately. You don't have to pay to create it when you make it. In the future, the money for the service is also not withdrawn.

- the minimum limit is 10 thousand rubles;

- the maximum amount of debt is 300 thousand rubles;

- installment percentage - 0% per year;

- loan percentage (in case of violation of the terms of the installment plan) - 29.9% per year.

In this case, you will not have to pay any additional money for the use. Even SMS banking is free. In fact, the card will not cost anything, especially if you pay interest on time.

Within five years, you can pay for the card only once - if it suddenly turns out to be lost or broken. Reissue before the deadline will cost 200 rubles. On time - free of charge.

Limits

You cannot withdraw money from the card - only spend it in stores and outlets. In this case, you can replenish it in several different ways:

- In bank branches (through cash desks) - unlimited, money will come within two days;

- In the branches of the Russian Post - up to 500 thousand rubles, enrollment - in two days;

- Transfer from card to card - up to 75 thousand rubles at a time, money comes in the same second;

- Online transfer has no restrictions on one time, but you can send no more than 500 thousand rubles per month (with instant crediting).

No interest is charged on top up credit cards.

You can also deposit money to a plastic card through many Home Credit partners. But the conditions will depend on the internal agreements of the bank and the partner, so it is worth clarifying them on the spot.

Application approval deadlines

To get a preliminary decision and not to wander to the office in vain, you need to fill out an application on the website or call the bank's hotline. This will speed up the process. The preliminary consent of the bank will become a boundary, after which you can go to the branch with a passport and write an application on the card.

As a rule, a credit card is finally approved within a few hours. But for confirmation, you will have to go to the bank, fill out an extended questionnaire there and wait this time at the branch.

The procedure for submitting through the site is as follows:

- Get acquainted with the information provided;

- Enter your full name and email address in a special field;

- In new lines, enter the date of birth and mobile phone;

- Mark consent to the processing of personal data;

- Submit the application and wait for a preliminary decision.

A few minutes after sending, the answer should come to the mail or by phone number - in the form of a message or a call.

You can do it easier - just call the hotline at 8-495-785-82-22 and ask the operator to accept an application for an installment credit card. In the process, you will have to answer a number of questions regarding the borrower.

And if you don’t want to wait for a preliminary decision, you can immediately take a passport and come to the bank. A free manager will independently fill out an application according to the client's words and send it for consideration. There will be no preliminary answer - it will be possible to get the final one right away. And, if the card is approved, immediately write an application and go to wait for the plastic.

To apply for a credit card, you must bring your passport and any of the documents to choose from:

- SNILS;

- international passport (valid);

- driver's license.

Attention, apart from a passport and a second document, no other documents are required. Enough of them and the provided contact details of relatives, friends or superiors.

Where can I get "Installment"?

After filling out an application for a bank card, the client must go to the nearest office of his city and receive a plastic card there. It is issued immediately, since there is no name on it.

But when visiting the office, you can also leave an application for the creation of a personalized card. That's just until it is done, you have to go with the usual one. Dates must be specified directly at the office.

Remember: the credit limit is set by the bank for each client separately!

Map Features

"Installment" is a rather unusual card. In fact, it is completely free for the client. There is no service charge or additional paid services on it. Nothing extra.

In this case, the client is granted a grace period of 51 days. And for the payment of installments - as much as three months. Quite a handy card.

A nice bonus: the installment plan is always at least 3 months. But if suddenly the client decides to buy in the bank's partner store (unfortunately, the exact list is unknown now, but Home Credit promised to provide it soon), then the period may increase up to 12 months!

In the summer of 2017, a new interest-free installment card from Home Credit Bank entered the market. We already have 2 similar offers on the market: cards from Qiwi-bank and from Sovcombank. By the way, they are in very good demand among the population.

Many credit institutions are aware of the prospects of this direction. And they begin to prepare for the release of their own installment cards. Moreover, the conditions for new products are getting better and better. But not always. So the card from Alfa-Bank "", launched in the spring of 2018, offers very modest installment terms.

But Halva, on the contrary, is gradually evolving. Transforming from an ordinary credit card into an almost perfect banking product. Possibility to use own funds on the card. Receive for purchases (for example, 12% in Pyaterochka or Perekrestok stores). Interest on the balance of own funds. And all this is free.

What can offer a new and special installment card from HCB (Home bank loan or simply from a hamster)?

The creators of the new product immediately assured that their card would be much more successful and profitable compared to Halva and Conscience. They took into account all the shortcomings of competitors and took only the best.

Map from Hamster - an application for victory?

I immediately remember characters from Russian fairy tales.

The father had three sons. The older one was smart. The average was this way and that. The younger one was an idiot.

Why am I doing this? It was the youngest son who ended up on a horse, snatched off his beautiful wife, became king, and so on and so forth.

I don't know if Home Credit will be able to become a leader or if it's just a PR move and the product will be just one of the similar offerings on the market.

Let's figure it out.

In this article, we will look at:

- what is an installment card from Home Credit;

- what is new in it compared to competitors;

- what are the benefits of plastic;

- features and hidden conditions;

- what you need to pay attention to.

So let's go…..

Basic rates and conditions

On the main page of the bank's website, we see the following information:

- the card is free (issuance and maintenance);

- installment period 3 months;

- overpayment for the use of borrowed funds - 0 (subject to repayment on time);

- 29.9% per annum in case of delay;

- The card is accepted in all shops.

Sounds tempting. But usually the bank indicates all the most unpleasant in the tariffs, leaving the most delicious in sight.

Is an installment card a credit card?

Pretty popular question. Many still hardly imagine the functionality of cards with the installment function. And how do they differ from ordinary credit cards.

Let's go in order.

- The use of borrowed funds on a credit card involves a fee to the bank. You borrow money (in cash or buy goods in a store) and the bank charges interest on the amount of the debt. Until the loan is repaid in full, interest is dripping.

- High competition and the struggle for new customers among banks gave impetus to a new type of lending - an interest-free period. Here you can use credit money for free for a certain period of time (from several weeks to several months). It is only necessary to fully repay the debt to the bank by the end of the free period. One example is "" from Alfa Bank. With long grace periods, the bank also obliges to make a certain minimum payment once a month (usually 5-10% of the debt amount). If you do everything right, do not miss payments and repay the loan in full on time, you do not need to pay interest. Usually such cards have an annual maintenance fee. From 500-1000 rubles to ...... let's say several thousand.

- Installment cards became the next (or parallel) stage of the banks' battle for customers. The meaning of use is very similar to cards with an interest-free lending period. You buy goods by card, if you deposit money on time, you do not pay interest.

The differences are as follows:

- The service is free. No need to pay banks only for the right (card) to use money if necessary. The installment card can be safely put on the shelf. And only use it in an emergency.

- Debt payment algorithm. A very small amount is paid on credit cards every month, and the main (almost all) part of the debt must be paid by the end of the interest-free period. But on installment cards, we need to split up the debt and pay it in equal installments.

It turns out that, according to its parameters,

Installment cards are credit cards. But with slightly different rules for providing borrowed funds and a repayment algorithm.

How to use the card?

The Home Credit card gives you the opportunity to buy goods in any stores (including the Internet) in installments for 3 months. The amount of the debt is divided into 3 equal parts and you only have to repay 1/3 every month. If everything is done on time, you will not have to pay any interest on the use of credit funds.

Bought a TV for 30 thousand. Every month you have to pay 10 thousand rubles. If during this period you make more purchases, then we add a third of the cost of new purchases to the current monthly payment.

Another question is when to make payments so as not to fall into penalties?

The installment card has 2 parameters: payment and settlement period.

The payment period lasts exactly one month from the date of issue of the card. Then comes the settlement period - 20 days. The bank counts all your purchases for the month and determines the amount of the required payment. You have 20 days to deposit money.

For example. Issued a card on January 1st. The payment period is until February 1st. In a month you spent 30,000 thousand. It doesn't matter when. At the beginning of the month or January 31st. All expenses are summed up and divided by 3. Your payment will be 10,000 rubles. You need to make it from the 1st to the 20th of each month (billing period), starting from February 1.

If in February you spent another 30 thousand, then by the next billing period, the minimum payment will be 20,000.

Possibilities of use

The card is accepted absolutely in any stores. This is one of its main differences, I'm not afraid of this word - advantages over competitors (Halva and Conscience).

Many cardholders complain about the limited number of partner stores. When you need to find out in advance before buying whether the cards can be used in this retail chain.

As a result, many installment cards gather dust on the shelf. There is nowhere to pay them.

Plastic from a hamster is devoid of such inconvenience. In fact, we have an ordinary credit card. Where we use it is up to us. No restrictions and imposition by the bank of their stores.

Home Credit also plans to acquire partner stores. For purchases, a longer installment plan will be given. From 4 months to a year.

But there is no official list yet. The bank promises to publish the list soon.

The first list of partner stores appeared on the Home Credit website. Not very big yet. But a start has been made. The minimum installment period is 3 months. The maximum so far is 10. For most offers, the period of interest-free use is 4-6 months.

The number of partner stores has increased to 20,000.

But in any case, the minimum installment period of 3 months is already good.

For example, at Conscience and Halva, for the most popular stores, installments are given only 1-2 months.

SMS info and personal account

Services, unlike most credit organizations trying to earn an extra penny for providing SMS services, are completely free.

The bank will calculate the amount of the monthly payment. And SMS notifications will prompt (remind) in what period and how much money needs to be deposited. You will have almost 3 weeks to calmly pay off your current debt.

Also, all this information is available in your personal account.

Deposit and withdrawal of cash

It is not possible to withdraw money from the card. Moreover, the ban is not only on credit, but also on own funds.

You can replenish the card for free at "native" ATMs and cash desks of the bank. The card does not know how to withdraw money through a personal account from other banks.

There are several more exotic ways to replenish. Through your own My Credit service (the first 2 top-ups are free) and through the telephone menu (but a call from outside Moscow will be paid).

Penalties

I think this is the most important point to pay attention to in the first place. The free installment plan is great. But what happens if the payment is not made on time?

We are all living people, but everyone can experience force majeure situations.

For delay, Home Credit begins to accrue interest at a rate of 29.9% per annum.

The bank rates are as follows.

It's written a little confusingly.

The meaning is the following.

If the next payment is not made on time, the bank charges interest for using the loan from the beginning of the last payment period (month) and only on the amount of the outstanding debt.

Example. Within 3 months, on the installment card, you must pay the bank 30,000 rubles (10 thousand each). The first 2 months were paid regularly and on time. Missed payment at the end. It is for the last month that the bank will begin to charge you interest for using the loan. And only for the remaining amount of the debt. That is, not 30 thousand, but only 10,000.

Interest continues to accrue until the loan is paid off in full.

Other features

Credit limit- from 10 to 300,000 rubles. The level is set at the discretion of the bank. With active use of the card, the limit will increase.

cash back- Partial refunds for purchases are not provided. Neither at the expense of credit, nor for their own.

Usage restrictions . The installment plan does not apply to operations not related to the purchase of goods (services), replenishment of electronic wallets, money transfers, purchase of lottery tickets, gambling.

Early repayments . You have the right to deposit money early. The bank has no sanctions in this regard. If you don’t want to pay for 3 months, deposit the required amount and immediately close the debt to the bank.

How to issue a card

There are 2 options for obtaining a card.

- Place an online order at official website Home Credit Bank. Leave your contact details and we will call you back within a few minutes.

- Come directly to the bank branch.

To get a card, you still need to visit the bank. But in the case of sending an online application through the site, you will immediately know whether the card was approved for you or not. With a positive decision, all that remains is to choose a department convenient for you and pick up the finished plastic.

Updated. The card can be delivered by courier to your home. For free.

When visiting the bank on your own to order a card, certain inconveniences may arise: loss of time (standing in line, waiting for the manager to complete all the documents and request approval), even if you fully meet the bank’s requirements for borrowers, there is a risk that the card may not approve.

Requirements for borrowers

To apply for a card, you will need 2 documents:

- Passport.

- The second identity document (rights, SNILS, passport).

Requirements are standard and very loyal.

- Citizenship of the Russian Federation.

- Local registration.

- Age 18 - 64 years.

- Availability of a cell phone and a second additional phone number.

- Experience at the last place of work from 3 months.

Comparison with Conscience and Halva

Based on the information received, it is already possible to deduce a certain verdict.

But is the card as good as the creators of the product say about it?

Let's make a comparison with the main (and so far the only) competitors: Halva and Conscience.

| Home Credit Card | Halva | Conscience | |

| Service | for free | for free | for free |

| Credit limit | up to 300 thousand | up to 300 thousand | up to 350 thousand |

| Withdrawals | not provided | only own | not provided |

| cash back | No | 12% (from own funds) | No |

| SMS info | for free | for free | for free |

| Shopping by card | in any stores without restrictions | in installments in partner stores / in any stores at our own expense | partner stores |

| Minimum installment period | 3 months | 1 month | 1 month |

| Maximum installment period | 12 months | 12 months | 12 months |

| Receipt | at the bank office | Courier delivery | Courier delivery |

Modern financial institutions in Russia offer their customers all kinds of banking products and allow them to make almost any purchase without obtaining a consumer loan. The Home Credit Bank installment card is based on Visa Classic and has a credit limit of at least 10,000 rubles. This is one of the best options on how to improve your own financial situation and purchase goods or pay for services without prior savings.

Page content

How to use the Home Credit Bank installment card

The Home Credit installment card is a convenient product that allows the borrower to use bank funds to purchase goods and pay for services. Subject to the requirements of the financial institution, the annual interest rate is zero.

You can spend the borrowed amount in whole or in part. As a result, the lender sums up all expenses on the card for the calendar month and divides by the number of installment months. The amount received must be returned to the account monthly until the entire debt is repaid in full.

Important! The card can be used to pay for travel packages, clothing, furniture, household appliances, and food. The refund is made in stages, although you can pay off the debt in one amount.

With an installment card, you get significant advantages - payment for purchased products in almost any store equipped with a terminal for electronic payments. The universal card allows you to pay for goods in online stores.

What is the catch of the card: pros and cons

Many users are wondering what are the benefits of an installment card and what is the catch of using it. Before applying for a banking product, experts recommend that you familiarize yourself with the conditions for the provision of financial services and learn in detail how to use an installment card. Note:

- The agreement sets out the conditions for the use of funds, options for cashless payments, as well as the features of debt repayment and the obligations of the parties.

- If you do not repay the debt on time, the lender automatically begins to accrue interest for the use of credit funds.

By paying off your debt on time, you will protect yourself from overpayments and will be able to fully appreciate all the benefits of interest-free installments. Stick to the payment schedule.

Among the advantages of a credit card from Home Bank it is worth noting:

- Understandable terms.

- Fast and free registration in almost any branch.

- The minimum package of documents when signing an agreement to receive an installment card.

- Availability of a grace period with a zero interest rate.

- No card maintenance fee.

- Availability of free SMS banking.

Important! Payment for goods and services using an installment card is made instantly. Compliance with the rules of use and repayment of debt on the card can improve the borrower's credit history and increase the chances of obtaining a larger loan in the future.

Experts also note shortcomings that cause customer disappointment and cast doubt on the reputation of a financial institution as a borrower:

- If you do not repay the debt in a timely manner and in the right amount, the bank begins to accrue interest on the use of credit funds.

- An installment card can only be used for purchasing goods or paying for services.

- It will not work to make a money transfer from a card to any electronic wallet.

- When making purchases using an installment card, you cannot earn additional bonuses.

Home Credit installment credit card has both disadvantages and advantages. Much depends not only on the lender, but also on the users, who often do not adhere to the requirements specified in the contract.

Important! By signing the agreement, you agree to the terms of the loan. The document clearly spells out the consequences of late payment.

Tariffs and terms of service

Home Credit installment credit card is issued to the client on certain conditions:

- You do not need to pay for registration and receipt of the card. Issuing a new PIN is free of charge.

- You can make any purchases without a down payment.

- The size of the credit limit can vary from 10 to 300 thousand rubles. It is set by the bank on an individual basis for each client based on the results of data verification. Its size can be affected by information about the borrower's salary, place of residence, age, availability of real estate and deposits. The limit is specified in the contract.

- For reissuing the card at the initiative of the client (theft, damage, etc.), you will need to pay 200 rubles. Reissue at the initiative of the bank (after the expiration of the plastic card) is not paid.

- The period during which the interest-free installment is valid is active if the loan is repaid on time. In case of violation of the conditions (late replenishment of the card, transfer of the amount not in full), the bank charges interest in the amount of 29.8% per annum.

- depends on the amount that was spent.

- Cash withdrawal from the card is not carried out. If you try to withdraw money, the ATM will give a system error.

Important! You can buy goods in installments from Home Bank partners for a period of 3 to 12 months. In other outlets, the service is provided for a three-month period.

The conditions for the installment card from Home Credit Bank are simple and clear. In order not to overpay, it is enough to repay the debt on time. Moreover, in your personal account on the website of a financial institution, you can get information on the movement of funds at any convenient time.

Timely repayment of the loan is a significant chance to save. Violation of the terms of the agreement will entail the accrual of an interest rate of 29.8% per annum or 2.48% for each calendar month.

If you decide not to pay according to the schedule or make an incomplete installment payment, but to replenish the card with minimal amounts, the amount of overpayment will eventually become huge. You cannot withdraw cash from an installment card. Payment is available on the territory of some outlets or when making purchases via the Internet.

Important! You can pay off the debt on the card at any time without commission and moratorium. That is, it is not necessary to pull 3 months.

The bank does not provide the user with the opportunity to use the installment card as a storage card. It can be used as an interest-free credit card. To transfer funds from card to card, it is better to use other banking products.

Important! The amount that needs to be paid monthly can be found in the SMS notification, which the bank individually sends to its customers. The SMS banking service is free.

You can also find out about the debt in your account on the website of the financial institution. In addition to the amount of the monthly payment, information is available on the dates of debt repayment. Here you can also see for which service or product you are returning money, when the purchase was made, where exactly and at what price. The personal account interface has a calendar structure, thanks to which you can select all the data of interest.

You can pay off your debt in different ways:

- At any branch of the bank.

- Through the official web resource of a financial institution.

- With the help of terminals and ATMs.

- Through virtual funds transfer services.

If you decide to make a payment outside the Home Credit Bank branch, it is advisable to do this in advance. Funds from self-service terminals are credited to the account within three business days. The legislative framework of the Russian Federation allows five days for the transfer of funds between banks.

Terms of receipt

Installment card from Home Credit is available only to citizens of the Russian Federation. The financial institution puts forward the following list of requirements:

- The client must have a permanent place of registration in the region in which at least one Home Bank branch is located.

- Mandatory presence of official employment.

- Suitable age of the client is from 18 to 64 years.

- A potential borrower must have a home or work phone number.

- An active cell phone is required.

- The client's income must be stable.

- Work experience at the last official place of work is not less than 3 months.

If you meet all the above requirements, then the minimum limit of 10 thousand rubles will be set for you guaranteed.

You can get an installment card from Home Credit by submitting the necessary documents:

- A valid passport confirming the citizenship of the Russian Federation. The presence of a permanent place of registration in the country is mandatory.

- The second document proving the identity. You can present a driver's license, a certificate of a sailor or a soldier, a foreign passport, a military ID or an insurance certificate - SNILS.

Important! The presence of the above documents increases the chances of obtaining a loan even with a faulty credit history.

You can get a special credit card at any Home Bank branch. If you do not intend to stand in lines and waste your time, you can apply online in advance to speed up the process. After receiving approval, you can safely go to any branch of a financial institution to sign an agreement and receive a credit card.

In Home Credit Bank, you can get an installment card in a few hours. If you would like to apply online, then:

- Visit the financial institution's website.

- Find the questionnaire and fill it out by entering personal information from the passport (series, number), phone number and email address.

- An SMS code will be sent to the mobile phone, which must be entered in the dialog box.

- Wait for the bank's response. If the result is positive, you need to come to the nearest branch with a package of documents to conclude an agreement and receive a plastic installment card.

Important! After sending the code, a hotline employee will call the client to further fill in personal data and clarify information.

Immediately after receiving the card will not work, so you need to activate it:

- Visit the bank's website.

- Indicate the number of the received card and passport data.

- Enter the answer to the captcha.

- Receive a message with an activation code.

- Enter your password and get a PIN.

Now the card is activated and can be used to pay for services and purchase goods.

Installment card partners

Home Credit Bank's partners are more than 20,000 organizations throughout the country that offer a variety of goods and services to their customers. These are shops, salons, ateliers, boutiques, travel agencies, workshops and companies providing services in various areas of human life.

An incomplete list of organizations and partner stores on the installment card from Home Credit Bank:

- Aeroflot airline.

- Chain of furniture stores "Shatura".

- Online store Vsekupi.online.

- "Know How".

- "Free Wheels".

- TechnoPark.

- "Sport Master".

- Askona.

- Kari.

- Pandora.

- Bork.

- Anex Shop.

On installment terms (from 3 months), various travel agencies, airlines, shoe, clothing, jewelry stores, household appliances hypermarkets, beauty salons, fitness centers, furniture workshops, home improvement and repair stores, car dealerships work with the bank.