Account cards during desk audit. Accounting cards. During the desk audit, the Internal Revenue Service requested cards of accounting accounts that were not related to the fact being verified. how to refuse

In connection with a tax audit, a request was sent to the organization's counterparty to provide documents, including accounting cards for settlements with the counterparty. The organization provided all the requested documents, with the exception of accounting cards. For failure to provide the latter tax office fined the organization under Art. 129.1 Tax Code of the Russian Federation. Are the actions of the tax inspectorate legal?

Answer: Account cards do not relate to the activities of the organization’s counterparty and cannot indicate the fact of business transactions(transactions) between an organization and its counterparty. They are also not documents (information) serving as the basis for the calculation and payment of taxes, or documents confirming the correctness of their calculation and timely payment. Therefore, failure to provide accounting cards to the tax authority cannot be grounds for a fine under Art. 129.1 Tax Code RF. The courts adhere to this position.

Rationale: In accordance with paragraphs. 1 p.

1 tbsp. 31 of the Tax Code of the Russian Federation, tax authorities have the right to demand from the taxpayer documents that serve as the basis for the calculation and payment of taxes or confirm the correctness of their calculation and timely payment.

In particular, inspectors have the right to request from the organization:

- documents (information) relating to the activities of its counterparty - within the framework of a tax audit carried out in relation to it (clause 1 of Article 93.1 of the Tax Code of the Russian Federation);

- documents (information) regarding a specific transaction with a counterparty - if, outside the framework of a tax audit, there is a justified need to obtain these documents (information) (clause 2 of Article 93.1 of the Tax Code of the Russian Federation).

The requirement to submit the specified documents (information) is sent to the organization through tax authority, in which she is registered (clauses 3, 4 of Article 93.1 of the Tax Code of the Russian Federation).

In accordance with paragraph 5 of Art. 93.1 of the Tax Code of the Russian Federation, an organization that has received such a requirement is obliged, within 5 working days, either to submit the requested documents (information) or to inform the inspectorate that it does not have them. For refusal to submit the requested documents or for failure to submit them within the established time frame, the organization that has the specified documents (information) may be held liable under Art. 129.1 of the Tax Code of the Russian Federation (clause 6 of Article 93.1 of the Tax Code of the Russian Federation). This article provides for punishment in the form of a fine in the amount of 5,000 rubles. or 20,000 rubles if the offense is committed repeatedly within a year.

From the meaning and content of the provisions of these norms it follows that the tax authority is given the authority to request from a person possessing the relevant information only those documents (information) that directly relate to the activities of the counterparty being inspected or a specific individual transaction.

Account cards are registers accounting, which by virtue of Part 1 of Art. 10 Federal Law dated 06.12.2011 N 402-FZ “On Accounting” are intended to systematize and accumulate information contained in primary documents accepted for accounting. They do not relate to the activities of the organization’s counterparty, and also cannot indicate the fact of business transactions (transactions) between the organization and its counterparty. In addition, account cards are not documents (information) serving as the basis for the calculation and payment of taxes, as well as documents confirming the correctness of calculation and timely payment of taxes. Consequently, account cards are not the documents that an organization is obliged to submit to the tax authority in order to carry out tax control measures in relation to its counterparty.

Thus, failure to provide accounting account cards does not constitute an offense established by Art. 129.1 Tax Code of the Russian Federation. This is confirmed by the currently established arbitration practice (see, for example, Resolutions of the FAS East Siberian District dated 08/13/2013 in case No. A10-2526/2012, dated 02/25/2013 in case No. A10-2227/2012, FAS North-West District dated November 29, 2011 in case No. A42-1789/2011).

Consequently, the decision of the tax authorities to hold the organization liable under Art. 129.1 of the Tax Code of the Russian Federation for failure to provide accounting cards can be successfully challenged in court.

E. M. Sigaeva

Company group

"Analytical Center"

M. N. Ozerova

Company group

"Analytical Center"

——————————————————————

Chart of Accounts 2018-2019

Accounting account cards

Accounting registers (forms, samples)

Read and absorb everything useful, and ignore the attacks. This is how it is done here. aka AMIGO

ATTENTION! Ctrl-F5 or Ctrl-R

2000

Human.

(0) I don’t believe that the tax authorities can demand this

TurboConf 5 - expanding the capabilities of the 1C Configurator

ATTENTION! If you have lost the message input window, click Ctrl-F5 or Ctrl-R or the "Refresh" button in the browser.

The topic has not been updated for a long time and has been marked as archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour on the Magic Forum there are more 2000

Human.

For the production of accounting cards, cardboard or paper with a density of 170 g/m2 is used. m. Their main difference from other forms of registers is the absence of binding. Such forms are opened for a year and serve to display economic activity enterprises in the documentation accompanying accounting.

During the reporting period, documents are stored in a file cabinet. Their location may be dictated by:

- alphabet order;

- item number;

- accounting account.

To ensure safety control, each accounting card is provided with a serial number and registered in the appropriate register.

Read completelyAccounting cards for materials, invoices, invoices, personal forms of employees

“Comus” presents typical accounting documents various types. For example, personal forms of employees, necessary to control the number of personnel at enterprises and placed in file cabinets alphabetically or by structural divisions. The main form of the document is Form T2, which contains information about the identity of the employee and his work activity.

The form includes 4 pages, that is, two A3 sheets. The first 2 pages are filled out when an employee is hired, the subsequent ones - during the work process. The basic number of documents per package is 50 pcs.

You can also buy accounting cards in form M17, which are used to register the movement of materials arriving at the organization’s warehouse.

The accounting card is filled out for a separate item number. Information is entered into it on the basis of primary receipt documents.

Forms according to the M17 form can be selected:

- A4 and A5 formats;

- in quantities of 50 and 1000 sheets per package.

To place an order, please indicate the required names of printed products and their quantity in the online application.

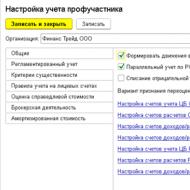

—>Lesson No. 95. Account card and subaccount card.

The account card is rightfully considered one of the most popular reports among users of the 1C system. The popularity of this report is due to a number of its inherent features, among which the following can be noted: ease of use, good readability, the ability, along with the compactness of the reporting form, to accumulate brief, but at the same time quite complete and specific information about all movements in the account, the ability track the current balance, etc.

The convenience of the account card is noted not only by direct users of the system.

There are often cases when, when conducting various audits, tax authorities ask to provide the necessary information on an account card from 1C.

To get an account card, you need to execute the main menu command Reports | Account card. As a result, the same window will open on the screen as for the account balance sheet,

in which you need to specify the report parameters and click the Generate button. An example of a completed report is shown:

Account card

By double-clicking on any position of the account card, you can quickly switch to the mode of viewing and editing the document on the basis of which this transaction was generated. The program has another similar report - a subconto card, which looks approximately the same as an account card, only it is linked not to the accounting account, but to the subconto.

To generate a subconto card, you need to execute the main menu command Reports | Subconto card, then in the toolbar of the window that opens, click the Settings button and select the subconto to generate a report. Example of a subconto card:

Subconto card

From this report you can also quickly switch to the mode of viewing and editing the primary document; to do this, you need to double-click on the corresponding transaction.

Lesson No. 96.

Account analysis and subconto analysis

Klerk.Ru > Accounting > General Accounting > Accounting and Taxation > Tax Requirement and Failure to Provide?

View full version: Tax requirement and non-provision?

The tax office, in its request for a meeting with the counterparty, set out, among other things:

1.04 [Document code-1987] Account cards for the period from to

Is it possible not to provide this? How can I explain why we don’t provide it?

Old grumpy

31.07.2017, 13:50

It depends on what accounts. At 62, you can probably provide a card. And for the rest, write that cards of such accounts are not maintained for the requested counterparty and it is not possible to provide them.

What is an "account card"?

What is an "account card"?

I agree))) never thought about it :D

I agree))) I never thought about it: D so write in response - why don’t we provide it?

So write in response - why don’t we provide it? Here it is:

What is an "account card"?

I usually write “that the chart of accounts approved by such and such a date consists of 99 accounts + a certain number of subaccounts + a certain number of off-balance sheet accounts. From your request it is not clear for which specific account an “account card” is required and I ask you to explain to me and send the corresponding request"

The strangest thing is that they swallow the answer with the documents without this card; requests for the updated card number are not received))))

and why be ashamed... as they have you, so you have them)))

What if you don’t write or provide anything at all on this item? What does this mean?

Our company is small, there are not many buyers. It would be better to give some kind of streamlined answer so that they fall behind.

Ill-mannered

31.07.2017, 17:49

I just ignore the points about cards and turnovers at oncoming traffic.

That is, I don’t give them, and I don’t write that I don’t give them.

request for a meeting with a counterparty

if there was a small volume, 1-2 trades

I gave statements for 62, 76 AB, 90 on the day of shipment, I chose it by counterparty

what not to give?

let them watch

Is it possible to write - maintaining accounting cards accounting policy not provided?

Is this allowed?

Ill-mannered

31.07.2017, 19:48

Is it possible to write

Old grumpy

31.07.2017, 20:37

It's better not to write anything. Just list the documents you provide.

Old grumpy

31.07.2017, 21:17

9. Information on the amounts of VAT calculated and paid to the budget for this counterparty for that taxable period, which reflects operations for the sale of goods (provision of services);

11. Information on the reflection of transactions in accounting and tax accounts;

On these issues, if you don’t write anything, is it okay?

Counter questions:

No. KND or OKUD, form, filling rules? where published?

Ill-mannered

31.07.2017, 21:34

1. What is “Information about amounts…”, etc. ?

2. What is “Reflection information...” ?

No. KND or OKUD, form, filling rules?

3. Where in tax (or accounting) accounting can you see the amounts of VAT paid to the budget for a specific counterparty?

++

Counter questions:

1. What is “Information about amounts…”, etc. ?

2. What is “Reflection information...” ?

No. KND or OKUD, form, etc.

it's all talk

what is this for

Old grumpy

31.07.2017, 22:26

it's all talk

I’m sure you yourself don’t write such questions in response to the tax office

what is this for

Of course I’m not writing.

I submit in a timely manner the unified documents that I have and which I am obliged to submit.

reverse balance sheet

accounting cards

and also a log of RECEIVED invoices

What is this for?

Today we received a request to check our buyer's VAT

are required to provide, among others:

reverse balance sheet

accounting cards

structure and staffing

the entire answer consists of the phrase “I am sending copies to your number/date following documents:" and the registry. That's it.

++

read the thread. Everyone has already discussed this.

Ill-mannered

05.04.2018, 12:57

so there is a fine for not providing a document

And you provide the documents that are and must be.

It does not mean that it is malicious not to provide. Provide what you have, and if that's enough to validate the deal or your tax credibility, then anything will do. We usually write: there are no documents for such and such an item, this is usually about accounting cards.

From the content of the norms of Art. 93 and 126 of the Tax Code of the Russian Federation it follows that in order to bring the taxpayer to justice for the offense provided for in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, it is necessary that he has the relevant documents (the documents must be available to him) and submits them not on time or avoids submitting them. Violation deadline submission of documents at the request of the tax authority that conducted the tax audit entails liability provided for by the said norm in the form of a fine in the amount of 200 rubles. for each document not submitted. (Article: On the disputes surrounding the details of the requested documents: are they needed in the request? (Firfarova N.V.) ("Tax Audit", 2017, No. 5)

do you think I didn’t read before asking the question??

I have never seen a description of the document “structure and staffing”

+

Well, I guess I didn’t understand you then)))

+

I also sometimes (when I get completely insolent) write something like: “my organization does not have information about the structure and staffing levels for the requested counterparty”)))

Well, this is a thought, and also write that we do not have our buyer’s SALT :)

what, this is a thought, and also write that we do not have our buyer’s SALT

Well, actually, this is a very impudent thought))))))

05.04.2018, 22:13

Colleagues, do you think a demand has arrived, they are asking accounting policy for 3 years from 2015-2017.

I made a UE for 2017, but in 2015-2016 the UE was completely inadequate. So I’m wondering what to do, replace the inadequate one, what if my predecessor has already exposed it... send it as is, I can’t raise my hand, it’s too clumsy

Colleagues, do you think a demand has arrived, asking for an accounting policy for 3 years from 2015-2017. I made a UE for 2017, but in 2015-2016 the UE was completely inadequate. So I’m wondering what to do, replace the inadequate one, what if my predecessor has already exposed it... send it as is, I can’t raise my hand, it’s too clumsy

Why could she shine it? Have there already been checks?

Agree. Well, besides everything else, you can always say “OH!...”

06.04.2018, 08:59

Well, there were definitely working meetings at the tax office, and all sorts of meetings and explanations. I rustled through all the folders with tax correspondence, I didn’t find anything, but my soul is not at peace. Do you think I should send them my updated UP now? To put it mildly, I’m already thinking about just “forgetting” about this document

are required to provide, among others:

reverse balance sheet

accounting cards

structure and staffing

Should we give them all our turnover for the 3rd quarter?

I stupidly imagined an extract from the circulation or a card for these shipments

first I made copies of the implementations and then for each implementation I made a card, for example, for account 90.01

or according to account 41

and in general, what do they want to know with all this, because now everything is almost transparent regarding VAT

we filed a declaration, they filed a declaration, everything came together

what else do you need?

what else do you need?

It seems to me that they are simply worried that without their demands we simply won’t have a job and we will all be fired))))))))))))) Take care of us)))))))))

06.04.2018, 11:41

I’ll cry a little, I’ll have a fluster, I’m 8 now!!! requirements for the subject, explain, provide, come and talk, etc., etc. The director is already suggesting that I hire a separate accountant specifically to work with the tax office, because I am no longer enough for all this

I have 4th in a week (for two companies) 🙁

Powered by vBulletin® Version 4.2.1 Copyright 2018 vBulletin Solutions, Inc. All rights reserved. Translation: zCarot

Within desk audit VAT returns, the tax authority required the company to submit documents: analysis of account 41 “Goods”, cards of accounting accounts in the context of this account and balance sheets.

The company, believing that it was not obliged to provide this documentation, contacted arbitration court.

The court declared the actions of the Federal Tax Service to issue a demand illegal, based on the following.

Before issuing a demand, the company submitted documents to the Federal Tax Service containing all the necessary information about the movement of goods and confirming tax deductions for VAT: cargo customs declarations; certificates of acceptance of goods, payment orders, report on the expenditure of funds, purchase book, account statement 41, invoices, certificates of work performed.

The documents requested by the Federal Tax Service are summary or analytical accounting documents. They are formed on the basis primary documents and are not the basis for calculating tax.

By demanding them, the inspection violates clause 8.1 of Art. 88 of the Tax Code of the Russian Federation, since they do not relate to specific operations about which the inspectorate had questions.

Thus, the Federal Tax Service violated the rights of the company by obliging it to generate and produce documents that the law does not oblige to submit for desk audit.

It's no secret that the main motivation for staff in every company is decent remuneration for work. On shoulders accounting staff It is important to carry out correct accounting of the remuneration of each employee of the enterprise. The following article will reveal the main aspects of such accounting, as well as the procedure for creating a special register - an account card.

Key Concepts

Let's consider the key concepts, the understanding of which is necessary when studying this article.

Personnel – the total number of full-time employees of the company.

Remuneration is the remuneration of company personnel for work performed. Magnitude wages employees is determined by their competence, qualifications, productivity, length of service, amount of work performed, degree of responsibility, complexity, intensity and a number of other factors.

The totality of such remuneration includes the following components:

- Set salary;

- Incentive payments;

- Awards.

Salaries are calculated in the following forms:

- Time-based (its essence is that employees are paid based on the amount of time they work);

- Piecework (the essence of this form is that employees are paid for the amount of work actually performed by them).

Accounting for payroll calculations

To collect information and record wages in the system of accounts, there is a separate account 70 “Settlements with personnel for wages”. It is active-passive, that is, the balance at the end of the period can be reflected both as a debit and as a credit. To calculate the balance by active-passive account The following arithmetic operations are required:

- Sum up the initial balance and turnover separately for debit and separately for credit;

- Next, subtract the smaller part from the larger part;

- The result obtained is to write down the final balance in the part where the amount as a result of the first action turned out to be greater.

Accounting for this account is carried out in the following order:

- The debit records the process of paying employees, withholding taxes and other amounts, and depositing salaries;

- The loan takes into account payroll and disability benefits.

Account analytics is performed specifically for each employee of the company.

Payment of wages is carried out both in cash and non-cash methods. In the first method, employees receive money from the company’s cash desk. In this case, a calculation is drawn up - payment statement for all employees, and each employee receives a pay slip ( full list all accrued and withheld amounts relating to his personal earnings). In addition, the cashier creates an expense account for the entire amount of funds issued for payment. cash order. If the employee is unable to receive the money within a three-day period, it is deposited and returned to the bank account. Therefore, now, more and more often, companies are using another method of payment - non-cash, in which employees receive cash on plastic cards. With this method, it is enough for the accountant to use computer program send payment order and lists of bank employees.

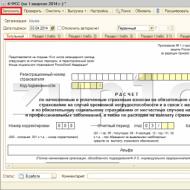

The procedure for forming a card

For the convenience of carrying out accounting functions and preparing reports, accounting employees who keep records of wages compile a variety of analytical registers:

- Back - balance sheet for the account;

- Settlement - pay slips;

- Journal - order and statement to it;

- Account card;

- Other registers.

Let's take a closer look at account card 70. This register is becoming increasingly popular among accounting employees; it allows you to track the following data:

- Account balance 70 at the beginning and end of the period;

- The date of each transaction;

- The primary document drawn up at the time of the transaction;

- Analytical data ( structural subdivision, last name, first name, patronymic of the employee, etc.);

- Total turnover for the period;

- Account in correspondence;

- Transaction amount.

Let's give an example of a card for account 70 “Settlements with personnel for wages” in the table below:

To make work easier, it is more convenient to create an account card in special accounting programs, for example, 1C: Accounting. IN similar programs This register is generated automatically, and the accountant can quickly study the information he needs.

This register - card for account 70 “Settlements with personnel for wages” helps the accountant to avoid accounting errors, to track all the facts of economic activity produced in the context of remuneration of an individual employee.

An account card is one of the most popular reports in accounting; it allows you to quickly check where a particular amount came from in an account and from which accounts it came. The account card also shows the turnover for the period of the account and the current balance.

The report is not regulated; it does not have strict form, but in many programs its printed form is also provided with footnotes with signatures of responsible persons. Theoretically, this report can be used, for example, when an accountant closes a shift. He prints the card, signs on it, and if on the next shift some mistakes or incorrect entries are made (by a different accountant), he has the opportunity to prove he is right. If the company is large and the accounting department is divided into sections - bank, payroll, cash desk, etc., this can be very helpful.

Sample account card and filling

A sample account card is shown in the figure; as for filling it out, you can watch our accounting lesson about matzo and nesting dolls and quickly understand its algorithm. In principle, there is nothing complicated.

In 1C, an account card is convenient because it also allows you to track analytical accounting, by registers or subaccounts. An entrepreneur, for example, can see what quantity of goods and for what amount is in which warehouse. And you don’t need to buy any programs for management and trade accounting - a standard accounting configuration together with an accounting card will provide all the information. So knowledge of accounting helps an entrepreneur a lot.