William J O Neal. William O’Neill. William J. O. "Neil" How To Make Money In The Stock Market "

He graduated from Southern Methodist University, receiving a bachelor's degree and went to serve in the US Air Force.

Already at this time, he began to actively study the futures market. To do this, he actively bought all the books on this topic.

William J. O’Neill Labor Career

O’Neill began his career in 1958 as a stockbroker in Hayden, Stone & Co., developing investment strategies using the first computers here.

Working on the exchange did not bring the desired income, so William J. O’Neill began to analyze all existing financial theories and tried to create his own methods of building his own business on the exchange. Gradually, he developed his own system of making a profit and began to receive a small but stable income.

The key to highly successful portfolio management is understanding that your goal in the market is not just to be right, but to make big money when you're right

But it always seemed to William that he did not have enough knowledge, so he decided to continue his studies and entered the Harvard Business School in 1960 for the first management development program. To do this, his family had to move to Cambridge, Massachusetts. Gradually, things began to improve on the stock exchange. So, in just one year, he increased the initial cost of shares from 5,000 to 200,000 US dollars.

At the beginning of 1964, on the profit received from the sale of shares, William acquired a place on the trading floor owned by the New York Stock Exchange.

Half a year later, William O’Neill set up an institutional analytical brokerage company called “William O’Neil & Co.” William later became one of the first entrepreneurs to create a complete electronic stock market base. This allowed him to repeatedly increase his income.

In 1983, William founded the Investor’s Daily. According to experts, this was a risky business, because an unknown newspaper could not compete with such a famous publication as the Wall Street Journal. However, he still took a chance and invested his money in printing.

Initially, the circulation of the newspaper was only 30,000 copies, but four years later it rose to 110,000 copies and continued to grow. O’Neill’s main bargaining chip was financial tables with data not found in any other publication. In 1991, the publication changed its name from Investor’s Daily to Investor’s Business Daily. Ten years after its founding, the circulation of the newspaper reached 149,557 copies, and the total readership was more than 850,000 people.

Initially, the circulation of the newspaper was only 30,000 copies, but four years later it rose to 110,000 copies and continued to grow. O’Neill’s main bargaining chip was financial tables with data not found in any other publication. In 1991, the publication changed its name from Investor’s Daily to Investor’s Business Daily. Ten years after its founding, the circulation of the newspaper reached 149,557 copies, and the total readership was more than 850,000 people.

By this time, William's family had grown. For all the years of marriage, the couple O’Nilov acquired one boy and two girls. It was they who submitted the idea to William to develop the CAN SLIM theory, which in translation means (son and two daughters). Moreover, each letter in this abbreviation denoted a certain financial indicator, for example, C - meant quarterly return on shares with an increase of a minimum of 15% for the quarter, A - meant annual return on shares in the ratio of 25% to the previous year for the last 3 years.

William O’Neill Books

William outlined all his ideas in books:

- At the end of 1988, a book was published entitled "How to make money on stocks." In it, O’Neal made specific recommendations for trading on the exchange. In addition, the presentation of the material itself was so clear and concise that every person who does not understand anything in the exchange trading system could easily learn all the tricks.

- Then the publication came out. In this book, the author paid special attention to the CAN SLIM stock selection system, thanks to which many American investors have already managed to make a solid fortune.

- A book later came out.

Currently, William is engaged in entrepreneurial activity, writes new books and holds investment seminars.

Another very interesting and useful book on investment in stocks. William J. O Neal, How to Make Money in the Stock Market, 7th edition.

The first thing you need to know is this book is written for investors, although information can also be useful to traders, as it also describes short-term analysis methods.

It is also worth mentioning right away that William J. O’Neill focuses only on fundamental analysis and describes it using CAN SLIM as his own investment strategy. Each first letter means an analysis method, for example, C - Current quality earnings per share - the more the better.

Each letter has a separate chapter that talks about the method of analysis of the company, stocks and its price.

J. O’Neill writes how to analyze company reports, what is important and what isn’t there, how to compare profit and production volumes, how to find successful companies using the CAN SLIM system. For example, the author advises to stop at companies with annual growth from 25 to 50%, to searchcompanies with good annual and current quarterly earnings. But the search for such companies does not end only on these two criteria, because you need to exclude a one-time surge, take into account the prospects and price of shares, and much more. The author explains all this in his book.

The second part is devoted to the practical side, investor errors, additional methods of analysis and, of course, the author’s brainchild - Investor’s Business Daily.

Download the book "How to Make Money in the Stock Market" - William O Neela

If you wish, you can convert the pdf format to fb2.

It is interesting that J. O’Neill says that more than 50% of transactions of even successful investors are unprofitable, and only skillful fixing of losses helps them to get a good plus. There is a separate chapter about this in the book, which says how to avoid large losses when fixing them and other nuances. This is followed by a chapter on profit taking.

The book turned out to be voluminous in content and it needs to be read not at a time, since it seems that the information is simply stated, you need to digest it, think about how it can be applied and when. Of course, the book is very useful and it is not in vain that it has the seventh edition.

On the publisher’s page you can see the characteristics and price of the book, as well as read the excerpt and reviews: http://www.alpinabook.ru/catalog/Business/4189/

If you find an error, please select a piece of text and press Ctrl + Enter! Thank you so much for your help, it is very important for us and our readers!

Special thanks should be given to those who made possible the release of this new edition: Wes Mann and Chris Gessel, as well as Daidra Abbott, Laylo Marsden Bart, Heather Davis, Inhua Gao, Charles Harris, Hilary Kercher, Jill Morales, Justin Nielsen, Michelle Playford, Wendy Rydt, Lisa Rubin, Katie Sherman, Gary Slimaker and Mike Webster.

I also want to thank Philip Rappel and the outstanding staff at McGraw-Hill.

Published with the assistance of the International Financial Holding FIBO Group, Ltd.

Transfer A. Shmatova

Science editor A. Kunitsyn

Technical editor N. Lisitsyna

Corrector E. Kharitonova

Typesetter A. Fominov

Cover design Designdepot

© William J. O’Neil, 2002

© The McGraw-Hill Companies, Inc., 1988, 1991,1995

© Edition in Russian, translation, design. LLC Alpina, 2011

Licensed by The McGraw-Hill Companies, Inc.

© Electronic edition. LLC Alpina Publisher, 2013

O’Neill W.

How to make money in the stock market: The strategy of trading on the rise and fall / William O’Neill; Per. from English - 6th ed. - M .: Alpina Publishers, 2011.

ISBN 978-5-9614-2883-4

All rights reserved. No part of the electronic copy of this book may be reproduced in any form or by any means, including posting on the Internet and corporate networks, for private and public use without the written permission of the copyright holder.

Foreword

The book "How to make money in the stock market" is dedicated to the CAN SLIM ™ trading system. It is simple, factual, time-tested and experienced by many people. The system includes buying and selling rules, obtained as a result of an extensive analysis of data on the most profitable stocks of the last fifty years.

All known fundamental and technical (price and volume of trades) variables and facts were studied in the most thorough way to determine what common signs took place just before these super-deals increased so much in price, and how these variables changed when stocks reached maximum and began to decrease significantly.

The rules for buying and selling included in this book are based only on time-tested facts that describe how the stock market actually works, and not on my own judgments and, of course, not on the personal ideas and beliefs of most Wall Street analysts or television investment strategies.

In this third edition, as in the earlier ones, you will find many links to the most suitable quotation tables, charts, data and company news published in Investor’s Business Daily (IBD). We have created and published IBD so that through the newspaper and website daily give business people and investors with any level of experience continuous access to the valuable research information described in the book “How to make money in the stock market”.

How do these rules work day after day on the battlefields of the real market? We have already accumulated over 500 success stories of readers of “How to make money in the stock market” and subscribers Investor’s Business Daily®who made and retained substantial profits - several hundred percent, or even more - using the rules and principles set forth in both publications.

We’ll name some of these sensible subscribers. Individual investors R. and D. Tank say: “We used IBD for about nine years, used CAN SLIMTM and read your book. As a result, only from the beginning of 1998 we managed to earn a profit of 5000%. The newspaper played a critical role for us in 2000 ... It allowed us in March 2000 to define the climax of the Nasdaq, which clearly illustrates the value of IBD. In the end, to make money in the markets, you must learn to save what you have earned. We would not have succeeded if it were not for the book “How to make money in the stock market”. Thanks again for sharing your knowledge. Your lessons were invaluable to us and to many people who are dear to us! ”

P. Kaiser mentions that “I tried other theories, and they did not work. Finally, I read the books of William O’Neill. And I didn’t listen to anyone else. Over the past two years, I retired, bought two houses, one is multi-apartment, using only IBD and Daily Graphs! Thanks".

Barbara James had never bought a single stock in her life; she was afraid of the market and kept her savings in a local loan and savings bank. After attending one of our free seminars in southern California in 1996, she was engaged in training for a whole year, before deciding to apply the rules and buy her first stock - an incomplete lot of EMC Corp. Shares rose 1300%. She sold them in September 2000. Her other stock rose 286%.

Allen Cecil, whom you may have seen in IBD television commercials pronouncing the words: “If you teach a person how to fish, you will provide him with food for life,” did during the 90s. over 1200% and, carefully following the system, was able to fulfill his dream of a decent five-room house in Colorado. Allen said: " Investor’s Business Daily it has a scientific basis due to its database and historical experience, and I don’t see anything else that would be even close to this. "

Jim Sugano in the mid-80s attended a seminar where we discussed Home Depot. He checked the company, guided by the rules, and bought quite a lot of its shares. Each time she reached a new high, he bought even more shares. He held her shares for over 16 years, during which they grew nine times.

One of the leading Morgan Stanley brokers in New York attended three of our paid Saturday seminars and increased his account from $ 250,000 to $ 6 million. A middle-aged lawyer from the South was like our meetings and spun $ 300,000 to 18. million on stocks like Yahoo! AOL and Qualcomm, after which he was able to leave his law practice and retire.

And here is the words of C. Phillips: “A few years ago, my husband suggested that I learn how to manage some of our investments. Now i love Investor’s Business Daily and CAN SLIM. [There] is so much information, and Mr. O’Neill gives great lessons in the book How to Make Money in the Stock Market. After I started using CAN SLIM and IBD, and now investors.com, I was able to make 359% on my initial investment! IBD has many useful features that help me find great promotions. I am grateful to you for all the work that you are doing to help investors. ”

Individual investor E. Boboc told us: “I started trading in stocks in 1995 and signed up for IBD. I re-read “How to make money in the stock market” four times and annually analyzed my unsuccessful transactions in order to learn not to do what is not necessary. Now I have earned enough money in the market to buy a new car for cash, and I am about to pay a loan to buy a house. My next goal is to achieve full financial independence. ”

William O’Neill is a successful stock exchange adviser who has written the book How to Make Money in the Stock Market. Nevertheless, fame came to him solely because of the excellent results that his approach to trading gives, and not at all because he promoted himself or strove for fame. O’Neill in his circle was known as a man not only smart, but also modest. He was never attracted by investor companies or the interests of his Wall Street colleagues.

Also, from the very beginning of his career, he was distinguished by the fact that he did not look for helpers and tips. Good or bad, it cannot be said. Some traders need their mentors, others do not. In this case, the man did without them and, importantly, he himself found effective ways to success.

Way to the top

Like many businessmen of the twentieth century, William began his career far from easy steps. The family was not rich, there was not enough money, and already in childhood he began to earn extra money - he distributed newspapers. Therefore, from an early age, he felt responsible for himself and for others, and longed to find more profitable ways to earn money. Even then, he began to collect information on how to get rich, sorting through all sorts of options.

And yet, from an early age, he did not become an entrepreneur. Part-time and family help helped him enter the university, and only after he graduated and served in the army did the young man become interested in the stock market. But William came close to his study. He was interested in futures; in those days - and that was the middle of the last century - in America one could find enough literature on the subject to study the basics and more. Therefore, he had the opportunity to purchase many books and study them.

Soon, self-study brought the first fruits. William managed to get the position of financial analyst in one of the firms. The company where he was hired was not known, but was promising. Here he was able not only to apply the existing knowledge, but also to begin to create new approaches to trade, namely, he developed computerized investment strategies. At that time, the possibilities in this direction were small, but there was almost no worthy competition.

Already there, O’Neill managed to prove himself to be the best, as a successful financier, quickly increasing the amount invested by the company's customers. His further actions determined his career and life. At only 30 years old, he bought himself a place on the New York Stock Exchange (in those days it was considered an early start) and then founded his own investment company. At that time, he already had not only knowledge, but also positive experience, which he could documented. There was a reputation, which is important.

O’Neil Trading System

The most attention, however, deserves not the biography of this famous specialist, but his trading system. It is believed that it is described in detail in the book mentioned above. The only question is how fully the topic is revealed there. It is unlikely that a person who shows an annual yield of several hundred percent, completely revealed his secrets to the whole world almost for free. And still each trader, if desired, can use this guide and try to apply ideas in their own market approach strategy.

His second book is “24 Key Lessons for Investment Success”. It is also useful to study the trader. The only “but” - do not forget that its publications are designed exclusively for the stock market, and not for Forex, although some ideas can be used in currency trading.

If you like to study book trading, then the Battle for Investment Survival deserves attention. O’Neill is not its author, but he often mentions that this is the best thing that he has read in his life in the field of his chosen activity. If you plan to become an investor or conquer the stock market, it will not be superfluous to study it. Posted by Gerald Loeb.

The trading system developed by William O’Neill is known as CAN SLIM. It has its own decoding - each letter corresponds to one of the principles of the investment company or success indicators. In the form of a list in Russian, the abbreviation can be stated as follows:

- From 15% of profit in each quarter - the minimum promised percentage.

- The minimum annual yield is 25%.

- New offers in the investment market, which leads to substantial demand.

- High volumes of transactions.

- Number one in your market.

- The presence of a large number of large players, and this figure should be constantly growing.

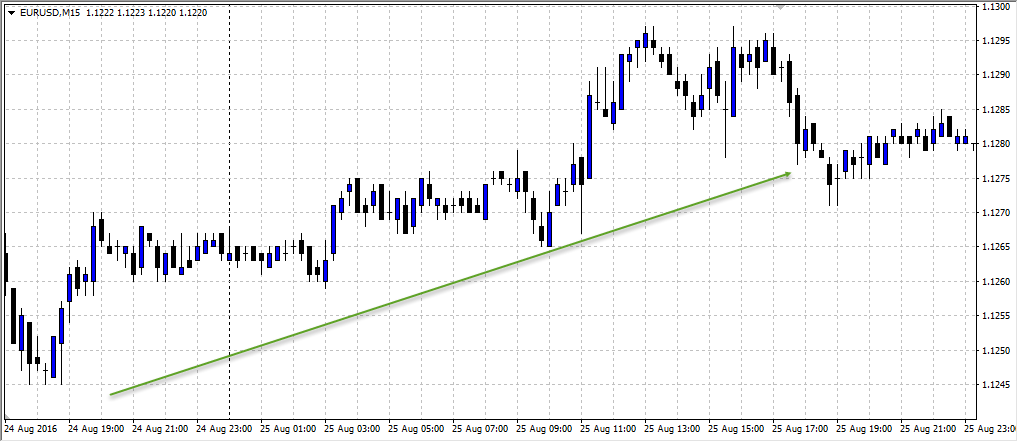

- The golden rule of investing is that the trend should increase. When you invest not in a currency pair, but in stocks or other goods, this is really very important.

Most of all, O’Neill scolds the desire of traders to buy cheaper goods. He compares this to a regular sale, when people rush headlong to give the last money for an unnecessary thing, simply because the price has been reduced. As a rule, in such cases “is sold more expensive thenwhat is worth three times cheaper. " If you have ever been interested in how discounts are created in modern stores, especially in large ones, then you understand well what is at stake. These are bad deals.

Most of all, O’Neill scolds the desire of traders to buy cheaper goods. He compares this to a regular sale, when people rush headlong to give the last money for an unnecessary thing, simply because the price has been reduced. As a rule, in such cases “is sold more expensive thenwhat is worth three times cheaper. " If you have ever been interested in how discounts are created in modern stores, especially in large ones, then you understand well what is at stake. These are bad deals.

The return on investor portfolios that donated money to O’Neil’s management in 2004 and 2005 was 700 and 860%, respectively. This is an excellent indicator, and he became world famous thanks to the analysis of the company. To date, the number of investors has exceeded 6 hundred.

O’Neill Trading Features

Is it easy to learn how to trade with this system? This is probably not too easy. And that's why. It is known that many traders in America work on it, but they all, firstly, read the regular publication Investor's Business Daily, which is published by William's company, and secondly, they consult with him personally. This is one of his main areas activities.

The basis of the system is the rules that allow you to choose the right assets for investment. They were identified as a result of a study of profitable companies over many decades. How good the system can be judged by the results of investors.

Interestingly, there’s nothing supernatural about O’Neill’s approach. He simply gathered together the facts that were already known to him, and managed to bring them into a harmonious system. This means that any purposeful person can not only learn how to trade according to someone’s strategy, but also improve it to get an excellent trading plan in the end.

+The book describes one of the world's most profitable CAN SLIM ™ stock selection systems, with which many investors made major fortunes in the stock market. The creator of this system, William O’Neill in recent decades, is one of the most respected exchange advisers in the United States. Among his clients are almost all the largest investment companies, banks, pension funds and other institutional investors of the country (more than 600), as well as hundreds of thousands of individual investors working on the CAN SLIM ™ system and receiving all the necessary information through the daily Investor's Business Daily, which he founded in 1984. It is currently the second nationwide business newspaper in the United States after The Wall Street Journal. CAN SLIM ™ is based on the behavior of the most profitable stocks in the last 50 years. She refutes many stereotypes and erroneous criteria for choosing stocks and in practice has proved its exceptional effectiveness. Knowledge of the CAN SLIM ™ system is absolutely essential for stock market professionals. In addition, the book serves as an excellent teaching tool for teachers and students of economic and financial universities, as well as all those who seek to earn money on stocks. 6th ...