Purchasing MTPL accident cases. Redemption of insurance cases for road accidents. Who came across

In our country, organizations have begun to actively appear that provide services to protect the violated rights of car owners by insurance companies. In fact, this is very similar to how collection agencies buy the debts of individuals from banks.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call by phone.

It's fast and free!

Important! All parties to this type of contractual relationship must act only within the framework of current legislation.

Such problems are faced more often than others by those people who have entered into a CASCO agreement on a voluntary basis. It is easier for MTPL owners in this matter, because legislators have clearly prescribed both the amounts of payments and the procedure itself. And if the insurer violates them, he will also be required to pay a fine.

It is worth noting that buyout is a very successful business. Definitely troublesome, but well paid. And such success attracts dishonest businessmen to this market. It is because of this that people have distrust of such organizations. But there is no need to put everyone on the same page; there are many decent organizations on the market that successfully cope with their responsibilities.

Pros and cons of buying out insurance cases

A person who sells his right of claim to an insurance organization receives his own advantages:

- The period for receiving compensation is significantly reduced (relative to independent appeal to the court and the bailiff service).

- There is no need to spend money on court costs and similar expenses (they will subsequently fall on the shoulders of the defendant).

- The risk of the amount of the disputed amount of compensation has been reduced (as practice has shown, it is possible to recover 100% of the amount, but with a competent and skillful approach, but usually this is 75-80%).

- A clear understanding of the amount of the insurance payment, the timing of its implementation, its payer (the assignee will clearly indicate to you the boundaries of both the amount and the timing, and will write them down in the contract).

- Saving personal time (everything is entrusted to the representatives of the reseller).

- There is no irritating factor in court arguments and other debates with the other side.

Despite so many advantages, there are also some disadvantages:

- Part of the compensation will go to the reseller of your right, which means you will not receive the full amount of compensation.

- To conclude an agreement with a reseller, you will have to independently collect a certain package of documents.

- Since this is a new type of service, people may have doubts about its success.

- If you went to court on your own and won the case, you would receive both a fine and a penalty, but the reseller will receive this.

The procedure for purchasing insurance cases in the event of an accident

When an insured event occurs, the insured person has every right to receive compensation under the assignment agreement.

Important! All relations on this issue are spelled out in Article 382 of the Civil Code of the Russian Federation.

Initially, you need to decide on the organization to which you will transfer your claim. Once this is done, collect the full package of documentation that she will require. They are needed so that she can exercise her right and act under the assignment agreement.

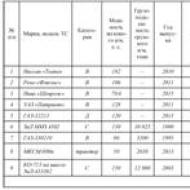

Documentation required for the assignment of the right to receive compensation from the insurance organization:

- Certificate from the traffic police in form 748 (copy).

- Protocol and resolution from the traffic police on the accident (copy).

- Written refusal of the insurer or statement of the occurrence of an insured event (copy).

- Document on the assessment of the insurance company representative and its final cost (copy).

- Independent expert's report (copy).

- Copies of your personal documents, driver’s license, car documents, etc.

- The original court decision recognizing the debt of the insurer if it is undergoing bankruptcy proceedings or if its license has been revoked.

When everything is collected, the contract is signed and a notification is immediately sent to the insurer. This must be done in writing and have confirmation of this. The ideal option would be to enclose this document in a letter with an inventory and delivery notification. You can also use the services of a courier; the main thing is to have in your hands a document certifying the fact that you notified the insurer about the concluded transaction.

How to choose a reliable company for assigning the right to receive payment

As practice has shown, after the occurrence of an accident, the insured person hopes that he will be able to independently receive his compensation without any problems. But the reality, unfortunately, is completely different. Some people give up halfway and are left alone with their problems. But others are stubbornly fighting for their money. And now it’s time to contact a special organization that will force the negligent insurer to pay you in full.

And when choosing among a very large number of such organizations, adhere to the following 5 rules:

- Do not decide to transfer your right to payment of compensation due to you on the first day of the accident.

- Never trust those who make estimates by eye. This is the competence of only a qualified specialist.

- Avoid those organizations that promise you 100% compensation.

- The assignment agreement should be concluded only after the pre-trial stage of work with your insurer has been completed.

- Carefully read the contract you intend to sign.

Important! Look for reviews about this organization on special resources.

Bureaucratic delays do not allow the victim of an accident to quickly receive the compensation due to him. If funds for repairs are needed immediately, and there is no desire to personally communicate with insurance managers and judges, you can sell the right of claim against the insurer to a specialized organization. The amount of compensation will inevitably decrease by 10–30%, but you can receive the money in the shortest possible time.

Since 2002, on the basis of 40-FZ “On OSAGO”, a system of compulsory insurance of property obligations of those responsible for road accidents to victims has been successfully functioning in Russia. A motorist has the right to voluntarily insure damage that could potentially be caused to his vehicle due to the fault of another road user. There are two types of copyright holders for claims against the insurer:

- owner of the CASCO policy;

- victim in an accident due to the fault of the owner of the MTPL policy.

The first is a client of the insurance company, since he has entered into an insurance contract with it. Claims under the MTPL system are based on the law and “someone else’s” insurance contract. However, in both cases we are talking about the right to claim. In the understanding of Art. 307 of the Civil Code, such relations are an obligation, where the copyright holder acts as a creditor and the insurance company as a debtor.

Important! A claim is an asset that can be bought, sold, gifted, inherited or pledged. “Marketability” is given to it by the insurance business - a set of documents and materials necessary to resolve the issue of receiving insurance compensation.

If the insured event is an accident, the insurance case is formed by the following package of documents.

- Notification of an accident. It is drawn up using a special form issued by representatives of the insurer at the conclusion of the transaction. According to the MTPL system, it is jointly filled out by the parties to the accident.

- An accident report drawn up by an authorized traffic police officer.

- A resolution in a case of an administrative violation or a ruling on the refusal to initiate administrative proceedings.

- State Traffic Safety Inspectorate certificate Form 12, containing information about the subjects of the insurance business, the car, and damage caused in an accident.

- Additional documents, depending on the specifics of the situation.

Insurance case materials are the basis for the insurer to make a decision on:

- payment of funds due to the recipient;

- issuing a referral for vehicle repair, if such a method of compensation for losses was previously agreed upon with the client.

Insurance must cover losses. For this, in fact, it is needed. Unfortunately, unscrupulous insurers often deny clients’ problems: they minimize compensation, delay payments, unreasonably refuse to satisfy legal claims, and ignore requests. In a problematic situation, the copyright holder has several options for behavior:

- try to defend your interests independently by seeking leverage over the insurer and filing complaints;

- hire lawyers for litigation;

- sell the right of claim to a third party.

Although both of the latter methods involve turning to professionals, they differ significantly. Hiring lawyers is a better idea than fighting the insurer's staff of trained employees alone. But this option also has disadvantages:

- uncertainty of the final result;

- postponing the receipt of real money in hand for an indefinite period of time (claim settlement + litigation + enforcement proceedings);

- in case of loss, the invested money (lawyers' fees + state duty + cost of examination) will become uncompensated expenses.

Buying out insurance cases for road accidents as a way to resolve a dispute with the insurer does not have these disadvantages:

- the final result of the litigation with the insurer is not important, losing the case will not affect the interests of the victim in the accident;

- the amount is determined and issued or transferred to the beneficiary’s account immediately, repairs can begin immediately;

- minimum formalities– you can agree on the sale of the right of claim immediately after notifying the insurer of the insured event;

- free negotiation on the amount is possible;

- assignment is possible, including in case of refusal to pay the insurance premium or incomplete compensation for material damage.

In Russia, companies are appearing everywhere that buy out claims from motorists at various stages of litigation with the insurer. Why do they need this? This is not an idle question. To negotiate with a counterparty, you need to understand how he makes money.

Organizations that purchase insurance debts are professional participants in the insurance market. They pay the victim of an accident with their own funds, hoping in the future not only to cover expenses, but also to earn money from payments from the insurance company.

Companies that practice buying out insurance cases after an accident tell clients that their income in this business is penalties and fines collected from insurers in accordance with 40-FZ “On compulsory insurance of civil liability of vehicle owners” and Federal Law-2300-I “On the protection of consumer rights." This is partly true. Having professional lawyers on staff, the reseller can compete with the sharks of the insurance business on an equal footing. Moreover, he often manages to take advantage of the advantages that the state has given to ordinary people as the weaker side of insurance legal relations.

If possible, the reseller is not averse to making money at the expense of the policyholder, offering the motorist a smaller amount than the likely amount of compensation from the insurer. There are other nuances:

- the entrepreneur is not obliged to repay debts; it is impossible to force him to do so;

- defects in the legal registration of an accident may cause a refusal to conclude a transaction to buy out the right of claim (assignment) or the basis for a significant reduction in the price of this “good”;

- assignment is a civil contract that is not subject to consumer rights legislation;

- from the moment the insurer’s debt is assigned, the motorist loses any connection with the policyholder within the scope of the dispute about the accident and the insurance contract.

Important! The usual margin between the reseller's price and the insurance compensation that can be sued from the insurer is 10–30%. And this does not take into account sanctions (penalties, fines) for unlawful refusal or underestimation of payments. In case of assignment of the claim, these amounts will unconditionally go to the income of the reseller.

Based on the situation, the car owner can choose: wait for payments from the insurance company or immediately receive funds from the reseller. One way or another, the practice of concluding assignment agreements in the insurance industry is gaining momentum. A key role in this is played by the factor of time and procedural savings for the policyholder.

The procedure for purchasing insurance cases for road accidents

The copyright holder has the right to transfer to a third party the right of claim against the insurer arising in connection with the accident. The following legal structures are used for this:

- power of attorney;

- assignment agreement on the assignment of the right of claim.

The lion's share of cases of transfer of rights is formalized by an assignment agreement. But this does not diminish the importance of the power of attorney. According to Art. 185 of the Civil Code, the latter is a written authorization issued to an attorney. The policyholder has the right to authorize a third party/persons to:

- representation of your interests before the insurer;

- appealing on your own behalf to regulatory authorities and courts regarding the collection of insurance compensation;

- receiving funds intended for him.

A notarized power of attorney is quite sufficient to provide the attorney with all the capabilities of a copyright holder. However, the document does not cover all aspects of the relationship between the policyholder and the insurer. A significant part of the agreements remains within the framework of an oral “gentleman’s agreement”:

- The fact of transfer of funds by the attorney to the principal remains legally undocumented;

- nominally the attorney receives money from the insurer not for himself, but for the principal (however, the fact of the subsequent transfer of money to the principal is not monitored by anyone);

- the principal has the right to revoke the power of attorney at any time and, thereby, prevent the attorney from receiving insurance compensation.

A power of attorney is convenient for formalizing the transfer of the right of claim to an individual. The buyout may be of interest to a practicing lawyer or an entrepreneurial person. Sometimes powers of attorney are used by start-up companies.

The assignment agreement is regulated by § 1 of Chapter 24 of the Civil Code. In the understanding of Art. 382 of the Civil Code, assignment is one of the mechanisms for changing the creditor’s obligation. At the same time, the essence of the insurer’s civil obligation remains the same, only the copyright holder changes.

To sell the right to receive compensation for losses from an accident, the car owner does not need the consent of the insurer. True, the CASCO agreement may establish a ban on the assignment of claims. In this case, the policyholder is deprived of the opportunity to enter into an assignment agreement (clause 2 of Article 382 of the Civil Code).

The insurance company should be notified of the conclusion of the assignment agreement as soon as possible. But the assignor (the car owner who sold the right of claim) has nothing to worry about. Being an interested party, the assignee (purchaser of the right of claim) will independently notify the insurer.

The ignorant insurer, who has fulfilled the requirements to the assignor, is released from fulfilling his obligations to the assignee.

To draw up an assignment agreement, a simple written form is sufficient. Such a transaction is not subject to notarization (Article 389 of the Civil Code). Companies that buy insurance company debts develop their own templates. When concluding an assignment agreement, the following conditions must be met:

- the assignor is a victim of an accident or his legal representative;

- at the time of assignment, the claim against the insurer is legally valid;

- the right of claim against the insurer has not previously been alienated to another person;

- the assignor transfers to the new creditor documentation certifying the existence of an obligation, that is, an insurance file.

If the assignor violated one of the above requirements, his counterparty has the right to demand the return of the entire assignment transferred under the agreement and compensation for losses (Article 390 of the Civil Code).

How to choose the right company for the assignment of rights?

In every corner of Russia there are enough companies offering insurance purchase services. Ads of this kind can be found on the Internet and in the media. But you should not completely trust resellers. It is important for the victim of an accident to realize that the assignee is an entrepreneur who cares, first of all, about his own benefit. Therefore, many of the reseller’s statements are just advertising gimmicks.

To choose a decent reseller and achieve the most favorable offer for yourself, you should adhere to a number of rules:

- do not enter into an assignment agreement rashly - immediately after an accident or on the day of contacting the reseller;

- do not deal with companies that guarantee full compensation for damage caused;

- carefully study the terms of the agreement for the assignment of rights of claim, and if they still remain unclear, involve a lawyer for clarification.

Urgent purchase of insurance cases for road accidents under normal conditions takes a few days, not a few hours. The copyright holder should be wary of the promise of payment on the day of application.

- An expert assessment is needed to assess the damage. The procedure can indeed be carried out by independent experts at the initiative of the reseller. However, it requires long and painstaking work. For minor damage, the inspection takes half an hour. In case of serious damage, it takes an expert several hours to identify hidden defects. It takes even more time to draw up a conclusion (description of identified defects, calculation of damage caused using formulas, determination of the amount of lost marketable value).

- Transferring the expert opinion to the legal department, having it read by specialists, establishing the completeness of the insurance case and analyzing the prospects for further proceedings with the insurer takes no less than a working day.

- A self-respecting reseller company prepares for negotiations on the amount of compensation for at least two working days. Excessive efficiency implies assessing the damage “by eye” and a willingness to agree with the expert opinion of the insurer. An offer to issue money immediately means an inevitable understatement of payments.

Important! The offer of full repayment of the damage is not true. If the reseller’s representative claims to be ready to compensate for losses in full, there is a catch. Most likely, it is hidden in the wording of the assignment agreement.

You should not go to a dealer immediately after an accident. In any case, you will have to file a claim about the occurrence of an insured event and form an insurance case yourself. It makes sense to personally contact the insurer with a claim in the manner established by 40-FZ “On compulsory insurance of civil liability of vehicle owners” or a CASCO agreement. And only if the compensation turned out to be incomplete or untimely, sell the right to collect the entire or remaining amount.

The assignment agreement contains provisions on the transfer to the reseller of rights to:

- insurance premium in connection with an accident;

- penalties;

- reimbursement of legal costs.

- represent the interests of a victim in an accident as an attorney;

- receive on his behalf funds for insurance payments and loss of commodity value.

Such transactions are akin to contracts concluded with lawyers or intermediaries. The client can count on payment only if the dispute is won, and after the insurer pays off the obligations.

Memo for those assigning the right of claim to the insurer:

- reliable resellers avoid concluding assignment agreements on the day of application;

- reading and understanding every point of the transaction with a reseller will protect you from fraud;

- it is pointless to look for an organization that is ready to fully compensate for the damage;

- in auto insurance practice, an assignment agreement involves the assignment of rights to compensation for damage, loss of market value, and legal costs;

- the presence in the contract of non-standard powers, a clause on the right to represent the interests of the policyholder before the insurer, regulatory authorities or the court indicates that a contract that is not an assignment has been presented to the policyholder for signature.

By adhering to these simple rules, the policyholder reduces the risk of fraud on the part of the reseller to a minimum.

Redemption of insurance cases for road accidents: video

Almost every driver has been in a situation where they need to receive compensation for car repairs after damage from an insurance company. Refunds are made through payment of monetary compensation or payment for repairs.

In what cases does insurance buyout occur?

Buying out insurance cases for road accidents is a fairly popular service today, because it allows drivers to receive money for car repairs without much effort and time. Cases are purchased by companies that specialize in collecting debts from insurance companies. They can also often offer the services of lawyers and experts.

Important!Many companies offer high interest rates for car accident debt.

The redemption percentage depends on the area, but on average it is 65% of the debt amount.

Redemption of insurance claims for road accidents occurs in the following cases:

The insurance company paid insufficient insurance compensation. In most cases, payments from the insurance company are 2-3 times less than the cost of repairs.

The insurance company refuses to pay compensation. If your insurance company won't pay out, you can contact a debt settlement company. If the outcome is positive in court, you will be offered to buy out the case under compulsory motor liability insurance.

The insurance company does not pay compensation. When an insurance company does not pay compensation for more than 20 days and does not send a refusal to pay, this is a gross violation of the Federal Law “On Compulsory Motor Liability Insurance”.

Insurers are deliberately delaying the process. When you are required to provide additional documents due to inaccuracies during registration of an insurance claim.

The case goes to court. When you need to prove your right to receive compensation in court.

The insurer does not have the means to pay compensation. In the event that the insurance company goes bankrupt.

The insurer does not have the means to pay compensation. In the event that the insurance company goes bankrupt.

The purchase of insurance company debts is carried out according to the following scheme:

After an accident, the victim demands payment of the policy under OSAGO (Compulsory motor third party liability insurance) or CASCO (Comprehensive motor insurance except liability), and the insurance company refuses to pay or agrees to pay a small part of the amount.

The driver contacts an organization that deals with the redemption of insurance cases and offers to make the redemption for a specific amount. If the business is promising and the price is fair, the company’s employees draw up documents for the buyout. The organization receives the right to demand compensation for the debt from the insurance company, and the driver receives money for the ransom.

It is possible to sell an insured event for an accident on a legal basis (in the Civil Code “Law on the organization of insurance business”). This procedure is called assignment, and this means that you transfer the rights to claim insurance compensation. All details of cooperation are recorded in the assignment agreement, which is concluded between the driver and the organization.

It is possible to sell an insured event for an accident on a legal basis (in the Civil Code “Law on the organization of insurance business”). This procedure is called assignment, and this means that you transfer the rights to claim insurance compensation. All details of cooperation are recorded in the assignment agreement, which is concluded between the driver and the organization.

Benefits of using the service

Firms that buy out debts from insurance companies make a significant profit from the difference between the funds paid to the driver and those received from the insurers. Therefore, selling the debt of an insurance company to another organization is not always profitable.

But there are also advantages of such a service:

- Speed. The car owner can receive monetary compensation within a few hours, immediately after concluding the contract. The driver does not need to spend a long time on proceedings and queues. In an insurance company, this process can last 7-8 months. And there is no guarantee that you will definitely receive all payments.

- Guarantee of monetary compensation. The victim will definitely receive compensation for car repairs, although not the full amount. The insurance company cannot give such guarantees.

- Guarantee of monetary compensation. The victim will definitely receive compensation for car repairs, although not the full amount. The insurance company cannot give such guarantees.

- Reducing risk. Due to the fact that you receive compensation in cash, you reduce the risk of a reduction in the amount based on the conclusion of a forensic examination. There will also be no risk of an increase in the price of repairs and spare parts until the end of the proceedings.

- You don't need to pay VAT.

- No additional costs. You do not need to spend money on lawyers, a notary, or an independent examination.

How to choose a company?

In order to receive debt reimbursement as quickly as possible, you should choose a company to transfer the rights to claim reimbursement.

To avoid any problems, choose a reliable and decent company. To do this, follow these rules:

- Do not try to speed up the process of drawing up an agreement and transferring rights to the company. Documentation cannot be completed in a few hours; - Entrust the assessment to a qualified specialist. Remember, assessment is never done by visual inspection alone;

- Do not try to speed up the process of drawing up an agreement and transferring rights to the company. Documentation cannot be completed in a few hours; - Entrust the assessment to a qualified specialist. Remember, assessment is never done by visual inspection alone;

If you are promised a full refund or a huge percentage, do not enter into an assignment agreement.

Receive documents on the appointment or refusal of payment before signing the contract. Try to take steps to resolve the compensation amicably without going to court.

Read the assignment agreement carefully before signing it. If the company to which you transfer the rights to claim the debt offers to assess the damage in a short time (less than 24 hours), then the amount of compensation can be significantly reduced.

How to draw up an agreement?

An agreement is drawn up to entrust the claim for debt repayment to a third party or a specialized company. It must be signed by both parties and correctly drafted. The agreement must be registered in accordance with Article 389 of the Civil Code of the Russian Federation.

An agreement is drawn up to entrust the claim for debt repayment to a third party or a specialized company. It must be signed by both parties and correctly drafted. The agreement must be registered in accordance with Article 389 of the Civil Code of the Russian Federation.

You must provide information whether the debtor has debts or unpaid taxes. If the insurance company has debts, transferring rights will be very problematic.

In order for a company to buy your insurance business, it requires:

- be the owner of the car, or you must have a power of attorney for the car in order to represent the interests of the owner;

Provide all copies of documents related to the accident;

Provide an independent expert assessment, or show the car for it to be carried out.

Next, the lawyers will work independently. Within a few hours you will be notified of a decision on consent/disagreement to buy out an insurance claim for an accident. If the organization decides, you get your money for buying out the insurance business.

Next, the lawyers will work independently. Within a few hours you will be notified of a decision on consent/disagreement to buy out an insurance claim for an accident. If the organization decides, you get your money for buying out the insurance business.

Buying out insurance cases is the only way to receive compensation for damage after an accident within one day. The service is available to owners of CASCO and OSAGO policies. All transactions are concluded strictly within the law.

An assignment agreement, regulated by the Civil Code of the Russian Federation, is concluded between the company and the owner of the insurance business. In other words, the owner of the car (assignor) transfers his right to receive insurance payment to another person (assignee).

Benefits of the service

Beneficial to all car owners. If you get into an accident, it is very difficult to obtain compensation for damages from the insurance company. The size of payments may be artificially low, and the terms may be delayed. In this case, there are two ways: collecting money through the court or urgently selling the insurance business.

The service is beneficial to car owners in the following cases:

- the conditions for compensation for damage under compulsory motor liability insurance or CASCO insurance have been changed;

- the insurance company is in no hurry to pay;

- there is no time for litigation.

Before you try to deal with insurers on your own, you should remember that court cases in such cases last from 4 to 7 months. When going to court to recover compensation, you will have to pay for the services of an appraiser, stand in long lines, receive a lot of certificates from the traffic police and visit the insurance company’s office more than once.

If immediately after the accident, the proceeds from the transaction can be used to immediately begin repairing the car. The transaction will be completed within one business day. The car owner will immediately receive his money in full, minus the discount.

When is it possible to sell an insurance business?

Buyout of accident cases is carried out at almost any stage. The service can be used even after the car has been repaired or sold, provided the appropriate documents are available. You can receive an insurance payment in one day if:

- after the accident there was no visit to the insurance company;

- the insurer compensated for the damage, but the amount was underestimated;

- compensation was refused;

- payment terms are artificially delayed;

- The insurance company declared bankruptcy.

What is needed to conclude a deal?

The company's employees specialize in insurance cases involving road accidents. Our wealth of experience allows us to resolve issues very quickly. Therefore, selling an insurance business is beneficial to both parties.

Only the owners of the car or persons to whom a general power of attorney has been issued can transfer debt obligations. All documents must be notarized.

To conclude a deal, you need to prepare copies of all documents in advance. You will need certificates of accidents, examination results, protocols, and so on. The company also conducts an independent assessment of the condition of the vehicle to submit claims to the insurance company. At the same time, the car owner does not need to go around the authorities himself to confirm the right to receive payments. The company guarantees a positive completion of the transaction.

Redemption of debt obligations of insurance companies is a unique service. It eliminates all possible risks when receiving payments and does not require much time. And even though the amount of compensation is incomplete, the money is paid immediately and in full, without delay.