Plan schedule payable payables. Schedule of payments - annex to the loan agreement. The order of repayment of claims

For business entities, the law provides for two options for paying off debts to the budget with a change in the due date:

- by obtaining a deferred payment;

- through installments.

Extension of maturities without interest is available for a limited list of situations. The basic provisions of this issue are set out in Art. 64 of the Tax Code of the Russian Federation.

Payment of tax arrears: how to extend the deadlines

When applying for a deferred payment, the taxpayer agrees to pay off the debt to the budget at a time, but after the established deadline. Installment involves phased payments to reduce arrears after the standard payment deadline. Extension of the time frame of the payment period for deferment and installment plan, according to paragraph 1 of Art. 64 NK is possible for one year. When it comes to federal taxes and insurance premiums, the payment interval can be extended up to 3 years.

To obtain a deferment or installment plan, it is necessary to convince the tax authorities of the current financial insolvency of the taxpayer, to provide guarantees that during the period provided by the tax authorities the economic situation of the company / individual / individual will improve. Payment of tax arrears on terms of prolongation of the payment period can be realized if one of the following reasons exists:

- the taxpayer suffered material damage as a result of a natural disaster, catastrophe, or other insurmountable circumstances;

- budget allocations were late;

- with timely payment of tax obligations, the taxpayer risks going into bankruptcy status.

Obtaining a delay is also possible for those business entities that experience temporary difficulties due to the seasonal nature of the activity.

You can pay tax arrears under the TIN online on the FTS website or through the State Services portal. To do this, you must register an electronic taxpayer account. In it, you can create a print receipt for subsequent payment at the bank or pay off the required amount from a bank card immediately.

The IFTS website has a service for paying tax obligations and generating payment orders. Individuals, legal entities and individual entrepreneurs can use it. You can pay tax tax arrears online, for this it is enough to find out the amount of debt and make a payment through the service “]]\u003e Pay taxes]]\u003e”. To form a payment order, select the tax type in the empty fields, enter the amount and indicate what will be paid off - the tax itself or a fine.

Tax debt repayment schedule: sample

To obtain the right to installment payment, a taxpayer must contact the Federal Tax Service with a written statement. Restructuring of liabilities may be requested for one or more taxes. For each type of tax, it is necessary to develop a separate payment schedule. The sample of documents recommended by the tax authorities by which an installment plan or a deferral is drawn up is given in the Order of the Federal Tax Service dated December 16, 2016 No. MMV-7-8 / 683 @.

Documents are attached to the application according to the list given in paragraph 5 of Art. 64 of the Tax Code of the Russian Federation (application for deferral / installment plan, bank statements, list of debtors, obligation to comply with deferral / installment plan, etc.). The schedule is prepared taking into account the limiting restrictions on the terms of extension, installment conditions must satisfy the requirements and capabilities of all parties. It is necessary to enter into the payment plan the deadlines for payment of the next part of the debt, the amount of payments and indicate how transfers will be made to pay interest and interest (if any). Payments are made quarterly in equal installments.

The debtor taxpayer retains the right to early payment of all obligations. The basis for the development of the schedule can serve as a form from the order of the Ministry of Taxes and Duties of the Russian Federation dated June 21, 2001 No. BG-3-10 / 191 (Appendix No. 8).

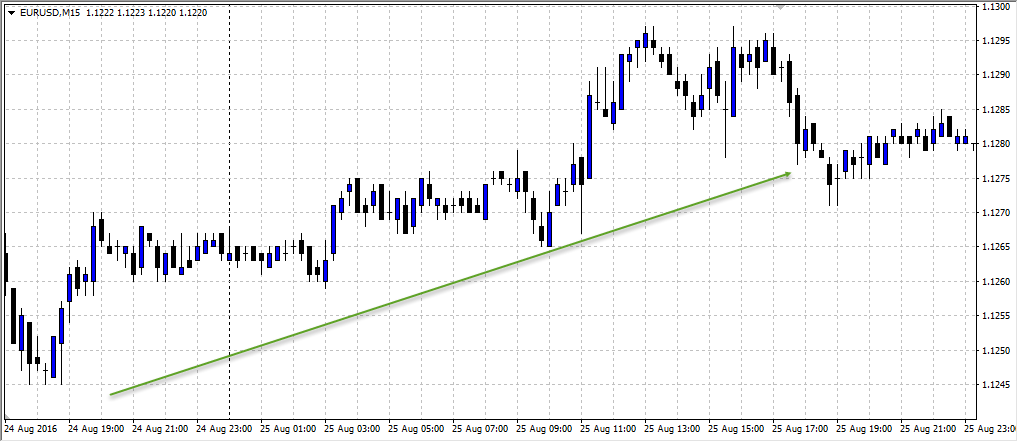

Debt repayment schedule - a table with numerical data that allows you to know the amount due in a specific period. The sample can be downloaded for free.

Repayment of debt between counterparties should be regulated by the accompanying documentation. Written confirmation of cash flows is necessary to exclude disputes between the parties. The smallest details fixed on a paper source will allow to describe a circle of various rules of behavior. The debt repayment schedule is a table with numerical data that allows the debtor and creditor to know the exact amount needed to be paid on time. A sample of the paper under discussion can be downloaded for free by direct link.

This application will be required at the conclusion of a loan, supply, loan and many other transactions. Using a debt repayment schedule, counterparties can track the history of relationships, delay in other matters. The application in question does not have a critical form and is free to execute. Each organization has its own examples and samples in the databases. Using the presented template, it will be easier for the user to draw up a document on their own and apply it in their own practice.

Mandatory items of the debt repayment schedule

:- The affirmative visa of the head in the upper right corner of the schedule;

- The name of the schedule, its relation to the agreement;

- After that, a table with parameters, columns and rows is made out in a free form;

- Columns and lines indicate the numerical values \u200b\u200bof amounts, terms, interest rates;

- At the end of the graph, a summary is made;

- Signing and decryption are required.

drawn up in cases where the obligation is fulfilled in parts. Such a schedule is needed by both parties in order to control the time of making payments and to avoid accidental delay.

The order of repayment of loan requirements

Debt repayment schedule can be drawn up as an addition to the contract. For example, when taking a loan from a bank, such a schedule is issued to the client along with the agreement, and in the text of the loan agreement is listed as a mandatory application. Not always the layman can understand the jungle of terminology that banking lawyers love to use.

And in the schedule, the debtor can clearly see the amount of the payment and the date it was paid.

And here for the client lies the main danger. He may not try to understand the terms of the contract, but simply pay according to which the total amount is indicated.

And it may include hidden fees. Hence the overpayment, which was not agreed upon before the conclusion of the agreement, but legitimized by the signing of the contract, and therefore, accepted for execution.

Therefore, it is so important to compare the loan conditions with the figures prescribed in the application.

When applying for a loan should clarify:

- whether it is possible to deviate from the schedule, and how it will affect subsequent payments;

- will it be possible to get a new schedule from the bank with up-to-date information on the size of the monthly payment.

Repayment schedule for a monetary obligation that has been past due

Another reason for the formation of the order of repayment of claims may be the failure to fulfill the main obligation, resulting in delay and debt. In relation to the delay in the performance of an obligation by agreement of the parties penalties may be provided.

For example, a penalty may be provided for a failure to deliver.

But if the company does not refuse to pay, but simply cannot due to lack of funds, the counterparty may make concessions. Alternatively, the parties may agree to pay the debt in installments.

Better than getting no money at all. The debtor will have to follow debt repayment schedulewhere pay periods are indicated.

Penalties may also be included in it if they are nevertheless applied.

Rules for drawing up a debt repayment schedule. Sample

The form of the debt repayment schedule largely depends on the type of obligation for which it is being repaid. Here, the rules mainly apply, which are enshrined in the contract or voiced at the negotiations. So when plotting, you can simply follow the logic.

It must be understandable and clear. After reading it, there should be no ambiguity.

The chart itself has the form of a table where the following categories can be used:

- the amount of payment, moreover, it can be divided into payment of the loan body and interest on the loan;

- date of implementation.

If the organization incorrectly calculated its forces associated with the repayment of debt on loans, or lost solvency for a number of reasons, legal proceedings are instituted against the company.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve your problem - contact the consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24 HOURS AND WITHOUT DAYS OFF.

It is fast and IS FREE!

There can be two court decisions: liquidation of a company or setting deadlines for its financial recovery. The latter option is inextricably linked with the development of a schedule for paying off debts to creditors.

What it is

A debt repayment schedule is a document signed by a creditor and a debtor, according to which the second returns the money to the first. With its help, the frequency of payments and their volumes are established in accordance with a court order. The process of using and creating a schedule is regulated by the 85th article of the Bankruptcy Law.

Such a schedule may appear as:

- annex to the loan agreement;

- section of the loan restructuring agreement;

- an additional condition of the supply contract;

- agreement in case of default on various debt obligations.

Each of these types is different in format and content, but all types of graphs are the same in essence. This is a schedule of subsequent payments on past due debts, disaggregated by date and amount.

For the financial recovery of the company in the event of ruin, the formation of the sequence of payments is an integral part of the procedure. As such, the schedule is a one-way debtor obligation. Creating a schedule is carried out with the beginning of recovery. And the payment of debts starts relative to the deadlines set in the document.

In what cases is needed

The debt repayment scheme becomes necessary if the debtor has a certain amount of outstanding obligations, and he is ready to repay the debt. This schedule expresses the intention of the debtor to settle. It is introduced if creditors have received a request from an insolvent organization. It is composed of the founders of the latter.

An application must be filed before the first meeting of creditors, or rather, 15 days before the appointed date of the meeting of the council. The petition should be supplemented not only with the planned cancellation schedule, but also with the schedule of measures aimed at restoring the debtor's solvency, a letter of guarantee and other documents confirming the desire to financially strengthen the company.

Payments start after the appointment of the manager of this process, who is obliged to ensure control over payments.

The sequence of payments is of great importance both for the recovery procedure itself and for the company that is the debtor.

This value is expressed in the following:

- All claims of creditors are satisfied. The measures that were taken to satisfy their requests earlier are subject to cancellation.

- Restrictive effects, for example, the seizure of property and other assets, can be imposed only as part of the bankruptcy procedure.

- If there are enforcement proceedings against the debtor, they are suspended.

- Repayment of interest, dividends and other additional fees is prohibited.

- Charges, penalties and interest will be suspended.

The main significance of the schedule for the debtor is that it has the opportunity to restore solvency and maintain its legal status. For the creditor, he gives confidence in the fulfillment of the claims on debts presented to them.

How to compose a document

As for the formation of any other paper, there are a number of established rules for scheduling, which should not be neglected.

These include the following requirements:

- The payment scheme includes all searches of creditors.

- Be sure to indicate the start of payments.

- Lenders are allocated to the first and second turn.

- Payments for the first and second priority are transferred within six months from the beginning of the recovery process.

- Payments to other lenders must be paid no later than one month before the end of the process.

- Debt is repaid in proportion to the size of the claims in accordance with the established sequence.

- The design of the schedule is exclusively in tabular form.

- Modifications to the original scheme and early repayment of obligations are allowed.

- The schedule is signed not only by the persons of the bankrupt company, but also by those who are responsible for the execution of the agreement.

- The payment scheme is approved by the Arbitration Court.

When creating the schedule, you must follow the provisions of the loan agreement, on the basis of which the loan was received. The structure of the scheme should be clear and logical. When looking at a document, it should be immediately clear when and how much the debtor is required to transfer.

Most often, two columns are enough to compile the table - the amount of payment and the due date. Often the amount is split into two more columns. In one they indicate the size of the main debt, in the other - interest charges.

If there are several creditors, then it is advisable to expand the form to include the names of lenders. If you plan not a lump sum payment, but a breakdown into several payments, then the column indicating the term is divided by the corresponding dates.

In the heading of the document, in the upper right corner, the name of the body that approved the form, that is, the arbitration court, is affixed. Then follows the name of the paper, the debtor and the year in which the repayment is carried out. After the payment table is entered. The document ends with signatures of representatives of the insolvent company and those who ensure the implementation of the scheme. All signatures are decrypted.

Sample

An approximate form of the payment scheme will look like this:

Approved by

Court of Arbitration (full name)

Debt repayment schedule

(name of the debtor) for 20_year.

Founders (participants, owner): (signature) Name

Person providing security for obligations: (signature) Name

In the test agreement, which this schedule accompanies, the order of payments is also prescribed. The scheme can be either annuity or differentiated. The first option involves the payment of debt in equal installments. The second option means a gradual decrease in payments, from larger to smaller.

An annuity schedule is easier to understand, it is easy to remember the size of the debt and control the financial situation. Differentiated payments in the case of a schedule drawn up by the bank allow interest recounting in case of early repayment of a loan.

Debt repayment schedule approval

The formed structure of payments is subject to mandatory approval by the Arbitration Court. Without its mark the document will not be considered valid. In addition, the court appoints an administrative manager responsible for monitoring payments.

Other persons approving the form are representatives of a bankrupt company. These may be managers, founders, owners of property and other individuals and legal entities responsible for fulfilling all the requirements of the creditor.

From the moment of approval, the debtor has an obligation to clearly implement all clauses of the agreement. Loans should be repaid at a time determined by the structure, however, legislation provides for the possibility of early repayment.

Can I make changes?

The Bankruptcy Law establishes the possibility of amending a previously established cancellation structure. Procedures are governed by different clauses of a regulatory act, depending on the nature.

So, if the debtor does not fulfill the obligations attributed to him - he pays at the wrong time or to a lesser extent, the first section of the law should be studied. If the size of the stated claims of creditors included in the register exceeds by 20% the size of the surveys established by the repayment scheme, the process is regulated by the second section.

In order to resolve this issue, it is necessary to collect a council of creditors. A designated administrative manager convenes the meeting. If there is a failure to fulfill the agreement, the collection initiative may come from persons acting as guarantors of the agreement.

After receiving a request from them, the manager is obliged to collect advice not later than two weeks from the date of receipt.

If as a result of the meeting it was decided to amend the structure of payments, all changes must be agreed upon and approved by the Arbitration Court. The court's refusal of approval by the document indicates the impossibility of making changes to the scheme.

If creditors categorically refuse to give in to the debtor, then a decision is made on early termination of the recovery process. To do this, again, you need an appropriate petition from the board of creditors.

At the same time, the introduction of adjustments is not the basis for the refusal of persons ensuring the execution of the contract to perform the same functions in the future. During the recovery process, previously established requirements can be canceled by the lender himself. To do this, he appeals to the courts with a statement.

When repaying, the debtor must, first of all, be guided by the amounts and terms stipulated by the scheme. Failure to pay in time or in full will lead to delay, which will only aggravate the situation of debtors. It is better to make a payment in advance, because the transfer date may coincide with a weekend or holiday. And the delay arises, despite the fact that the debtor has settled.