On the withholding of income tax on income received by individuals in the form of interest on bank deposits. The National Bank told how the tax on deposits will be calculated Top irrevocable deposits in usd and eur

: citizens will give to the treasury part of what they earn on some deposits. the site sorted out who would have to pay tax and who would not.

What's happened?

Yesterday, the President signed Decree No. 7 “On raising funds for deposits.” One of its innovations is the introduction of income tax on interest on deposits in rubles for a period of less than a year and in foreign currency for a period of less than two years. Let us remind you that the income tax rate in Belarus is now 13%.

— So the National Bank wants to encourage citizens to abandon short-term deposits and choose deposits for long periods, explains senior analyst at Alpari Vadim Iosub. — It is difficult to predict how investors will react to this. On the one hand, they may actually reorient themselves towards long-term deposits, on the other hand, someone may decide to withdraw their deposit from the bank altogether.

Reference: The share of ruble deposits for up to a year is now 80%. Moreover, among “fast” deposits the most popular term is 3 months. Among foreign currency deposits, 60% of savings have a maturity of up to a year.

Who will have to pay what tax?

The most important thing you need to know is that tax must be paid not on the entire deposit amount, but only on interest and only in certain cases. From April 1, those who choose deposits in rubles for a period of less than a year, in foreign currency for a period of less than two, or withdraw money from “long” deposits before these terms, will pay the tax. They will not charge tax if the interest does not exceed the current bank rate on demand deposits. The document does not apply to existing deposits. At the same time, the decree applies to all investors - both Belarusians and foreign citizens.

By the way, the National Bank intends to provide banks with benchmark interest rates on demand. " These rates will be approximately 3% for Belarusian rubles and 0.2% for foreign currencies"- said the Deputy Chairman of the Board of the National Bank Taras Nadolny.

Let's say you opened a deposit in rubles for three years, and for some reason decided to withdraw the money after 6 months. The tax will be calculated on the interest that has accumulated over these 6 months.

Example: A deposit of 20 million was opened for a period of 3 years at 25% per annum. In six months, the amount of your contribution will increase, taking into account capitalization, to almost 23 million. In this case, interest will amount to 2.9 million rubles. So they will need to pay tax. The tax amount will be 380.9 thousand rubles. If you open the same deposit in the amount of 100 million, then the tax on interest earned will be almost 1.9 million rubles. The calculation is made without taking into account additional contributions.

Do investors need to go to the tax office?

No. Each investor does not have to fill out a declaration.

— Banks are tax agents. When paying income to an individual, they will collect tax and transfer it to the budget. Individuals will not need to indicate this in their tax return., said the Deputy Minister for Taxes and Duties Svetlana Shevchenko. Please note that the provisions of the decree on deposits, which relate to taxation, begin to work on April 1, 2016.

The tax will be paid after withdrawal of the deposit or after the expiration of the validity period, if the deposit in rubles was concluded for a period of less than a year, in foreign currency - less than two.

When concluding a deposit agreement, banks must warn clients about these conditions, and also inform them about the withholding of income tax if this occurs.

Will there be a tax on salary cards and bonds?

In these cases, the income tax benefit will remain. Thus, taxes will not be deducted from the interest that banks charge on salary card balances. As a rule, this is a demand rate.

« In fact, salary projects, where the demand rate is very low, are not savings in nature and are not subject to taxation, - said Taras Nadolny. — If the nature of the deposit involves performing savings functions, then in this case they are subject to taxation».

The same goes for bonds. " There are no plans to introduce income tax on foreign currency bonds of the Ministry of Finance and such a possibility is not even being considered“, assured Taras Nadolny. Those who bought corporate securities (for example, from banks) now have income tax relief until January 1, 2016. According to Taras Nadolny, this benefit will be extended.

Will a tax on interest on deposits save you from parasitism fees?

As you know, next year some unemployed Belarusians will have to pay a tax for parasitism. They will also include those who are not employed anywhere and live on interest on deposits. It turns out that they will have to pay two taxes?

As explained in the Ministry of Taxes and Duties, if a citizen lived on interest this year, then he will have to pay the fee for 2015. If he does not find a job in 2016, but pays tax on the deposit, then the amount of this tax will be credited to him when paying the fee for parasitism in 2017. If such a citizen next year pays tax on interest on a deposit worth more than 20 basic units, then he will not be considered a dependent and will not have to pay the tax again.

Interest on deposits of individuals concluded after April 1 will be subject to income tax when placing funds for less than a year in Belarusian rubles or less than two years in foreign currency.

This was reported by the head of the main department for regulation of banking operations, member of the board of the National Bank of Belarus Ilona Lednitskaya.

“Income in the form of interest received by individuals on bank deposits is subject to income tax, subject to the simultaneous observance of a number of conditions,” - noted the head of the main department. We are talking about the following conditions: contracts were concluded from April 1, 2016, the actual placement of funds in deposits is less than a year in Belarusian rubles or less than two years in foreign currency, income is accrued at an interest rate exceeding the rate on a bank deposit on demand.

"If bank deposit agreements were concluded on April 1, 2016 and later for a period of one year or more in Belarusian rubles, 2 years or more in foreign currency with the possibility of replenishment and partial withdrawal, then only interest income accrued on that part of the deposit, the actual the placement period of which, in connection with replenishment or partial withdrawal, will be less than a year for deposits in Belarusian rubles or less than two years for deposits in foreign currency,” - Ilona Lednitskaya drew attention. She clarified that income should be accrued at a rate exceeding the interest rate on demand deposits.

Interest received by individuals on deposits under agreements concluded before April 1, including on additional contributions to these deposits, will not be subject to income tax.

On November 11, 2015, the President of Belarus signed decree No. 7 “On raising funds for deposits.” The document, in particular, prescribed the introduction by banks of irrevocable deposits from November 12, in which early repayment at the initiative of the depositor is not provided.

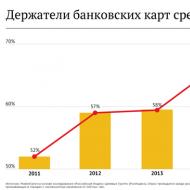

According to the National Bank, after the adoption of the decree and to the present day, the outflow of deposits in foreign currency in dollar equivalent amounted to about $350 million. “This figure is significantly lower than that predicted by the National Bank when developing the regulatory legal act,” - Ilona Lednitskaya emphasized and added that today there is a positive trend. Thus, over 23 March days, balances on time bank deposits of individuals in national currency increased by Br132.3 billion, or 0.5%, and as of March 24 amounted to Br24.4 trillion.

Currently, there are rare cases where people withdraw funds without explanation. “Banks do not indicate any reasons for withdrawal in connection with the provisions of Decree No. 7,” - noted the representative of the National Bank.

According to banks, individual depositors withdraw their savings due to the deadline for returning the deposit. Funds are mainly withdrawn to purchase foreign currency, bonds of banks and the Ministry of Finance, purchase real estate, a car, and run a business.

Income tax is imposed on all income of individuals; an exception is made only for part of social payments and amounts included in the list of tax benefits and deductions. Accrued interest on bank deposits is considered income receipts for citizens and is also subject to taxation. The tax on deposits of individuals in 2019 remained at the same level and does not apply to all types of deposits.

When is personal income tax collected from a deposit account?

The procedure for taxing interest income from deposits in savings accounts directly depends on the rate of return fixed by the deposit agreement. A high interest rate on a deposit does not mean that a large amount will be withheld as tax. Taxation of deposits of individuals in 2019 applies only to certain types of investments. The main criterion for classifying amounts as subject to income tax is the size of the gap between the key rate of the Central Bank of the Russian Federation and the deposit rate.

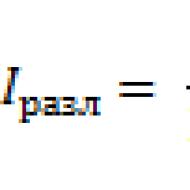

To assign taxable status to income, a single formula is used:

The key rate fixed by the Central Bank of the Russian Federation is + 5%.

If the calculated value is higher than the current deposit rate, no tax is charged on deposits of individuals. If the rate actually exceeds the calculated threshold, personal income tax must be withheld. For example, from March 26, the key rate was set by the Central Bank at 7.25%. The non-taxable interest rate limit will be 12.25% (7.25% + 5%).

The current average interest rate on deposit programs does not exceed 9%. There are several reasons for this:

- saving money on paying profits to your clients and increasing margins;

- there is no need to act as a tax agent, to carry out deductions and transfers in favor of the budget of tax on bank deposits of individuals;

- the declared interest rate is in the same range with the basic level of return on deposits, which is calculated by the Central Bank of the Russian Federation, which avoids paying additional insurance premiums to the DIA.

Personal income tax on deposit income

Income tax on passive profits is applied provided that the level of income interest exceeds the standard established by the Central Bank of the Russian Federation. Tax is charged on interest on deposits of individuals, and not on the amount of the deposit. To differentiate groups of deposits, the following approaches are used:

- if the deposit is made in rubles, then the distinction between taxable investments and those exempt from personal income tax is carried out taking into account a limit equal to the key rate (or refinancing rate), increased by 5%;

- taxation of deposits of individuals in foreign currency is carried out after the level of profitability exceeds the level of 9%.

For example, the deposit is valid for 1 year. Interest is calculated and transferred to the current account on the last day of each month. Tax on deposits of individuals in 2019 will be calculated and withheld from the amount of interest income on a monthly basis. If a banking organization is a tax agent for a person, it independently:

- determines the amount of tax liability;

- repays current personal income tax debt to the budget;

- declares the income received by him for his client.

When transmitting data on passive income to the Federal Tax Service, the bank does not disclose the amount of the deposit. The report specifies only the tax on deposits of individuals (2019) and the amount of income taken into account to determine it. This approach is due to the need to maintain the secrecy of investment.

The most difficult option is to calculate tax liabilities on deposits with monthly capitalization of funds. In this case, taxation of deposits of individuals will be carried out each time taking into account a new base. The situation with early termination of the contract is non-standard. When closing a deposit before its expiration, the bank reduces the interest rate and recalculates income accruals.

It may turn out that as a result of premature termination of the deposit agreement, tax on interest on deposits does not need to be withheld. If there were no personal income tax deductions from this deposit at the earlier stages of cooperation, the bank only needs to recalculate rates and income. In situations where the tax was paid regularly before the date of termination of the contract, the financial institution must recalculate the tax and declare to the Federal Tax Service its intention to return the funds excessively transferred to the budget.

Interest income from other investments

What to do in a non-exceptional case:

- at the end of the year for which income accruals were made, submit a 3-NDLF declaration to the tax office;

- calculate the tax on existing deposits;

- pay off tax liability.

It is not necessary to declare the entire amount of income received, but only that part that exceeds the tax-free minimum. For example, a rate of return of 12.25% is not subject to taxation. The owner of the share received 14.3% income from the invested funds. Taxation of income on deposits will concern only the difference between the actual indicator and the Central Bank limit - 2.05% (14.3% - 12.25%).

At the next stage, it is necessary to convert the calculated percentage difference into monetary measures. The last step is to determine the tax liability based on the estimated amount of income. In this case, the standard tax rate on deposits is applied, the amount of personal income tax may vary depending on the status of the shareholder - a resident of the Russian Federation or a non-resident (35% or 30%).

A different approach is used for bond transactions. The procedure for taxing income received from them has been adjusted - new rules have been put into effect since the beginning of 2019. From this moment on, the basis for deducing the tax liability is the entire amount of income. Is interest on deposits in bonds in foreign currency taxable? No, this category of investment is in the group of exceptions, like bonds issued before 2017.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Taxation of deposits of individuals in 2017

Having decided to increase their capital, most Russians choose a bank deposit. This is a small income, but it helps to avoid inflation, securely preserve savings and even earn a little money.

What is the result of investing in a bank? Income. And all income in Russia, as you know, is subject to taxes. Do I need to pay tax on interest on deposits in 2017? Let's explore this issue in today's material.

Are bank deposits subject to tax?

Let's say right away that for most deposit programs you do not need to pay personal income tax on bank deposits in 2017. Tax on bank deposits of individuals is charged only when the income limit established by law is exceeded.

In 2017, deposits are not characterized by high profitability - all banks were forced to lower rates due to an increase in DIA insurance rates. Opening a deposit under new conditions in 2017. You won't have to worry about taxes.

Which deposits are taxed in 2017:

If your income in percentage terms is higher than the key rate* + 5%, you must pay tax on the individual deposit. In 2017 (Q1), the key rate remains at 10%. This means that the tax-free deposit rate in 2017 is 15%.

*As amended by the law, the refinancing rate is + 5%, but for 2 years now this rate has been abolished (equated to the key rate of the Central Bank of the Russian Federation). Please note: the key rate is dynamic - it is set monthly by the Central Bank. In the 2nd quarter of 2017, the key rate is expected to decrease by approximately 0.5%.

How long have you seen a deposit with such a high yield - 15%? We dare to assume that you have never come across a deposit with a profit higher than 9.5-10%. But let’s assume the situation is that you have a prolonged deposit on the terms of 2013-2014. What then?

How is personal income tax measured on income on a deposit of more than 15%?

Income tax on interest on deposits in 2017 is 35%. It is accrued only if the yield exceeds the “key rate + 5%”. For example, if you earned 17% per annum from a deposit in one of the reporting periods, you will be calculated a tax on the “extra” 2%.

The reporting period is taken to be a calendar month. Even if you received 17% in one month, and 5% in all others, you are required to pay personal income tax! Banks report to the tax authorities for the profitability of deposits, so it will not be possible to hide income.

- 35% - for tax residents of the Russian Federation (clause 2);

- 30% - for foreigners and non-residents of our state, that is, those who stayed in the territory of our state for less than 183 days (clause 3).

Let's assume that banks offer the coveted 13% for open deposits. What then will be considered the taxable base (the amount on which tax is calculated)?

To determine it, we need the following indicators:

You may have noticed that the tax rate on deposits is extremely high. But it does not apply to all the income you receive.

The taxable part of the deposit is calculated using the formula: Bank interest rate - (Key rate of the Central Bank of the Russian Federation + 5%).

Thus, we reduce the income received by the maximum allowable profit, which is calculated based on the threshold determined by the state.

To clarify, let's look at an example:

The client opened an annual deposit in a Russian bank in the amount of 400,000 rubles. The interest on the deposit is 14%. The deposit does not provide for capitalization; accrued interest will be paid at the end of the year. The key rate of the Central Bank at the time of opening a deposit is 8.5%.

- First, let's find out whether you need to pay tax: 8.5 + 5 = 13.5%. Profitability exceeds the threshold.

- We determine the taxable part of the deposit: 16 - (8.5 + 5) = 2.5%.

- When you replenish the deposit, the taxable amount increases, which entails an increase in the amount of the final tax payment.

- If interest is gradated or increases as the deposit is replenished, tax will begin to accrue at the moment the yield exceeds the required standard (key rate + 5%).

- If the deposit agreement is terminated early and personal income tax has already been paid, you can return the funds transferred to the budget. But this is only possible in a banking institution that provides for the recalculation of tariffs in favor of reducing interest.

(200 thousand + 11.96 thousand)

(200 thousand + 14.176 thousand)

($5,515)

(5 thousand * 57 + 29,335)

(182 days)

(182 days)

(365 days)

part of the deposit

(15 - (7,75 + 5))

(11 - 9)

(200 thousand * 2.25% * 182 / 365)

(5 thousand * 2%)

(2.24 thousand * 35%)

($35)

(100 * 35% * 57 RUR¹)

before tax

(200 thousand * 12% * 182 / 365)

(200 thousand * 15% * 182 / 365)

($550)

(5 thousand * 11% * 57 rub.)

after tax

(14.96 thousand - 784)

($515)

(31.35 thousand - 1995 rub.)

It is important to understand that tax on bank deposits is accrued at the time of interest payment. That is, if you opened a time deposit for a period of one month, then when you receive income, your tax payment will be deducted.

Deposits with capitalization (when accrued interest is added to the principal amount of the deposit) complicate the tax calculation process.

The theory of its calculation boils down to the following:

Important! Tax on deposits is not charged if at the time of opening or renewal of the deposit, a non-taxable rate was in effect (Central Bank Tax Code + 5%). In this case, the following conditions must be met:

- less than three years have passed since the interest exceeded the non-taxable rate;

- Bank interest remained at the same level.

3. The procedure for making tax payments to the budget of the Russian Federation.

Let’s imagine a situation where deposit rates began to exceed the standard under Article 214.1 of the Tax Code of the Russian Federation. How then to pay the legal tax on contributions to the budget of our state?

You don't need to do anything yourself. The bank, acting as a tax agent, handles the accrual and payment from start to finish.

The actions of banking institution specialists are as follows:

- prepare lists of clients who have opened deposits;

- the interest rate is assessed every month (if it is floating or increases as the deposit is kept);

- if the deposit rate is exceeded, the amount of tax payable is calculated;

- prepare and submit tax reports (certificates and personal income tax declarations);

- transfer accrued taxes to the treasury;

- upon request, provide all the necessary information on the calculation and payment of personal income tax to the client.

Important! When paying taxes, bank secrecy is observed. Only information about the calculation and transfer of tax payments is submitted to the tax office. The amount of your savings does not appear in the reporting documents.

The tax transfer system is fully automatic. You do not have the right to make tax payments yourself; your powers are limited only to finding out the total amount to be paid.

If you closed the deposit agreement ahead of schedule, but the interest tax has already been paid, then you should not lose your money. To do this, you need to contact bank specialists who will issue you a 2-NDFL certificate for a tax deduction. With it you go to the local branch of the Federal Tax Service with an application for a refund of the funds paid.

Features of taxation of deposits in Russia.

What taxes should Russians pay, if any?

term deposit in Russia and abroad? Tax payment procedure.

Tax on deposits in foreign banks

Not every citizen of the Russian Federation can boast of a deposit opened in a foreign bank. Lack of awareness on this issue can lead to trouble. Therefore, before opening a savings account abroad, you need to know what you are doing.

- To begin with, you should know that a foreign banking institution is not a tax agent of the Russian Federation, therefore all reporting and payment of tax payments falls on your shoulders.

- For concealing the movement of funds and income received from a deposit in a foreign bank, you will have to bear responsibility - pay a fine.

- The tax is calculated as 13% of the income received (i.e. accrued interest). 35% concerns only deposits in Russian banks.

- Income is calculated at the current exchange rate on the date interest is received.

- You must submit reports at the Federal Tax Service office at your place of residence. This must be done before April 30 of the following year after receiving income. By the way, please note: if you pay the tax but do not submit the declaration, then after the expiration of the period provided for this, you will be charged a fine and penalty.

- If a double tax treaty is in effect, you will be subject to tax paid to the state in which you opened the deposit account.

If you do not pay tax, but the Federal Tax Service finds out about this, then you face a fine of 20% of the unpaid amount. In some cases it can reach 40%. Therefore, you should not think that the tax service does not have information about the accounts of Russian citizens abroad. Banking secrecy concerns only the protection of information from third parties.

And it is now impossible to hide your accounts in foreign banks. This year Russia joins the agreement on the international automatic exchange of information. Now the Russian government has access to data on accounts opened by Russians in foreign banks. Believe me, the movement of funds on them and the accrual of interest will certainly be of interest to tax inspectors.

At the moment, Russian citizens are not subject to tax on bank deposits. But it won't always be like this. Legislation is constantly changing, and more and more often officials are talking about the abolition of the regulatory rate and the need to tax all deposits.

| Video (click to play). |

The tax on deposits has slightly undermined public confidence in banks. But that as soon as citizens understand how the system works, they will again take their savings to the bank.

Let us remind you that from April 1, 2016, the agreement signed on November 11, 2015 by the President of the Republic of Belarus comes into force Decree No. 7“On attracting funds to deposits (deposits).” According to the document, when opening a deposit from April 1, income on it is taxed if the funds are placed for less than 1 year in Belarusian rubles or for less than 2 years in foreign currency.

As it turned out, both ordinary citizens and professional economists did not fully understand the scheme of the decree. A reader contacted the Minsk-News agency: the National Bank told him one thing, but his bank told him the opposite. Since the Ministry of Taxes and Duties is responsible for the tax on income from deposits, we turned there to get accurate answers to readers’ questions.

“I made a deposit on March 21, that is, before decree No. 7 came into effect. I will receive interest on the deposit after the decree comes into force. Do I have to pay tax on the interest received?

Anna Zakharovna"

If you made a contribution before April 1, 2016, then the interest received on it is not taxable.

The provisions of Decree No. 7 on the taxation of income in the form of interest on bank deposits, as well as current accounts, come into force on April 1, 2016 and will apply to agreements concluded from that date. If a bank deposit agreement was concluded before April 1, 2016, then interest received on such a deposit is exempt from income tax.

The exception is cases of contract extensions.

Example. Let’s assume that on March 21, 2016, you entered into a bank deposit agreement for 20 million rubles for a period of three months. The agreement provides for monthly interest payments: April 21, May 21, June 21, 2016. Interest received on such a deposit is exempt from income tax, since the bank deposit agreement was concluded before April 1 of the current year.

If such a contract is extended for another three months, then all interest earned during the next three months will be subject to tax.

“Decree No. 7 says that if Belarusian rubles are on deposit for 1 year, then the interest on it is not taxed. I want to open a deposit in Belarusian rubles for a period of 1 year and replenish it every month. Did I understand correctly that if I withdraw all the money exactly one year after opening the deposit, I will still have to pay some kind of tax?

Minsk resident»

“I opened a deposit in Belarusian rubles for a period of 1 year. If I withdraw money earlier, will I have to pay tax, since the deposit, as required, is open for the required period?

Sergey Vasilevich"

If you replenish a deposit, then the income received for an additional contribution is taxed provided that the money from the moment of replenishing the deposit has been in the account for less than 1 year - for deposits in Belarusian rubles or less than 2 years - for deposits in foreign currency. If you open a deposit, for example, in Belarusian rubles for a year and then replenish it, then if you decide to withdraw all the money exactly one year after opening the deposit, you will have to pay tax on the income received for additional contributions, since it has passed since the moment of replenishing the deposit and withdrawing money less than 1 year.

Interest on deposits is not subject to tax if the period of actual placement of funds on such a deposit is 1 year or more in Belarusian rubles, 2 years or more in foreign currency. If you open a deposit in Belarusian rubles for a period of 1 year or in foreign currency for a period of 2 years and the money is actually in the account for less time, as happens with early withdrawal, you will have to pay tax.

Example. On April 1, 2016, you, as an individual, entered into a bank deposit agreement for a period of one year, until April 1, 2017, in the amount of 10 million rubles. Interest accrued on 10 million rubles is exempt from income tax. And on May 1, 2016, you replenish your deposit by 2 million rubles. Since May 1, 2016 is considered the date of depositing 2 million rubles into the deposit and the period of their actual placement on the deposit will be less than one year, the interest accrued by the bank on the amount of such additional contribution is taxable.

“How is the tax calculated if I decide to withdraw part of the money from the deposit early?

Ivan Ivanovich"

Let's continue to consider the example of opening a deposit for 10 million Belarusian rubles (the date of depositing money is April 1, 2016) and replenishing it with 2 million rubles (the date of replenishment is May 1, 2016).

Exactly six months after opening the deposit, you want to withdraw funds in the amount of no more than 2 million rubles. In such a situation, it will be considered that you are withdrawing money from the funds that have been on the deposit for the shortest period, that is, from the amount of the additional contribution in the amount of 2 million rubles, which were deposited on the deposit on May 1, 2016.

If the interest accrued for the period from May 1, 2016 to September 1, 2016 on the amount of the additional contribution was previously paid to you, then income tax was already withheld from it.

If you want to withdraw bó a larger amount, for example, 5 million rubles, then the withdrawn amount will consist of funds from the additional contribution and funds deposited on April 1, 2016 when opening the deposit.

Please note that interest accrued on the amount of the additional contribution and part of the funds withdrawn from the amount of the main deposit placed on April 1, 2016 are subject to taxation, since the actual period of placement of such funds on the deposit was less than one year.

For information

You will have to pay tax on income from the deposit if all of the following conditions are met:

– you open a deposit in Belarusian rubles for a period of less than 1 year, in foreign currency – for less than 2 years. Or you withdraw money ahead of schedule and Belarusian rubles have been in the account for less than 1 year or foreign currency for less than 2 years. If you replenish your deposit, the day of replenishment will be considered the first day of depositing funds. And so on every time you deposit the next amount;

– if your interest rate is higher than the interest rate on a bank demand deposit (they usually have the lowest interest rate).

The deposit holder will not have to go anywhere or fill out any documents to pay the tax. The bank itself will withdraw the required amount from your account and transfer it to the tax office. The tax is 13% per annum. If the deposit is in foreign currency, then on the day the income is received, this income will be recalculated at the National Bank rate.

Then Belarusians will only have to think about paying taxes on interest income in the spring. But here, as in the well-known proverb, prepare the sleigh in the summer, and in the winter... but what will happen in the winter, one can only guess. But for now, let’s figure out what’s going on with taxes.

Cool you got it

Decree No. 7 will cover not only income from deposits opened after April 1, 2016 (don’t flatter yourself!), but also all interest accrued after that date. That is, those who wanted to be conscientious investors and chose at the end of October, alas, will receive less than they planned. The amount of interest income will be recalculated on the date of receipt of income into Belarusian rubles and will be the taxable base.

I'm glad that double taxation will not occur, since even if an individual has to pay 13%, it will only be on the amount of accrued interest, and not on the deposit itself. The tax agent will be the bank, which means clients will not have to collect papers and fill out declarations.

Speaking about the taxation of interest on short deposits at a meeting with representatives of the media First Deputy Chairman of the Board of the National Bank Taras Nadolny emphasized that this practice is worldwide. According to him, in Belarus there will be a certain unification of the tax regimes of individuals and legal entities, the latter, by the way, paid tax before.

- In our opinion, the new norms will stimulate long-term savings,- explained the National Bank. - For deposits for a period of more than 1 year in rubles and for a period of more than 2 years in foreign currency, the current benefits will be maintained.

Rich parasites will save on taxes

It turned out that those who are forced to pay a tax on parasitism can benefit from a tax on deposits. If you understand the issue, then citizens who do not participate in the financing of government spending are required to pay the last tax. If you sold your apartment, put all the funds in the bank at interest and decided to go on an undeserved vacation, then you have every chance of not paying the tax on parasitism. Here we present trivial calculations.

In order for an official unemployed person to be exempt from paying the “laziness” tax, he must transfer to the budget at least 20 basic units or 3,600,000 rubles per year. In order for our potential unemployed person to be able to deduct such a tax on interest income after placing a deposit for up to 1 year, he needs to place about 110 million rubles in the bank at 25% per annum without taking into account capitalization. For larger amounts, we would recommend wealthy parasites to open deposits for a period of more than a year, so as not to accidentally exceed the budget replenishment plan.

Russia will catch up with us

If recently Russians were studying Belarusian deposits for profitability, then after the signing of Decree No. 7, Russian banks can compete with their Belarusian colleagues, since income tax in the Russian Federation is paid only if the deposit has a rate that exceeds the key rate of the Central Bank by 10%. That is, a Russian bank must offer the client at least 18.25% per annum in rubles in order to bring him under the monastery. Russian banks, as practice shows, take care of their depositors and do not offer more than 10-11%. In Belarus, in order to be subject to taxation, it is enough to receive more than 3% per annum on a ruble deposit, and more than 0.2% per annum on a foreign currency deposit.

- In fact, the issue of taxation of interest on deposits is being vigorously discussed in Russia, but the scale of the country and the prevailing conditions today do not allow us to make the necessary decision,- said Taras Nadolny. - I am sure that Russia will also come to this decision, we will interne and there will be common approaches.

In the meantime, all the conditions for healthy competition will be in place and the Belarusian market will be forced to offer something to its participants in order to prevent an outflow from happening.