IP simplified 6 percent what taxes to pay. Peculiarities of paying individual entrepreneur tax under simplified conditions. The deadline for payment of contributions for injuries may change

The simplified tax system for income in 2019 in terms of the basic rules of application is almost no different from the order of previous years. But there is still one important change. In the article we will tell you what this change is and consider in more detail the general rules for simplified taxation system for income - 2019.

How to switch to a simplified tax system at a rate of 6%

The application of the simplified taxation system for income of 6% (this is its basic rate, which in the regions can be reduced to 1%) requires taxpayers to comply with a number of restrictions (Article 346.12 of the Tax Code of the Russian Federation):

- number of employees - no more than 100;

- carrying out activities that do not fall into the list of its types that make the use of the simplified tax system impossible;

- residual value of fixed assets - no more than 150 million rubles;

Does this requirement apply to individual entrepreneurs, see.

- share of participation in the legal entity of other legal entities - no more than 25%;

- the legal entity does not have branches;

- total income for the entire current year is no more than 150 million rubles. (Clause 4 of Article 346.13 of the Tax Code of the Russian Federation), and if we are talking about the transition to the simplified tax system from next year - no more than 112.5 million rubles. for 9 months of the current year.

Read more about the application of established income limits in the article “Revenue restrictions under the simplified tax system in 2018-2019” .

The conditions for starting to use the simplified tax system “income” of 6% are quite simple. If the above criteria are met, it is enough to inform the tax office about the transition to the simplified simplified tax system “income”.

When calculating tax under the simplified tax system of 6 percent, taxable income is determined according to the norms of Chapter. 25 of the Tax Code of the Russian Federation (Articles 249 and 250). Taxable transactions do not include those listed in Art. 251 of the Tax Code of the Russian Federation, as well as transactions subject to income tax for legal entities and personal income tax for individual entrepreneurs.

The amount of tax accrued on income received may be reduced by the amount of insurance premiums paid by the taxpayer. However, if the simplifier has hired employees, in this way the tax can be reduced by no more than 2 times (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation).

Features of the simplified tax system “income” 6% in 2019

In terms of general principles of taxation, nothing distinguishes the simplified taxation system (6 percent) in 2019 from the simplified taxation system of 2017-2018.

The key change in 2019 is the transition of most simplifiers to paying insurance premiums at general rates. This change affected not only the simplified tax system of 6%, but also the income-expense simplification with a rate of 15%. Reduced tariffs remained only for a small number of simplified tax payers.

simplified tax system 6% and property tax

The application of the simplified taxation system of 6% does not exempt the taxpayer from paying property tax in relation to those real estate objects whose base value is determined as cadastral. For individual entrepreneurs, property used in business activities will be taxable.

Such facilities, in particular, include offices (business centers or premises in them), shopping or administrative centers, as well as premises for the placement of public catering facilities or the provision of personal services to the population.

IP on simplified tax system 6%

Simplified taxation at a rate of 6% is applied by individual entrepreneurs on the same basis as other taxpayers (Article 346.12 of the Tax Code).

The exception is that for individual entrepreneurs there is no limit on the amount of income received for 9 months of the year for switching to the simplified tax system from the next tax period (letter of the Ministry of Finance dated March 1, 2013 No. 03-11-09/6114). However, it is necessary to meet the total limit of permissible income for the year.

For individual entrepreneurs, there is also a limitation on the number of employees (there cannot be more than 100) and the residual value of fixed assets (letters of the Ministry of Finance of Russia dated January 20, 2016 No. 03-11-11/1656, dated March 27, 2015 No. 03-11-12/ 16911, dated 02/13/2015 No. 03-11-12/6555, dated 09/19/2014 No. 03-11-06/2/47029, dated 08/14/2013 No. 03-11-11/32974, Federal Tax Service dated 10/19/2018 No. SD -3-3/7457).

Those entrepreneurs who are engaged in the extraction and marketing of minerals (except for those that are widespread), manufacture excisable products, or have chosen a single agricultural tax are deprived of the right to take advantage of the simplified taxation system.

Also, those individual entrepreneurs who have not notified the tax authorities about the transition to a simplified tax system in accordance with the established paragraphs do not have the right to use the simplified tax system. 1 and 2 tbsp. 346.13 Tax Code of the Russian Federation deadlines.

Read about the procedure for notifying tax authorities when switching to the simplified tax system. “Application for transition to the simplified tax system in 2018-2019 (sample)” .

simplified tax system 15% or simplified tax 6% - what to choose?

It is always quite difficult for newly registered taxpayers to figure out what is more profitable - a simplified 6% or 15%? In most cases, the choice of taxation object is dictated by what turnover the simplifier will have and what types of activities he plans to engage in.

If the share of expenses for activities on the simplified tax system is significant, it is more profitable to choose the object “income minus expenses” with a rate of 15%, otherwise it is more reasonable to pay tax on income at a rate of 6%.

The place of doing business is also important, because many constituent entities of the Russian Federation establish preferential conditions for simplifiers, reducing taxes for certain categories of taxpayers (or for specific types of activities).

For more information on how the simplified tax system is calculated for the object “income”, read the article “The procedure for calculating tax according to the simplified tax system “income” in 2018-2019 (6%)” .

Results

The rules for applying the simplified tax system with the object “income” in 2019 generally correspond to those applied in 2017-2018. Only the procedure for calculating insurance premiums has changed. Other requirements limiting the use of the simplified tax regime with a basic rate of 6% remained unchanged.

The simplified taxation system is one of the special tax regimes, implying a special procedure for paying taxes and intended for small and medium-sized businesses. Under the simplified tax system, it is possible to choose the object of taxation: “income” or “income minus expenses” (Article 346.14 of the Tax Code of the Russian Federation). In our consultation, we will focus on the simplified tax system “income” (6 percent).

Simplified 6%

With a simplified tax system of 6%, the object of taxation is “income”. Depending on the region, the tax rate can be reduced from 6 to 1 percent (clause 1 of Article 346.20 of the Tax Code of the Russian Federation). At the simplified tax system of 6 percent, expenses incurred are not taken into account when determining the tax base (clause 1 of article 346.18 of the Tax Code of the Russian Federation).

When determining the amount of income, sales revenue is taken into account, determined on the basis of all receipts for products sold (services provided), as well as non-operating income listed in Art. 250 of the Tax Code of the Russian Federation (Article 248, Article 249, clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Taxable income does not include the income listed in Art. 251 of the Tax Code of the Russian Federation, as well as income subject to income tax (for organizations) and personal income tax (for individual entrepreneurs) (clause 1.1 of Article 346.15 of the Tax Code of the Russian Federation).

The cash method is used to calculate the tax base. In this case, the date the simplifier receives income is the day the money is credited to a bank account or received at the cash desk, or other property is received (Clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

The calculated amount of tax is allowed to be reduced by insurance premiums, temporary disability benefits at the expense of the employer and payments under voluntary personal insurance contracts concluded in favor of employees in case of illness (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). At the same time, organizations and entrepreneurs with hired employees have the right to reduce the amount of tax on these expenses by no more than 50%. Individual entrepreneurs on the simplified tax system of 6% without employees have the right to reduce the amount of tax on insurance premiums paid for themselves in full (clause 3.1 of article 346.21 of the Tax Code of the Russian Federation).

Simplified 6 percent for individual entrepreneurs 2019

In 2019, a simplified taxation system (6 percent) for individual entrepreneurs will simplify accounting, since tax accounting is maintained only in KUDiR (Article 346.24 of the Tax Code of the Russian Federation, Order of the Ministry of Finance of Russia dated October 22, 2012 N 135n). Namely, the book reflects the income received. Also, the simplified tax system of 6 percent for individual entrepreneurs significantly minimizes the tax burden, since the use of the simplified tax system exempts the entrepreneur from paying personal income tax, personal property tax and VAT in accordance with the provisions of clause 3 of Art. 346.11 Tax Code of the Russian Federation.

The transition of an individual entrepreneur to the simplified tax system is possible if the following conditions are met:

- number of personnel - no more than 100 employees (subclause 15, clause 3, article 346.12 of the Tax Code of the Russian Federation);

- residual value of fixed assets - no more than 150 million rubles. (subparagraph 16, paragraph 3, article 346.12, paragraph 4, article 346.13 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated October 19, 2018 N SD-3-3/7457, Letter of the Ministry of Finance of the Russian Federation dated June 15, 2017 N 03-11-11/ 37040, Letter of the Ministry of Finance of Russia dated January 20, 2016 N 03-11-11/1656);

- activities are carried out in which the use of the simplified tax system is permissible (subclause 2-10,21 clause 3 of article 346.12 of the Tax Code of the Russian Federation);

- The unified agricultural tax does not apply (subclause 13, clause 3, article 346.12 of the Tax Code of the Russian Federation).

About the restrictions on the application of the simplified tax system (6 percent) in 2019, violating which the right to simplification is lost, read in.

Entrepreneurs and organizations switching to a simplified taxation system are primarily interested in the question of which is better: simplified tax system 6 or 15%? After all, the selected rate cannot be changed until the end of the year. And the tax base and the amount of deductions depend on it. Therefore, when choosing an option, you need to weigh everything carefully.

Feature of simplified tax system 6%

For the “income” object, tax is paid at a rate of 6% on all financial receipts, including non-operating income, regardless of the amount of expenses in the reporting period. Accounting is carried out using the cash method.

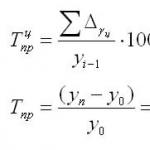

The advance payment is calculated based on the results of the quarter. The formula for determining tax is:

Tax = Income x 6%

Advantage

Businessmen on the simplified tax system with employees can reduce tax due to paid insurance premiums, temporary disability benefits (except for occupational diseases), and voluntary insurance. These costs can reduce the simplified tax by a maximum of half.

When there are no employees, the amount is reduced due to insurance contributions for oneself to the Pension Fund and federal health insurance.

EXAMPLE

The individual entrepreneur operates without employees. For 2016, income amounted to 500,000 rubles. Then the tax on the simplified tax system is 6% - 30,000 rubles. The contributions that the merchant made for himself in 2016 amounted to 28,633.5 rubles. As a result, the amount of simplified tax payable is 1,366.5 rubles.

Flaw

When calculating tax, in general, only income is taken into account. But in practice, the amount of costs is not always regular and sometimes exceeds planned limits and expectations. If this happens frequently, the use of the simplified tax system of 6% will result in losses.

Features of simplified tax system 15%

Simplified people who have chosen a rate of 15% make a payment from the difference between income and costs (from profit). The formula for calculation is:

Tax = (Income - Expenses) x 15%

When determining the tax base, costs are included in it if:

- necessary for the operation of the enterprise;

- mentioned in the Tax Code of the Russian Federation (Article 346.16);

- paid, which is documented (there are cash receipts, bank account statements, payment orders, etc.);

- actually took place and this fact is evidenced by invoices, acts of receipt of services, etc.

Advantage

Flaw

Some expenses incurred are confirmed by two types of documents: for their payment and for the receipt of their subject for further actions. In the absence of one of them, it is impossible to count on a reduction in the tax base. Often, evidence cannot only be a receipt, BSO, contract or invoice.

Which simplified tax system is better to choose: 6 or 15%

When costs are usually absent or permanently insignificant, it is advisable to use the simplified tax system of 6%. It is beneficial to use this rate for organizations and individual entrepreneurs whose expenses do not exceed 60% of income. And taxation at a rate of 15% is more beneficial for a business that has a low level of profitability and small markups.

EXAMPLE

The Cosmos company received an income of 120,000 rubles for the quarter. Expenses amounted to 80,000 rubles. The tax amount will be:

- on simplified tax system 6%: 120,000 x 6% = 7,200 rubles.

- on the simplified tax system 15%: (120,000 – 80,000) x 15% = 6,000 rubles.

If expenses increase to 87,000 rubles. deductions under the simplified tax system of 15% will amount to 4950 rubles, then it is more profitable to use - income minus costs. But if costs decrease to 68,000 rubles, the company is obliged to pay 7,800 rubles. This means that it is better for her to choose the simplified tax system of 6%.

It is worth remembering about deductible amounts that can reduce payments to the budget. They cannot be more than half of the simplified tax using the simplified tax system of 6%. And the object of taxation “income minus costs” is beneficial to individual entrepreneurs and organizations if the following equality is true:

(Income-Expenses) x 15%

Give a clear answer right away which is better: simplified tax system 6 or 15%, sometimes difficult. A simplifier should carefully calculate the amount of his expenses: how large it is and whether a deviation from the norm and expectations is possible. This is the only way to make the right decision on the method of taxation.

USN, UTII, OSNO, Unified Agricultural Tax, PSN - for some these abbreviations mean nothing, but for entrepreneurs they indicate the tax burden. Absolutely all taxpayers can work according to the general scheme. But in Russia OSNO is the most burdened - both financially and administratively. Small businesses more often choose preferential tax regimes, which allow start-up businesses to develop in gentle conditions. In this article we will talk about the simplified tax system (6%).

The essence of the scheme

The simplified tax system is the most popular among small businesses. Its attractiveness is explained by its low load and relative ease of record keeping. Entrepreneurs who choose this regime are exempt from paying VAT and property tax and transfer only a single tax. The procedure for using the scheme is explained in Chapter. 26 of the Tax Code of the Russian Federation.

The right to apply the simplified tax system (6 percent) is granted to organizations without branches with an average annual number of up to 100 people and an income for 9 months of less than 45 million rubles. The residual value of the fixed assets cannot exceed 100 million rubles. Taxpayers can independently choose the base for calculations: simplified tax system 6%, tax reduction due to expenses.

“Simplified” cannot be used by the following organizations:

- banks, investment funds, insurers;

- budgetary institutions;

- foreign companies;

- providing legal and notary services;

- involved in gambling.

Also, individual entrepreneurs who:

- manufacture excisable goods;

- are engaged in the extraction and sale of minerals;

- are located at the Unified Agricultural Tax;

- did not inform about their transfer in a timely manner.

The tax base is determined on an accrual basis, that is, income and expenses are calculated from the beginning of the year. The declaration is submitted once a year, and the tax is paid quarterly: advances are paid for reporting periods, and the balance of the amount is paid at the end of the year.

Advantages of the simplified tax system (6%)

There are not so few of them:

- reduction of tax payments;

- filing a declaration once a year;

- the ability to reduce the tax base;

- exemption from VAT, personal income tax;

- the ability to independently choose the tax base;

- availability of preferential rates;

- simplified accounting.

Disadvantages of the simplified tax system

- Restrictions on types of activities. Financial institutions, notaries and lawyers, non-state pension funds and other organizations listed in Art. 346 Tax Code of the Russian Federation.

- There is no possibility to open representative offices. This factor can become an obstacle for companies that are planning to expand their business.

- Limited list of expenses for the second scheme.

- No obligation to prepare invoices. On the one hand, this saves time on paperwork. On the other hand, it may become an obstacle for counterparties who pay VAT. They will not be able to claim the tax for refund.

- The inability to reduce the basis for losses incurred during the period of using the simplified tax system when switching to other modes, and vice versa.

- Under the second scheme, tax will have to be paid even if the company incurred losses during the reporting period.

- In case of violation of regulations, the right to use the simplified tax system is lost.

- Reducing the basis due to advances that in the future may turn out to be erroneously credited amounts.

- Preparation of reports upon liquidation of an organization.

- In the case of selling fixed assets purchased during the period of using the simplified tax system, the tax base will have to be recalculated, an additional fee and a penalty will have to be paid.

How to go?

For newly created individual entrepreneurs, the procedure is as follows. Submit an application in Form No. 26.2 simultaneously with the package of documents for state registration. Individual entrepreneurs transfer documents at their place of residence, LLCs – at their location. If an application to use the simplified tax system (6%) is not submitted within 30 days after state registration, the taxpayer automatically switches to the general system. Operating enterprises must submit an application by December 31. If all parameters (number of employees, volume of income, cost of operating systems) are met, there will be no problems with the transition to the “simplified system”.

First scheme: simplified tax system (income 6%)

The tax base (income) is multiplied by 6%. Advances already transferred for the year are deducted from the result obtained. Due to insurance premiums paid to employee benefits (the first three days of sick leave), individual entrepreneurs can reduce the amount of tax by a maximum of half. This scheme is more attractive for entrepreneurs who have hired employees.

An important nuance. The base can be reduced only by advances accrued and paid by the time of settlement. That is, if contributions for December 2015 are transferred in January 2016, they will reduce the amount of the collection for the previous period. They will not affect the 2016 tax in any way.

Examples

The tax base for 9 months of work amounted to 1.45 million rubles. For the first half of the year, insurance premiums were transferred in the amount of 35 thousand rubles, advances for individual entrepreneurs (USN 6%) - 40 thousand rubles.

Base: 1.45 x 0.06 = 0.87 million rubles.

Due to insurance contributions, the tax amount can be reduced by: 87 x 0.5 = 43.5 thousand rubles.

This figure is less than the amount of contributions, so they are taken into account in full.

Tax payable: 87 – 35 – 40 = 12 thousand rubles.

Let's change the conditions of the previous problem. Let the amount of insurance premiums transferred for employees be 55 thousand rubles, disability benefits - 4 thousand rubles, advances - 45 thousand rubles.

The amount of contributions and benefits is greater than the limit, so only 43 thousand rubles will be taken into account.

Tax payable: 87 – 43.5 – 45 = - 1.5 thousand rubles.

There is an overpayment. Accordingly, nothing needs to be transferred to the budget for the current period.

Second scheme: reducing costs

Expenses are subtracted from income, then the amount is multiplied by 15%. Regional regulations may reduce the tax rate to 5%. For example, in St. Petersburg, all individual entrepreneurs pay the simplified tax system at a rate of 10%, and in the Moscow region - only those employed in the field of crop production. If the profit is zero or a loss is received, then there is no need to pay advances for the quarter. If the amount collected for the year is less than 1% of income, then you need to pay a minimum tax of 1% of income.

Expenses may include costs for the purchase of materials, fixed assets, creation of intangible assets, wages, insurance premiums, etc. All of them must be economically justified and supported by documents. An entrepreneur must keep a “Book of Income and Expenses” and reflect in it the fact of purchase or provision of services.

Examples

The company's income for the year is 4 million rubles, expenses - 3.5 million rubles, advance payments for 9 months - 45 thousand rubles.

1) 4 – 3.5 = 0.5 x 0.15 = 0.075 million rubles. – tax amount;

The tax amount is greater than the minimum payment. You should pay to the budget: 75 – 45 = 30 thousand rubles.

The enterprise's income for the year amounted to 4 million rubles, expenses - 3.8 million rubles, advance payments for 9 months - 45 thousand rubles. We count:

1) 4 - 3.8 = 0.2 x 0.15 = 0.03 million rubles. - tax amount;

2) 4 x 0.01 = 0.04 million rubles. – 1% of income.

The calculated tax amount is less than the minimum. You need to pay 40 thousand rubles to the budget.

This is how the simplified tax system is calculated (6%, 15%).

Object of Calculus

The entrepreneur must choose the taxation scheme himself. At the end of the year, individual entrepreneurs can write an application to change the type of simplified tax system. For entrepreneurs providing services who do not have large material expenses, it is more profitable to use the simplified tax system (6% income). Individual entrepreneurs engaged in trade or production should choose a scheme that reduces costs.

As for the interest rate, the key factor here is the profitability of the business. If the planned amount of expenses is 60% (or more) of income, it is more profitable to use the second scheme. At the same time, it is important to keep records correctly and have primary documents (with signatures and seals) confirming expenses.

Reporting

Individual entrepreneurs using the simplified tax system (6%) must know what data to submit to the tax office.

- Book of accounting of income and expenses (KUDiR).

- Declaration.

KUDiR is kept by the individual entrepreneur. It displays only income. At the end of the year, it is printed out, the pages numbered and stitched. Until April 30, 2016, a declaration under the simplified tax system is submitted to the Federal Tax Service. Contributions to extra-budgetary funds can be paid in two payments until December 31.

Deadlines

Individual entrepreneurs must pay taxes by the 25th day of the first month of the next quarter: 6% of the simplified tax system is repaid at the end of the year. Let's look at the tax calendar for the year:

04/01/16 - pay contributions to the funds (for the first quarter of 2016 and the balance for 2015);

04/25/16 - pay an advance to the Federal Tax Service (for the first quarter of 2016);

04/30/16 - transfer taxes from the simplified tax system to the funds (for 2015);

04/30/16 - submit a declaration for 2015 to the Federal Tax Service;

07/01/16 – transfer contributions (for the 2nd quarter);

07.25.16 - pay an advance to the Federal Tax Service (for six months);

01.10.16 - transfer contributions to the funds (for the third quarter);

10.25.16 - pay an advance to the Federal Tax Service (for the third quarter);

12/31/16 - transfer contributions (for the fourth quarter).

You only need to appear at the inspectorate once to submit a declaration under the simplified tax system.

Changes 2016

In the new year, income limits increased by 32.9%:

- 79.74 million rubles. - the maximum amount of income at which you can remain on the simplified tax system in 2016;

- 59.805 thousand rubles. the income limit that will be in effect in 2017;

- no more than 51,615 thousand rubles. Entrepreneurs must earn money in 9 months of 2015 in order to switch to the simplified tax system in 2016.

Amendments introduced by Federal Law No. 232 allow regions to reduce rates: from 6% to 1% for the first scheme and from 15 to 7.5% for the second.

From 01/01/16, small companies are exempt from non-tax audits. If an organization is included in the audit plan by mistake, it can exclude itself from the list. To do this, you need to write an application, attach certified copies of the report on financial results, information about the average headcount and submit a package of documents to the Rospotrebnadzor office.

For individual entrepreneurs in 2016, mandatory contributions to the Pension Fund and the Federal Migration Service remain. At the same time, the payment scheme itself to the Pension Fund and the Federal Migration Service has not changed.

If an individual entrepreneur has no employees, several changes need to be taken into account. Firstly, from January 1, 2016, the minimum wage (minimum wage) increased. Consequently, the contribution in terms of pension contributions and health insurance has also increased.

In the Pension Fund, the employee will pay for himself based on the minimum wage, which from January 1 is 6,204 rubles:

6204 rubles X 26% X 12 months = 19,356 rubles. 48 kopecks

Contributions to the FMS:

6204 rubles X 5.1% X 12 months = 3,796 rubles 85 kopecks.

Total per year an individual entrepreneur must pay:

RUB 19,356 48 kopecks + 3,796 rub. 85 kop. = 23,153 rub.

So, we see that the payment scheme itself has not changed. Only the contribution has increased due to an increase in the minimum wage.

In 2016, the rule remains that individual entrepreneurs must pay 1% on income over 300,000 rubles. in year. For example, if an entrepreneur received an income of 6 million, then from this amount he throws out 300,000 rubles and receives 5,700,000.

57,000 rub. + 23,153 rub. = 80,153 rub.

The amount of insurance premiums cannot exceed the amount determined as the product of eight times the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid:

RUB 6,204 X 8 months X 26% (PF rate for individual entrepreneurs) X 12 months = 154,851 rub.

Requirements and penalties

The requirements for individual entrepreneurs have become more stringent in case of failure to provide information regarding personal information. Registration in this case may be suspended for a period of 1 month. Moreover, if it turns out that a person previously had the status of an individual entrepreneur and conducted his activities in violation of the law, registration may be denied. Providing false information regarding the data of future individual entrepreneurs will be punishable by a fine of up to 10,000 rubles. Repeated provision of false data may result in denial of registration for up to 3 years.

If an individual entrepreneur with employees

From January 1, 2016, all tax agents-employers must submit Form 6-NDFL - quarterly calculation of calculated and withheld amounts of income tax for individual employees.

Also, for individual entrepreneurs with employees the following are required:

- average number of employees;

- reports to the Social Insurance Fund;

- reports to the Pension Fund;

- personal income tax report for employees.

In addition, standard reports are submitted depending on the taxation system on which the individual entrepreneur is located (simplified taxation, UTII, general taxation system, Unified Agricultural Tax).