What happens if you don't pay taxes for a long time? What happens if you don’t pay transport tax: possible scenarios, consequences. Punishment for non-payment of taxes

The service will calculate taxes and prepare reports for individual entrepreneurs, LLCs and employees. You can do it even if you don’t know anything about accounting.

Penalty size

The tax office itself calculates penalties, so you don’t have to waste your time on calculations. But it’s still useful to know why they require penalties from you and how they were calculated for you. This way you can estimate your expenses in advance if you suddenly missed a deadline, and you can even check the tax office.

Penalties are calculated for each day of delay - the longer you do not pay, the more penalties will be charged. If the amount of the debt and the duration of the delay are small, few penalties will be charged: 0.72% of the tax for the month of delay.

Sets the key rate Central Bank. Take into account the one that was valid during the period of delay. You can find it on the website of the Central Bank of the Russian Federation. From September 17, 2018, the key rate is 7.5%, and from December 17 - 7.75%.

Penalties begin to accrue the day after the deadline for payment expires, and end on the day you remit the tax. That is, for the day when you paid the debt amount, there will be no more penalties. This position is shared by the Ministry of Finance in a letter dated July 5, 2016 and the Tax Service in a letter dated December 6, 2017.

For example, October 25th is the last day to pay taxes, and you transferred the money only on October 29th. Penalties will be accrued for 3 days - October 26, 27 and 28.

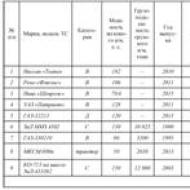

Calculation of penalties using an example

Until October 25, Nikita must pay an advance payment under the simplified tax system for 9 months—50 thousand rubles. But he waited for payment from the client and transferred the tax only on November 1. We will calculate penalties for 6 days of delay.

Let's look first key rate on the website of the Central Bank of the Russian Federation - since December it has been equal to 7.75%. Now let’s substitute everything we know into the formula:

7.75% / 300 * 50,000 * 6 days = 75 rubles.

This amount will have to be paid along with the tax amount.

In fact, few people count penalties manually. It is more convenient to use a calculator.

Penalty calculator

How to use the calculator

- Choose whether you are an individual entrepreneur or an organization.

- Indicate the amount of tax that was not paid on time.

- Specify the deadline for paying the tax. For example, for the simplified tax system for the 1st quarter of 2019, this is April 25.

- Indicate the day on which the tax was actually transferred.

- Do not include the day of payment as late - the tax office said this in a letter dated December 6, 2017.

Penalties for LLCs from October 1, 2017

Since October 1, penalties for LLCs for long delays have increased. If you do not pay tax for more than a month, then from the 31st day the penalties will become twice as large.

The World of Socks organization did not pay the simplified tax system for the 1st quarter of 2018 until April 25. And for 40 days now she has been in debt of 20 thousand rubles. Here is how penalties for this delay are calculated:

For 30 days of delay = 7.25%/300 x 20 thousand x 30 days = 145 rubles.

For 31-40 days of delay = 7.25%/150 x 20 thousand x 10 days = 96.67 rubles.

In total, for 40 days of delay, Mir Socks LLC will pay 241.67 rubles in penalties.

Nothing changes for individual entrepreneurs. Even after a month of delay, they pay 1/300 of the key rate.

Deadlines for paying penalties to the Federal Tax Service

Penalties are paid voluntarily or at the request of the tax office. Penalties on demand must be paid within 8 working days after receipt, unless the tax office has established a different deadline. For missing the deadline, the bank will block the amount of debt in the account.

You don’t have to wait for the request and pay the fines in advance. Calculate their size yourself or find out from the tax reconciliation.

How to pay penalties on individual entrepreneur taxes?

- First, find out if you have penalties: to do this, check with the tax office or register in your personal taxpayer account on the Federal Tax Service website.

- Prepare your payment on the tax website. Instructions for filling out are in the article “How to create a payment slip for the payment of penalties and fines.”

For LLCs the procedure is the same.

How will Elba help pay the fines?

Elba will prepare the payment automatically upon request from the tax office. Read the article how to do this.

To find out the amount of penalties, send a request for reconciliation with the tax office: section Reporting → Reconciliation with the tax office → Create a statement of transactions for settlements with the budget.

Tax inspector fines

Fine tax office may be charged in addition to penalties. But you won't be fined just because you missed a deadline. To impose a fine, you must incorrectly calculate the tax and underestimate it. This is explained by the Supreme Arbitration Court in paragraph 19 of the resolution.

- If you pay tax later than necessary, but in the correct amount, only penalties will be charged.

- If you underestimate the tax in your return and pay this amount, the tax office will charge additional taxes, penalties and fines.

The amount of the fine is fixed; it is charged not for days of delay, like penalties, but for the violation as a whole. The penalty for non-payment of tax is 20% of the debt amount if the tax was not underestimated on purpose, 40% if it was intentionally underestimated.

It is useful to remember about penalties and fines

- The tax office charges penalties if taxes and fees are not paid on time.

- Penalties are calculated for each calendar day of delay. The amount of penalties is approximately 10% per annum of the debt amount for an individual entrepreneur and about 20% for an LLC.

- From October 1, 2017, LLCs from 31 days of delay pay twice as many penalties as before.

- In addition to penalties, the tax office may charge a fine. But to do this, you need to calculate the tax incorrectly and show an underestimated amount in the declaration. For simply missing a deadline, you only face penalties.

Expenses today are growing uncontrollably, which, unfortunately, often cannot be said about income. In addition, the profits of citizens and their property are subject to a large number of taxes. Therefore, sometimes there may be a temptation not to pay the required amount for any item. This often concerns car owners. After all, they, as a rule, already have a large number of necessary expenses associated with maintaining their car, so they are also required to pay regularly transport tax. Some people cannot allocate such an amount from family budget. Many people ask the question: “What happens if you don’t pay transport tax for 7 years or more?” As part of our article, we will try to explain what the essence of this payment is and the dangers of trying to avoid paying under this obligation.

Liability for non-payment

Many car enthusiasts are interested in the question of what will happen if they do not pay transport tax. And in general, what are those funds subsequently spent on? cash, which were received after its payment? According to the legislation, these financial assets are used to develop road infrastructure, build new roads and regularly repair existing ones. Control over exactly how funds received from taxpayers are ultimately allocated is exercised by the authorities local government. However, a certain responsibility also lies with the tax service, which is responsible for the regular flow of money. Legislation Russian Federation is considering this tax as a mandatory payment.

What happens if you don't pay transport tax? Such a motorist will be considered a violator, because even incomplete or simply untimely payment may entail administrative or criminal liability.

What is taxed?

Owners of which vehicles are included in the group of persons obligated to pay the tax in question? This applies to the following objects: motorcycles, trucks, buses, snowmobiles, cars, buses, air transport.

Who should pay?

To answer this question, you need to have a good understanding of the principles by which the tax in question is calculated. And money is accrued directly based on the fact of owning a specific car, and not on the fact of using the vehicle. What does this mean? In other words, regardless of whether you personally drive your car or someone else, it sits in a garage without moving or is constantly used for its intended purpose, if you are the owner of the car, then paying the transport tax is your responsibility. These are the requirements of today's legislation.

What happens if you don’t pay the transport tax? We will look at the answer to this question later in this article.

Basis for payment of tax

What happens if you don't pay transport tax? Some, not wanting to either deposit money into the account or break the law, are trying to find legal ways avoid costs. To do this, such car owners seek to understand what is the basis for paying the tax. IN in this case it's personal tax notice. As a rule, the relevant services must send these types of documents at least a month before the established payment deadline. What if you haven't received any notifications? If you don’t pay the transport tax, what will happen in this case? The responsibility of the car owner is still not removed. The purpose of sending a notice is to notify the taxpayer of the amount claimed in advance so that he has the opportunity to appeal it if necessary. However, this document may arrive with a delay or not arrive at all. That is why there is the following recommendation: check the updated information on the Federal Tax Service website yourself, and from there print out a receipt, according to which you can pay the tax.

Consequences for individuals

What happens if you don’t pay transport tax at all? What consequences await individuals? The main thing is the accrual of penalties, which occurs from the very first day of delay. The mechanism for calculating it is designed in such a way that the amount that you will have to pay in the end will very soon significantly exceed the initially assessed tax.

The second type of sanctions is fines. So, if a car owner is behind on payments, he will have to pay an additional fine, which will be 20% of the debt amount. However, there is another scenario. If the competent authorities are able to prove that the motorist deliberately did not pay the required amount or deliberately reduced it, then the fine will increase to 40%.

After this, the debtor will have another six months to pay off his debt. If he does not do this, then the tax service has the right to take even more stringent measures to induce the taxpayer to make the payment. For example, they may be arrested and subsequently confiscated bank accounts the car owner and any of his property. Also, in agreement with certain services, the tax office can regularly withdraw the funds necessary to pay off the debt from wages individual. He may also be prohibited from leaving the territory of the Russian Federation until he pays off all his obligations.

Who is exempt from paying

Some groups of persons have the right not to pay the tax in question. If the car owner falls into one of the following categories, the requirement to pay transport tax does not apply to him:

- persons who were previously prisoners of fascist camps;

- those who were in the radiation zone of the Chernobyl nuclear power plant and have official documentary evidence of this;

- pensioners;

- a person whose vehicle is officially listed as stolen (subject to the provision of the relevant official police certificate to the tax service);

- people who, as officially recognized, have any special services to the Fatherland (this category usually includes holders of the Order of Glory, WWII veterans, heroes of the Russian Federation, heroes of the Soviet Union);

- guardian of a child who is disabled;

- disabled people who have the first or second disability group;

- car owners whose vehicle is equipped with an engine whose power is less than 70 horsepower;

- enterprise employees defense industry who were previously employed at various military facilities, especially during periods of nuclear weapons testing;

- persons who are officially participants in any hostilities;

- a parent whose family, in accordance with regional legislation, is recognized as having many children.

What happens if you do not pay transport tax for 2 years or more, but do not belong to any of the above categories of citizens? The sanctions described in the article will be applied to such a car owner.

What if the car was inherited?

Sometimes the vehicle that is subject to tax was not purchased directly by its current owner. For example, a car could be inherited. So, what will happen to the new owner if he does not pay transport tax? As current legislation states, any vehicle that has been inherited is considered as property from the moment it was registered with the relevant authorities in a specific name. Once all formalities have been completed, the new owner is expected to pay all applicable costs. What happens if you don’t pay transport tax? Such a car owner will be subject to the same sanctions as any other in a similar situation.

Consequences for legal entities

It is important to know that the requirements for legal entities in this regard are much more stringent than for individuals. For example, they must pay transport tax much earlier, namely before February 5 of the year following the reporting year. Moreover, legal entities are forced to regularly make certain advance payments, unlike individuals, for whom a full one-time payment is sufficient.

What happens if you don't pay transport tax? After three years, as in the case of individuals, the statute of limitations will expire. However, until this point, many sanctions will be applied to the legal entity. For example, penalties will necessarily be assessed and appropriate fines will be levied. A specific deadline for the final payment of all obligations has been determined - six months. If this does not happen, the tax service receives legal right go to court to recover the required amount from the debtor. The basis for such a claim becomes just one order from the head of the Federal Tax Service of the Russian Federation. Within six days from the moment the Federal Tax Service begins to move on the case, the debtor will receive a corresponding notification. What court decision can be made in such a case? The property of such a legal entity may be seized. If an organization deliberately indicated false information in its declaration, then administrative or even criminal liability.

Collection

The tax service has been granted the broadest powers by current legislation of the Russian Federation with respect to the collection of the tax in question from debtors. In addition to what has already been discussed earlier in this article, today it is planned to carry out tax audits, as well as the direct transfer of all available data about the defaulter from the mentioned department to the Ministry of Internal Affairs. However, not every debtor should fear this. As a rule, this happens in cases where there is reason to suspect the defaulter of hiding or laundering income.

Now you have complete information regarding what will happen if you do not pay transport tax.

Statute of limitations

Like other payments of a similar format, this tax has a certain statute of limitations. In our case it is three years. If within specified period Since no measures of responsibility were applied to the debtor, then in the future any attempts at collection will be considered illegal by the current legislation of the Russian Federation. This means that the most desperate non-payers can be pleased with the answer to the question: “What happens if you don’t pay transport tax for 3 years?” After all, after this period of time no claims can be brought against the debtor.

Conclusion

So, paying transport tax is a mandatory requirement for all vehicle owners. An attempt to avoid settlement of obligations may be equated to an administrative or even criminal offense, depending on the surrounding circumstances. It would be reasonable to pay transport tax regularly, subject to the requirements of current legislation of the Russian Federation. This will save car owners from numerous problems.

Every law-abiding citizen of Russia must understand what to pay state taxes it is necessary at the tax service, because it says so current legislation our country. What will happen to the violator if he does not pay taxes and what consequences of this violation are expected, we will analyze further in the article.

To pay or not to pay taxes

Because economic situation in our country it is quite complicated, many citizens are thinking about whether or not to pay taxes to the state treasury. Moreover, they are looking for an answer to this question:

- pensioners;

- disabled people;

- working and temporarily unemployed citizens;

- entrepreneurs who decide to open an individual entrepreneur;

- founders of companies and LLCs;

- individuals.

This is not at all surprising, since the financial situation of our compatriots currently cannot be called stable. But it is worth considering that if Pension fund If tax payments do not arrive on time, then in the future you will still have to spend your cash savings, and the amounts of payments will be much larger. After all, if the payment is not made on time, the violator will be fined and in the future he will face other penalties if the fact of the violation is not eradicated.

To avoid such a situation, you first need to know what taxes you need to pay and how long you need to invest.

How does the tax office find out about income?

Many citizens are interested in how the tax office works and how does it find out about income if a person is not registered as a legal entity or individual entrepreneur and the person has not come to the tax office to fill out a declaration at all? The answer to this question is quite simple - the tax service receives information about income from banking institutions, and almost all citizens, without exception, use the services of banks:

- current account in financial institution opened by persons registered as individual entrepreneurs or when opening an LLC;

- freelancers have to transfer earned money via the Internet;

- Almost every individual uses by bank card or has a deposit with a financial institution.

According to the legislation of our country, banking structures have the right to transfer information on their clients to both the tax inspectorate and the Rosfinmonitoring service.

Punishment for non-payment of taxes

One of the most common economic crimes, for which the violator faces serious penalties, is evasion or late payment of taxes. Moreover, this applies to any type of payment that goes to the state budget:

One of the most common economic crimes, for which the violator faces serious penalties, is evasion or late payment of taxes. Moreover, this applies to any type of payment that goes to the state budget:

- property tax;

- transport payment;

- tax on the sale of an apartment, etc.

As was previously said, both the individual and various companies and organizations will be held liable for such a violation, as stated in Tax code Russian Federation.

For an economic crime, the tax inspectorate has the right to impose the following types of sanctions on a fine:

- arrears;

- a fine in a certain amount;

- fine.

Arrears are assigned if, when considering the case, the tax service discovers in the declaration the amount of income of the payer, which will be lower than it actually is. For example, if, when paying land tax, the payer does not include in the declaration one of the buildings that is on summer cottage, the tax inspectorate has the right to impose a penalty on him - arrears.

The fine is assigned as additional measure punishment for arrears. That is, if the payer violates economic laws, as a result of which there will be arrears when paying state taxes, then he will have to not only pay the arrears, but also an additional fine. It is worth noting that even if the fine is paid in full, the arrears will still have to be paid.

A penalty is charged if the payer fails to pay the tax on time. Both fines and arrears, according to the law, are subject to penalties.

If the state payment is not paid or incorrect data is submitted to the tax office, the violator will be subject to a fine of 20% of the total unpaid amount. If the payer pays the tax, but with a slight delay, he will not be charged a fine, but will have to pay the arrears for late payment. Fine in the amount of 5% of general tax collected from the violator if the tax return is not submitted to the appropriate authority.

After the tax inspectorate identifies a violation, a notice is sent to the negligent payer, which specifies the deadline for paying taxes. If the violator does not pay the tax within the specified period, he will be liable for both arrears and penalties. If this punishment does not affect the violator, then the tax service may seize liquid property to pay taxes:

- for a personal car;

- to a summer cottage;

- for an apartment or private house.

Of course, the seizure of the above-mentioned property can only be imposed on a malicious offender, who has a large national debt. And to pay a small arrears, a lien may be placed on household appliances, for example, a washing machine or a TV.

Let us reassure you right away: they will not go to jail. So does that mean you don't have to pay? You have to pay. What if the notification from the tax authority did not arrive on time? Or did it arrive, but it contains incorrect information? Let's figure it out.

So, December 1 is the deadline for paying property taxes for individuals. It, as you already understood, in addition to apartments and dachas, also includes vehicles. In other words, everyone who owns a car had to pay transport tax by December 1. You didn’t do this and want to know what our strict but humane state will do to you. Please!

First and most important. If you do not find a notice in your mailbox from the tax authorities about the need to pay transport tax (according to Article 52 of the Tax Code of the Russian Federation, it must be sent to the car owner no later than 30 working days before the deadline for paying the tax), this does not mean that you are exempt from him. You will still have to pay. But in this case, you need to take the initiative yourself to fulfill your civic duty.

Pay the transport tax yourself!

To do this, you can use one of the methods above. The most reliable way is to contact the tax office at your place of registration. The inspector will issue you a second notice indicating the amount of transport tax and details of the organization where your money will go.

The most difficult way is to calculate the transport tax yourself. To do this, you need to find out (use the calculator on the website of the Federal Tax Service - FTS) the base tariff in force in your region and multiply it by the number of months over the past year during which you owned this vehicle (if you have owned the car for a long time, feel free to multiply by twelve). Owners of expensive Mercedes, Rolls-Royces and various Maybachs should be aware of the increasing coefficients for luxury cars - they can be found on the website of the Ministry of Industry and Trade. Next, you should find out the details of the tax office at your place of registration and pay the tax. This can be done on the Federal Tax Service website.

To be aware of your obligations to the state, it is best to create a taxpayer page ( personal account) on the website at nalog.ru. True, for security reasons, the registration process itself does not take place via the Internet, but through personal communication with the inspector. In other words, to get a password to enter your personal account, you will have to go to tax authority(You should take your passport and Taxpayer Identification Number with you). After this, you will be able to independently monitor and regulate your relationship with the tax authorities.

Sometimes a situation arises when you have a car, but the tax office does not have information about it. Is it possible not to pay? You need to pay, you just need to contact the traffic police to change the address of the vehicle owner in its database.

There is another convenient service where you can find out about debts - the State Services website. It also displays information about taxes and even gives you the opportunity to pay them. Please remember: the Federal Tax Service has 14 days to process the payment. During this period, the paid debt may “hang” on the site, after which it will disappear.

Now you are a debtor!

December 1 has passed, and the transport tax has not been paid. Congratulations (in quotes): he changed his status to “debt”, and you, therefore, turned into a debtor. With all the consequences...

Firstly, a penalty is charged for each day of delay. It is not large, but, firstly, if the amount of debt exceeds three thousand rubles, the tax service can sue you in order to collect it - taking into account penalties and fines. Yes, yes, the Federal Tax Service, as it turns out, can still impose a fine in the amount of 20 to 40 percent of the debt amount. However, before this you may receive a new notification with the need to pay the debt. Next comes into play Federal Service bailiffs (FSSP) to collect it. And this is where the “fun” part begins. The FSSP can seize the debtor’s property (arrest a car) or, for example, block his bank account. And recently, the state has acquired the right to completely write off unpaid taxes from the debtor’s account. But not for life. This type of lawsuit has a statute of limitations of 3 years. If you managed to avoid the tax office for more than three years, consider that everything turned out well...

You should remember: if the Russian Post messed up by sending a tax notice to the wrong address, losing the letter or forgetting to notify the addressee about it (against signature), you will still have to pay the tax - only without penalties and fines. But if the post office notified you of the arrival of a letter, but you did not pick it up, in this case the responsibility falls on you - six days after the notification it is automatically considered delivered to the addressee.

Various situations

It seems that's it! No, not all. Sometimes there are nuances that you should also be aware of. For example, you sold a car, but you still received a notification about payment of transport tax. Look carefully at the amount: if you got rid of the car at the beginning of the reporting period, it will be small (take into account only those months when the car was in your possession), if at the end it will be much more.

It’s another matter if the car was sold several years ago, but letters of happiness are still coming. The reason for this is the notorious “ human factor" It’s just that someone somewhere (most likely the traffic police) forgot to correct the information about the owner of the vehicle.

Where to contact? First, go to the state traffic inspectorate (with a purchase and sale agreement and a passport) - let them correct the data. You can go to the tax office, but they will still send a request to the traffic police. You don’t have to go anywhere at all - write an appeal on the Federal Tax Service website (for registered users). But this is the most “dangerous” option: your letter may not arrive, get lost, be accidentally erased, not sent, sent to the wrong place, etc. In short, look at the beginning of the paragraph and act according to the circumstances...

There are times when new owner the car did not register it in his name. In this case, “chain letters” will be sent to you. What to do? After selling the car, check the change of owner (for example, on the traffic police website). If after 10 days the data has not changed (you are the owner), go to the traffic police and write an application to terminate registration. The same “jambs” can occur if the car was stolen (and not found), disposed of, or, for example, fell under “total” (cannot be restored after an accident).

There are often situations when the notice asks you to pay more than necessary. There are many options: from an incorrectly indicated engine power to an incorrectly calculated ownership period by a Federal Tax Service employee. vehicle. In this case, you will also have to contact the Federal Tax Service inspectorate to clarify and correct the data - in person or through the Federal Tax Service website.

Today we have to find out what will happen if you don’t pay taxes. In fact, this issue interests many citizens. Also, the answer may seem useful to organizations and individual entrepreneurs. After all, if you know about responsibility, everyone will be able to avoid negative consequences. This should be remembered. So what should Russian residents pay attention to? Are they given any punishment for this? And if so, what is it? All this will be discussed further below. In fact, understanding the question posed is easier than it seems. Especially if you have knowledge of the Tax Code of the Russian Federation.

Is there responsibility?

The first thing you should pay attention to is whether there is liability for non-payment of taxes. Is it available in Russia? If so, who exactly will carry it?

It's not that difficult to answer. There is liability for tax evasion in Russia. But the specific punishment will depend on many factors. For example:

- depending on the type of taxpayer;

- from the amount of non-payment;

- from the period of delay in payment.

Accordingly, it is not so easy to say exactly what taxpayers should be afraid of. The only thing that is said with confidence in Russia is that failure to pay taxes necessarily entails a number of negative consequences. Which ones exactly? They will be discussed further below.

Penalty

What happens if you don't pay taxes? The first problem that all taxpayers face is penalties. This is a monetary penalty that increases the tax paid by a certain amount. Accrued daily. Accordingly, the longer a citizen or organization does not pay, the more they will ultimately have to give to the state.

Penalties begin to accrue from the moment the debt is formed. That is, if the tax is not paid before established deadlines, the payment will increase the next day. This measure applies to all taxpayers. Therefore, it is recommended not to delay the payments being studied.

Individuals

There are several types of taxpayers. They are subject to various penalties for non-payment of due taxes. What options for the development of events take place?

The first large group of taxpayers is: For them, as a rule, there are income taxes, as well as property, transport and land. What to expect if you ignore payment order from the tax office?

What happens if you don't pay taxes? There are several punishment options. Which ones exactly? The Tax Code of the Russian Federation will help you answer. According to him, you may encounter:

- With penalties. Citizens who have delayed paying taxes will have to cover the penalty when paying. This measure has already been mentioned. Size additional expenses directly depends on how delayed the payment was.

- With a fine in the prescribed amount. The most common measure of liability that is only found in Russia. The fine for non-payment of taxes, according to established rules, is established on an individual basis, but with some restrictions. Citizens pay 100-300 thousand rubles or lose their earnings for 12-24 months. Everything depends on the court's decision.

- With forced labor. Responsibility for non-payment of taxes in Russia by individuals is expressed (sometimes) in the form of forced labor. Its maximum duration is no more than a year.

- With imprisonment. The extreme measure of liability that a taxpayer can incur. Imprisonment is proposed for 1 year. Arrest for a maximum of 6 months is possible.

All of the listed penalties are the responsibility of individuals for failure to pay taxes in accordance with established legislation. Similar measures are also provided for the preparation of false documents or failure to provide tax return on time.

Special sizes for individuals

Now it’s clear what will happen if you don’t pay taxes. But all of the listed measures cannot be called the only ones of their kind. Responsibility is sometimes expressed somewhat differently. What are we talking about?

On tax evasion on an especially large scale. Such a crime has harsher penalties for negligent taxpayers. Which ones exactly?

The fine for non-payment of taxes in such a situation will increase. Now for the committed act you will have to pay from 200 to 500 thousand. An alternative punishment is payment in the form of a citizen's profit for 1.5-3 years. Forced labor also occurs. If taxes are not paid on a particularly large scale, the court may impose 36 months of forced labor. Or imprisonment for a similar period. But the arrest no longer takes place.

It is precisely these measures that are provided for individuals, if Article 198 of the Criminal Code of the Russian Federation indicates such measures. But there is another interesting nuance in it. More about him a little later. First you need to figure out what the consequences of non-payment will be. legal entities and IP.

Individual entrepreneurs and organizations

The difference is not too big in the established penalties. But for organizations and individual entrepreneurs, as a rule, the consequences of debts to tax services more dangerous than it seems. During such events, the company may cease to operate.

Tax evasion is punishable by:

- A fine. As well as individuals, individual entrepreneurs and legal entities. individuals pay from 100 to 300 thousand rubles. Alternatively, you can forfeit your profits for a maximum of 2 years.

- Forced labor. Distinctive feature is that the organization is deprived of the right to conduct a particular activity. More precisely, a taboo is imposed on the violator. Most often - to the head of the organization. The maximum duration of punishment is 2 years for work and 3 years for restrictions on activities.

- Arrest for six months.

- Imprisonment. It is usually associated with restrictions on the conduct of a particular activity. The limits of punishment are exactly the same as with forced labor.

Everyone should know what will happen if they don’t pay taxes. In addition to these penalties, organizations face penalties. Therefore, an increase in invoices still occurs.

Special cases

But there is another option for the development of events. What are the consequences of not paying taxes? According to the established rules, if this act is committed by prior conspiracy or on a large (especially large) scale, the punishment is more severe. It is somewhat reminiscent of the liability of individuals for a similar act.

Accordingly, you may encounter:

- Cash payments. Fines range up to half a million. You can also lose 3 years of income.

- Forced labor for a maximum of 5 years. Additionally, the head of an organization or an entrepreneur may be deprived of the opportunity to conduct certain activities, as well as occupy specific positions. This measure lasts no more than 3 years.

- Imprisonment. Along with it, a taboo on activity is imposed. The duration of punishment is up to 36 months inclusive.

It follows that taxpayers face approximately the same consequences. But with a small caveat. Which one exactly?

Release from liability

The fact is that you don’t always have to think about what will happen if you don’t pay taxes. In Russia, criminal punishment can sometimes be avoided. This feature applies to all taxpayers.

According to the established rules, if an individual entrepreneur, an organization or just a citizen has independently closed the debt and paid the fine in full, there is no need to be afraid of liability. But such an indulgence applies only to cases when the violation is committed for the first time.

Results

From now on, it is clear what the consequences of non-payment of taxes are. In practice, most often citizens are faced with penalties. But criminal liability does not occur so often. At least for individuals. And this cannot but rejoice.

All citizens need to pay taxes. In some cases bailiffs they confiscate property for which they do not pay. Every taxpayer should remember this.

In 2017, a new penalty for non-payment of taxes comes into force in Russia. Citizens who did not pay on time for transport, property or land tax, will be fined. The payment amount will be 20% of the invoiced tax.